GlobalFoundries has reported strong Q3 2022 numbers with its revenue growing 22% YoY to $2.074 billion, driven by an increase in wafer shipments, richer mix of products and rise in average selling price (ASP).

The company’s focus on high-growth megatrends in the automotive and industrial segment, along with its enabling specialty semiconductor manufacturing capabilities and advancing innovation and production of next-generation GaN chips, will further aid in broadening GlobalFoundries’ portfolio of feature-rich and enablement solutions and maximize revenue in the long term.

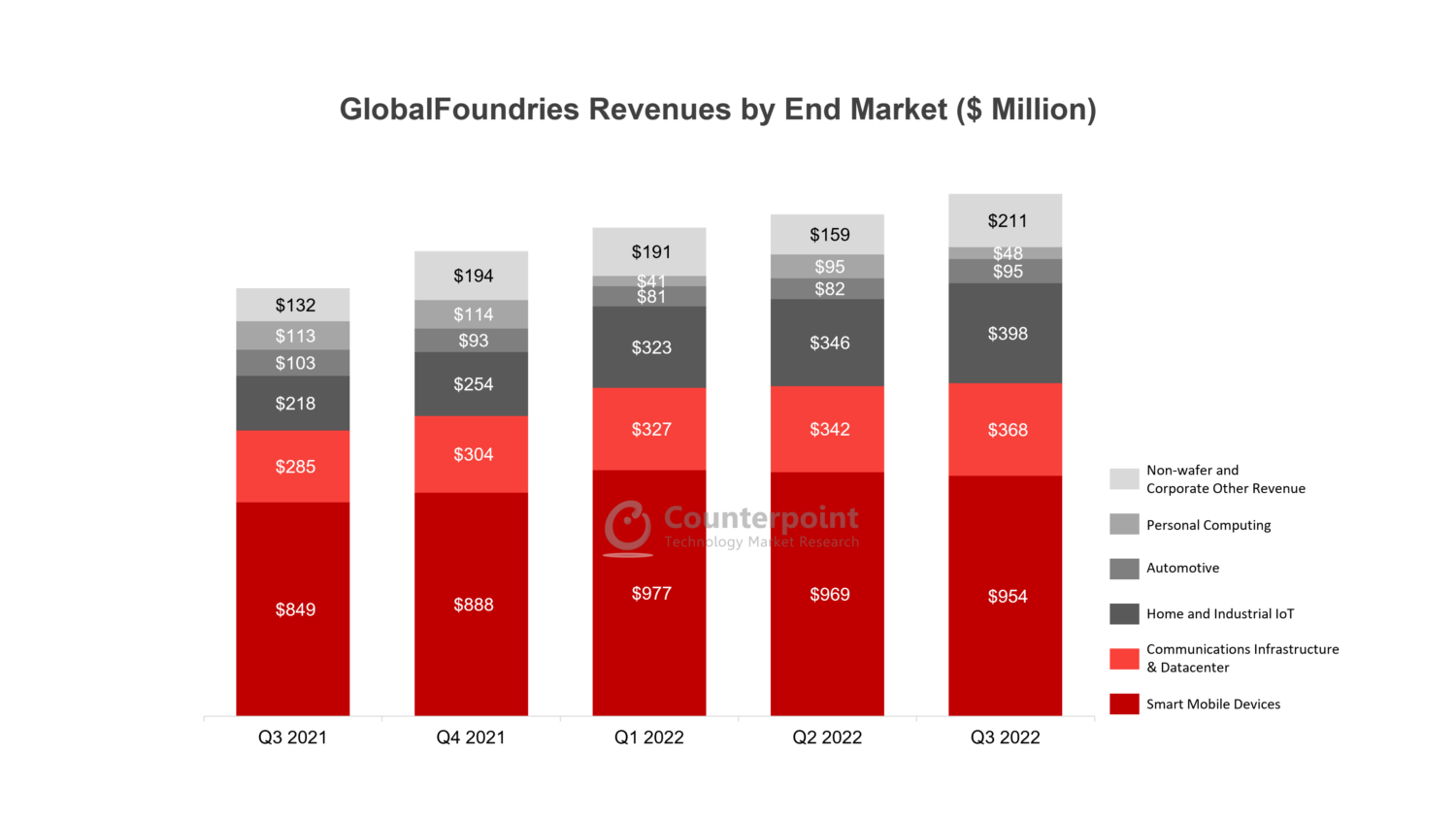

Q3 KPIs

- Net revenue was $2.074 billion, better than the guidance provided in the previous quarter.

- Shipped approximately 637,300-mm equivalent wafers in kilo units, a 5% increase YoY.

- Wafer revenue from end markets accounted for around 90% of total revenue.

- Adjusted gross margin stood at 29.9%, a 12%-point YoY improvement driven by better fixed cost absorption, higher ASPs and improved mix.

- Wafer ASP was $2,925, an increase of 14% YoY, driven by ramping up of long-term customer agreements with better pricing as well as continued improvement in product mix.

- The total value of long-term agreements was above $27 billion. The amount of committed prepays increased 6% from a quarter ago, to approximately $3.8 billion.

- Expect the full-year 2022 total gross capex to be between $3 billion and $3.3 billion, impacted primarily by delays in capital equipment.

- Modest guidance of $2.05 billion-$2.1 billion provided for Q4 2022. 300-mm fabs fully utilized but a reduction in capacity utilization, particularly with respect to 200-mm fabs, going ahead.

Source: GlobalFoundries Earnings, Counterpoint Research

Segment-wise details: Home and industrial IoT to be the fastest-growing end market in 2022.

Source: GlobalFoundries Earnings, Counterpoint Research

Q3 key announcements and analysis

- Received $30 million in US federal funding to advance the development and production of next-generation semiconductors at its Essex junction, Vermont, facility.

- Funding will be utilized towards the development and production of GaN chips used in improving the performance and efficiency of applications including 5G smartphones, RF wireless infrastructure, electric vehicles, power grids and other technologies.

- The addition of scaled GaN manufacturing to the fab’s capabilities will further boost GlobalFoundries’ leadership competencies in making chips for RF semiconductor technology and high-power applications.

- Completed five technology qualifications, including a 12-nm LP customer-specific technology covered under a five-year agreement.

- A proprietary automotive 40-nanometer embedded non-volatile memory product from GlobalFoundries has qualified for one of the largest automotive MCU suppliers in the industry.

- Tapped out five new customer products on silicon photonics platform, including a photo IC device and fully monolithic co-packaged optics for GPU-to-GPU 2 terabit optical interconnect.

- Successfully produced a high-performance RF GaN device through a silicon via technology solution to optimize power amplifier output and efficiency.

- Sampled GaN power devices to early engagement customers.

Key takeaways

- Despite the ongoing inventory correction in handsets, RF front-end modules performed well. We can expect mid-teens full-year growth in the premium segment to offset declines in the low- and mid-range segments.

- Home and industrial IoT to be the fastest-growing end market for GlobalFoundries in 2022.

- Focus on high-growth megatrends in automotive and industrial segment with its enabling specialty semiconductor manufacturing capabilities will further boost GlobalFoundries’ leadership competencies and maximize revenue in the long term.

Related Links

-

- Global Smartphone AP-SOC Revenue & Forecast tracker by Model – Q2 2022

- Smartphone RF Front-end Market Revenues Down 14% QoQ in Q2 2022

- GlobalFoundries Reports Solid Q2 2022 Driven by Differentiated Tech Platforms

- Counterpoint Macro Report – Featured Topics of Q3 2022

- Wafer Fab Equipment Revenue Tracker

- Wi-Fi 6 Market Key Drivers, Challenges, Applications, Market Size, Outlook

- Global Automotive Semiconductor Forecast by the Level of Autonomy, 2021-2030F

- Global Cellular IoT Module Manufacturing Tracker – H1 2022

- TSMC Conservative Outlook on 7/6nm Demand Reaffirms Weakness

- Infographic: Global Foundry Revenue Share | Q2 2022

- FWA to exceed 460 million subscriptions by 2030