- Delivered a record revenue of $8.3 billion in 2022.

- Auto and industrial end-markets revenue increased by 38% YoY.

- Revenue from silicon carbide to exceed $1 billion in 2023.

- Exiting sub-scale fabs and shifting to 300mm capacity will provide a significant cost advantage in terms of front-end costs and accelerate fab consolidation.

American semiconductor supplier onsemi has reported strong 2022 earnings with revenue increasing 24% YoY to a record $8.3 billion driven by secular megatrends of electric vehicles, advanced driver-assistance systems (ADAS), alternative energy and industrial automation.

With growing traction for silicon carbide solutions driven by electrification and ADAS, increased long-term supply agreements and adoption of a fab-liter manufacturing strategy, onsemi is well positioned to deliver revenue growth in the long term.

2022 highlights

- Delivered a record revenue of $8.3 billion at 24% YoY growth, primarily driven by strength in automotive and industrial businesses.

- Reduction in price-to-value discrepancies, exiting volatile and competitive businesses and pivoting portfolio to high-margin products helped onsemi deliver strong earnings.

- Revenue from auto and industrial end-markets increased 38% YoY to $ 4 billion and accounted for 68% of total revenues.

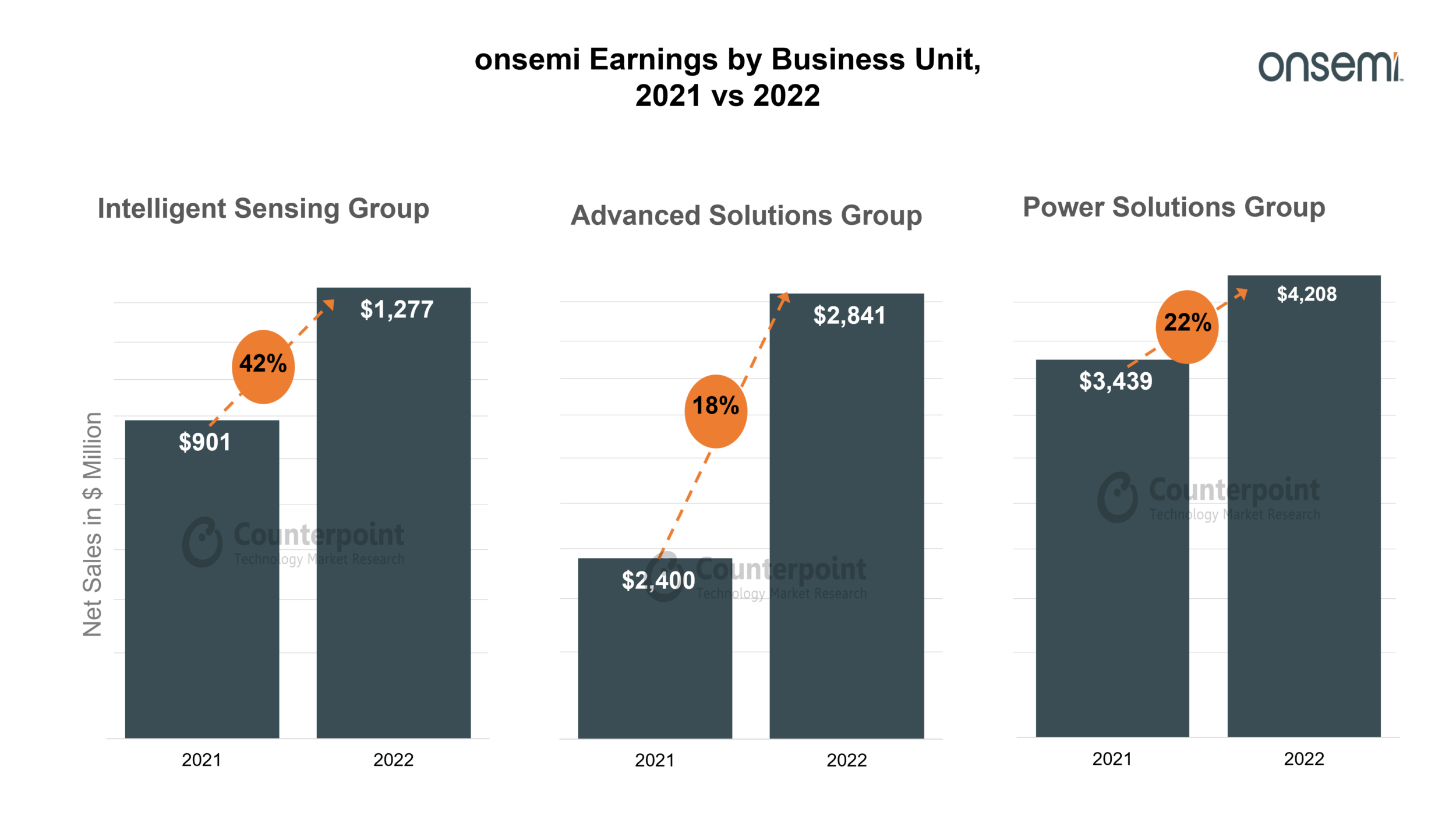

- Intelligent Sensing Group revenue increased 42% YoY to $1.28 billion driven by the transition to higher-resolution sensors at elevated ASPs.

- Non-GAAP gross margin was at 49.2%, an increase of 880 basis points YoY. The expansion was driven by manufacturing efficiencies, favorable mix and pricing, and reallocation of capacity to strategic and high-margin products.

- Revenue from silicon carbide (SiC) shipments in 2022 was more than $200 million.

- Revenue committed from SiC solutions through LTSAs increased to $4.5 billion.

- Total LTSAs across the entire portfolio were at $16.6 billion exiting 2022.

- Revenue from new product sales increased by 34% YoY.

- Design wins increased 38% YoY.

Source: onsemi Earnings, Counterpoint Research

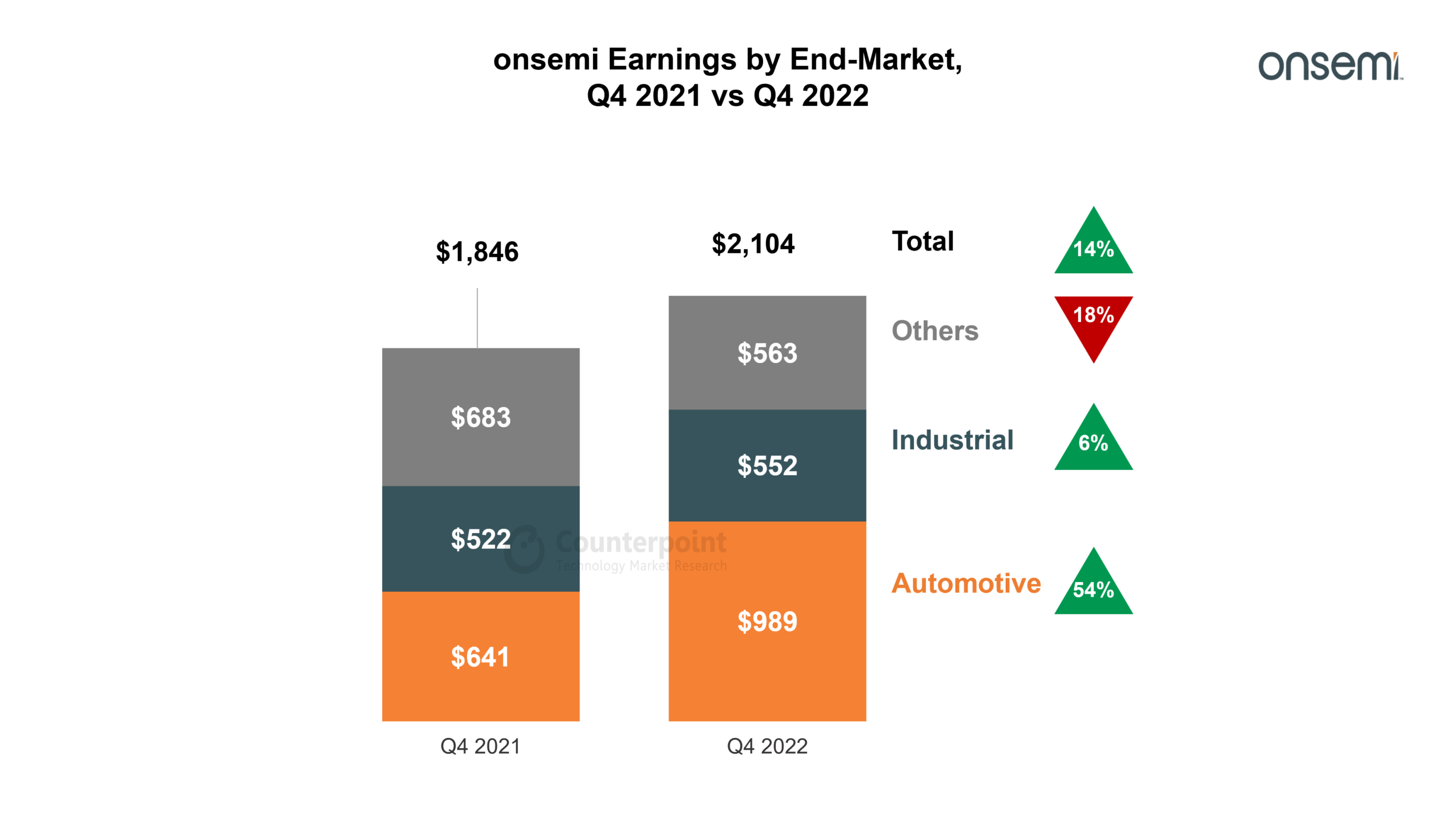

Q4 highlights

- Total revenue increased 14% YoY to $2.1 billion, with automotive revenue reaching a record $989 million.

- The automotive business grew 54% YoY to account for 47% of the total revenue, compared to 35% in the quarter a year ago.

- The industrial business accounted for 26% of the total revenue and grew 6% YoY due to strong demand for energy infrastructure and medical applications, which was offset by softness in parts of the industrial business.

- Non-GAAP gross margin was at 48.4%, an increase of 320 basis points YoY.

- Revenue from intelligent power and intelligent sensing accounted for 69% of the total revenue in Q4.

- Revenue from Power Solutions Group increased 10% YoY to $1 billion.

- Advanced Solutions Group reported revenue of $701 million, an increase of 8% YoY.

- Revenue from Intelligent Sensing Group was a record $354 million, an increase of 44% YoY.

Source: onsemi Earnings, Counterpoint Research

Developments in 2022

- Recognized as a strategic corporate supplier to Volkswagen Group for SiC modules that enable a complete traction inverter solution for its entire fleet of next-generation electric vehicles.

- Expanded partnership with Tesla beyond SiC and image sensor to numerous power and analog solutions.

- Signed a seven-year long-term supply agreement with Jaguar Land Rover to adopt onsemi’s SiC for its next-generation platforms and other solutions for onboard chargers and other xEV applications.

- Hyundai Motor Group selected onsemi’s EliteSiC family of SiC power modules for its high-performance electric vehicles.

- Mercedes-Benz adopted onsemi’s SiC technology for traction inverters.

- Partnered with Ampt, the world’s #1 DC optimizer company for large-scale solar and energy storage systems, to supply EliteSiC critical power switching solutions.

- Collaborated with global automotive innovator NIO to supply SiC traction power modules for next-generation electric vehicles.

- With a broad portfolio of SiC and silicon power modules, onsemi has LTSAs with the world’s top 10 solar inverter manufacturers.

These collaborations and wins will help expedite the commercialization of SiC technologies to bring EVs equipped with advanced semiconductor material to the market and leverage onsemi’s broad portfolio of power solutions.

These collaborations and wins will help expedite the commercialization of SiC technologies to bring EVs equipped with advanced semiconductor material to the market and leverage onsemi’s broad portfolio of power solutions.

onsemi’s focus on high-growth megatrends in the automotive and industrial segments with its enabling intelligent power and sensing portfolio capabilities will help further expand its leadership in these technologies and capture a significant amount of market share over time.

Manufacturing strategy

Divested four fabs and closed the acquisition of 300mm fab in 2022 to improve long-term cost structure.

Divested wafer manufacturing sites as part of fab-liter manufacturing strategy

- Closed the sale of its 150mm wafer fabrication facility at Oudenaarde in Belgium to Belgium semiconductor company BelGaN Group BV.

- Announced completion of the sale of 200mm semiconductor fab at Pocatello in Idaho to ATREG, Inc.

- Entered into a definitive agreement with Diodes Incorporated to divest its South Portland, Maine, 200mm fab.

- Completed sale of its 150mm facility at Niigata in Japanto JS Foundry K.K.

The full benefit of these divestitures will be realized over the next several years as onsemi transitions production to other fabs, further supporting long-term gross margin expansion plans.

The sales will further enable onsemi to invest in R&D and internal capacity expansion for differentiated technologies and strategic growth areas.

Expansion strategy

Expands its silicon carbide production facility at Hudson in New Hampshire

- The facility is expected to increase SiC boule production capacity and ensure supply of critical components.

Expands its silicon carbide fab in Czech Republic

- The facility will increase its SiC wafer production capacity over the next two years and enable onsemi to provide customers the critical supply assurance to meet the rapidly growing demand for SiC-based solutions.

The expansion will leverage full control over SiC wafer fabrication and manufacturing supply chain and enable onsemi’s progress toward SiC leadership.

These divestments and expansion will help onsemi capture value through a focus on highly differentiated products that enable disruptive innovation, optimize manufacturing footprint and leverage expertise.

Business outlook

- Q1 revenue will be in the range of $1.87 billion to $1.97 billion, with continued strength in automotive amid softness in industrial end markets.

- Gross margins to decline by 200 to 300 basis points due to lower factory utilization and the dilutive impact of ramping, silicon carbide and the recently acquired East Fish Kill fab.

- Revenue from silicon carbide to exceed $1 billionin 2023, emphasizing onsemi’s progress toward SiC leadership.

Conclusion

With end-to-end control over the supply chain, R&D and capex investments for SiC and a strong pipeline of customers, onsemi should see itself growing into the top three players in the auto semiconductor market in the coming years. Increased focus on engagement with Tier 1s due to an increase in onsemi content for upcoming select EV platforms and advanced safety applications will help revenue growth in the long term. onsemi’s focus on its enabling intelligent power and sensing portfolio and end-to-end SiC capabilities will help capture a significant market share in the fastest growing segments in the automotive and industrial market.

Related Links

- Global Passenger Electric Vehicle Model Sales Tracker: Q1 2018 – Q3 2022

- USA Autonomous Vehicle Tracker Q2 2022

- Top 10 IoT Announcements at CES 2023

- CES 2023: All about Cars, Electrification & Sustainability

- ADAS Penetration Crosses 70% in US in H1 2022, Level 2 Share at 46.5%

- Top 10 CES 2023 Automotive Announcements

- HERE Maintains Location Platform Leadership; TomTom Surpasses Google to Take Second Position; Mapbox Moves to Fourth

- Global Automotive ADAS/AD Sensor Forecast by the Level of Autonomy, 2021-2030F

- Infographic: Semiconductors Top 7 in Q3 2022

- Global Cellular IoT Module Forecast 2019 – 2030

- Global Cellular IoT Module and Chipset Tracker by Application Q1 2019 – Q3 2022

- GlobalFoundries Reports Strong Q3 2022; Home, Industrial IoT to be Fastest-growing End Market in 2022

- Global Automotive Semiconductor Forecast by the Level of Autonomy, 2021-2030F