Semiconductor equipment maker Applied Materials has reported strong earnings for FY 2022 (ended October 30). Total sales revenue increased 12% YoY to $25.78 billion despite supply chain shortages, geopolitical and macroeconomic headwinds, and softening consumer demand.

The company’s uniquely enabling technology and growing installed base will be its key growth drivers as chipmakers accelerate ramping up of new process nodes in R&D for high-volume manufacturing.

Financial highlights

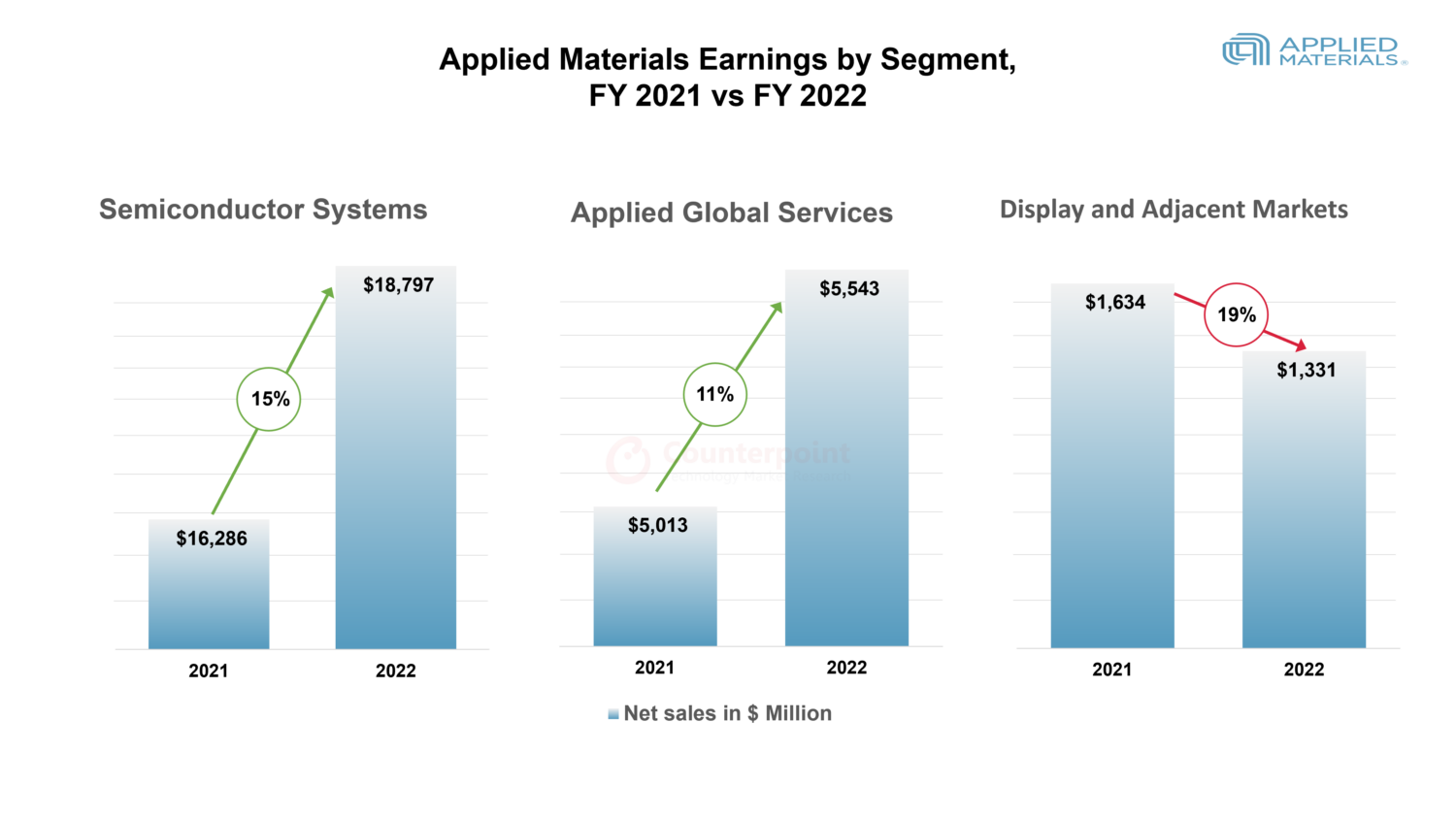

- Semiconductor Systems revenue increased 15% YoY in FY 2022 to $18,797 million on account of strong orders as customers continued to invest in next-generation technology.

- Applied Materials’ service revenue increased 11% YoY in FY 2022 to $5,543 million, accounting for 21% of the annual net revenue.

- Display and Adjacent Markets revenue decreased 19% YoY in FY 2022 to $ 1,331 million.

- Non-GAAP gross margin was at 46.6% in FY 2022.

- Non-GAAP operating profit grew by over 7% to $7.86 billion.

- Non-GAAP EPS increased nearly 13% to $7.70.

- Total ending backlog increased 62% to $19 billion with Semiconductor Systems backlog increasing 90% to nearly $12.7 billion and services backlog increasing 30% to over $5.6 billion.

- The company generated about $5.4 billion in operating cash flow and over $4.6 billion in free cash flow.

- The company’s installed base grew 8% YoY in FY 2022.

- The number of tools under comprehensive, long-term service contracts grew 16% YoY with the over 90% renewal rate for these agreements demonstrating the value customers see in subscription services.

- New export regulations for US semiconductor technology sold in China reduced Semiconductor Systems and AGS fourth quarter revenue by approximately $280 million.

Source: Company, Counterpoint Research

Applied Materials sees stable revenue growth from subscription services

- Applied Global Services (AGS) is a business segment with recurring revenue growth, which will give Applied Materials resilience through business cycles in the future.

- Applied Global Services’ growing installed base and service intensity will be key growth drivers as customers will keep spending to maintain their tools in optimal condition.

Key developments in FY 2022

- Applied Materials acquired Picosun, a Finland-based innovator in atomic layer deposition (ALD) technology.

-

- This acquisition broadens Applied’s product portfolio and puts it in a great position to capture a large portion of the specialty semiconductor market in the coming years.

- Collaboration with the Institute of Microelectronics (IME), a research institute under Singapore’s Agency for Science, Technology and Research (A*STAR).

- IME’s strategic R&D capabilities complement well Applied’s expertise in advanced packaging solutions and will accelerate material, equipment and process technology solutions for hybrid bonding and other emerging, 3D chip integration technologies.

- Introduced new Ioniq™ PVD system to solve wiring resistance challenges of 2D scaling.

- This new integrated solution offers a significant reduction in electrical resistance, which has become a critical bottleneck to further improvements in chip performance and power.

These acquisitions, collaborations and developments will further help Applied Materials secure technology and price competitiveness, and strengthen its manufacturing capacity to address demand through the development of derivative processes.

Business outlook

- Net sales revenue is expected to be between $6.30 billion and $7.10 billion in Q1.

- Mixed demand seen for the ICAPS, chips for IoT, communications, automotive, power and sensor markets.

- The company said the unmitigated impact of the new export regulations for US semiconductor technology sold in China on the FY 2023 revenues would be around $2.5 billion. However, the impact could be reduced to $1.5-$2 billion depending on how investments are refocused and how quickly the government provides licenses and approvals.

Key takeaways

- Applied’s business will be more resilient on account of the large backlog and strong customer demand for products that enable key technology inflections, especially in next-generation wiring, interconnect layers and advanced packaging.

- Key collaborations and acquisitions broaden Applied’s product portfolio and put it in a great position to capture a large portion of the advanced and specialty semiconductor market in the coming years.

- The company’s uniquely enabling technology, growing installed base and service intensity will be its key growth drivers in the long term.

The comprehensive and in-depth analysis on “Applied Materials FY 2022 Earnings Report” can be accessed from the link (Click here).

Related Links

-

- GlobalFoundries Reports Strong Q3 2022; Home, Industrial IoT to be Fastest-growing End Market in 2022

- ADAS Penetration Crosses 70% in US in H1 2022, Level 2 Share at 46.5%

- IoT Key to Meeting Sustainable Development Goals 2030

- Global Smartphone AP-SOC Revenue & Forecast tracker by Model – Q2 2022

- Counterpoint Macro Report – Featured Topics of Q3 2022

- Wafer Fab Equipment Revenue Tracker

- Applied Materials’ PPACt Play Drives Record Quarterly Revenues

- Wi-Fi 6 Market Key Drivers, Challenges, Applications, Market Size, Outlook

- Global Automotive Semiconductor Forecast by the Level of Autonomy, 2021-2030F

- TSMC Conservative Outlook on 7/6nm Demand Reaffirms Weakness

- Infographic: Global Foundry Revenue Share | Q2 2022

- Global XR (AR & VR Headsets) Shipments Market Share: By Quarter