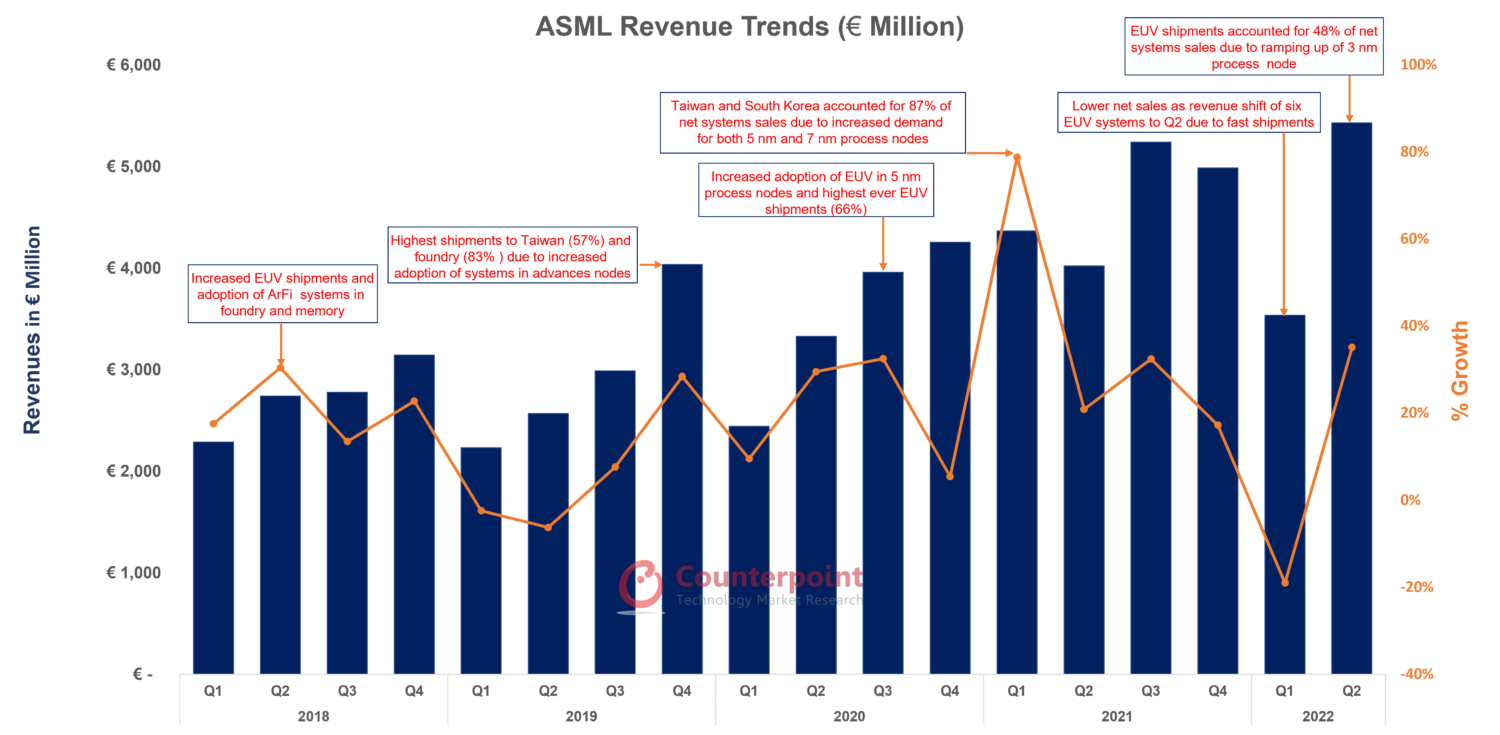

ASML has delivered a strong Q2 2022 ahead of its guidance with record quarterly orders. Net sales increased by 35% YoY to €5.4 billion driven by increased EUV shipments, which accounted for 48% of the net systems sales during the quarter.

However, the company outlook for 2022 has been lowered to around 10% YoY growth on account of deferred revenue recognition due to the adoption of a fast shipment strategy. Challenges will persist in the near term amid supply chain constraints and inflationary pressures. But strong demand in high-performance computing (HPC), automotive and IoT will enhance ASML’s growth prospects in the long term.

Q2 2022 KPIs

- Net sales of €5.4 billion ahead of guidance, thanks to deferred revenue recognition from six EUV systems’ fast shipments in Q1 2022.

- Net systems sales at €4.1 billion, an increase of 40% YoY with EUV accounting for 48% share.

- Service and field option sales at €1.3 billion.

- Shipped 12 EUV systems, an increase of 33% YoY.

- Gross margin of 49.1% at the lower end of the guidance due to inflationary effects.

- Record quarterly net bookings of €8.5 billion. €5.4 billion in EUV orders including High-NA, thanks to customer demand in both advanced and mature nodes.

- Record total order book of €33 billion at the end of the quarter – 85% for advanced semiconductor manufacturing, including High-end immersion and EUV, and 15% for mature technology needed for advanced production.

Source: ASML Earnings, Counterpoint Research Wafer Fab Equipment Tracker

Q2 Analysis

- Net system sales by end-use had logic taking 71% and memory taking 29%. Increased shipments to logic attributed to focus by foundries on ramping up 3nm process nodes.

- Lithography units: EUV-12, DUV-ArFi 21, ArFdry 8, KrF 38 and I-line 12.

- Gross margin to remain under pressure in the near term due to supply chain challenges and inflationary pressure on labor, freight and parts.

- High utilization rates of machines that are in the installed base will help ASML’s growth prospects despite demand slowing in the PC and smartphone markets in the near term.

- ASML has started integration and initial testing of first High-NA mechanical projection optics and illuminator along with the new wafer stage received from suppliers.

- On the DUV business side, it shipped the first NXT KrF system –TWINSCAN NXT:870 – with increased throughput capability, much needed for responding to the industry’s demand for KrF tools and wafer output.

- In the applications business, the company completed the first eScan1100 multi-beam system installation at a customer site.

- The company will revisit its medium-term forecast and guidance on growth opportunities beyond 2025 on “Capital markets day” on November 11, 2022.

Source: ASML Earnings, Counterpoint Research Wafer Fab Equipment Tracker

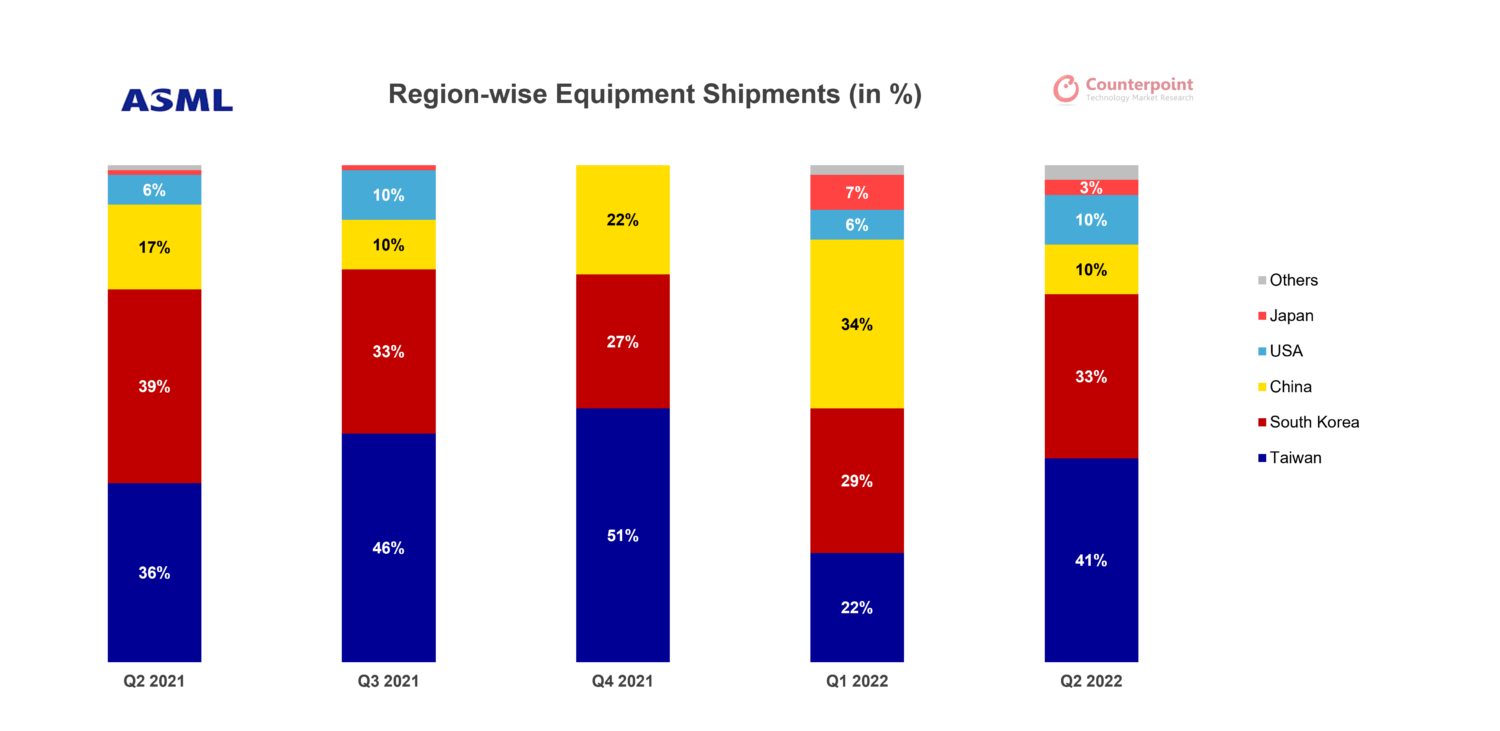

Regional Performance

- Taiwan took 41% and South Korea took 33% share of the equipment shipments in Q2 2022 driven by the ramping up of activities on advanced technology nodes and adoption of EUV in high-volume manufacturing by foundries to shorten ramp times, improve device performance and yield, and optimize factory output and operating costs.

- Restrictions on the supply of DUV machines used in mature nodes in addition to EUV systems led to a fall in shipments to China in Q2. However, increased shipments to Taiwan and South Korea helped boost net sales.

- China is a major player in the semiconductor value chain and any restriction on DUV systems’ sales, which find application in mature nodes, will affect Chinese chip makers’ expansion plans, further aggravating the component shortage crisis.

Outlook for 2022

- Q3 net sales are projected to be between €5.1 billion and €5.4 billion.

- Full-year revenue growth projection lowered to €20.5 billion on account of an increased number of fast shipments assuming priority due to supply chain disruptions and delaying of revenue recognition to 2023. Fast shipments reduce the cycle time by carrying out acceptance tests at the customer end to output more systems. ASML has been adopting this strategy from the beginning of 2022 to overcome issues arising out of supply chain constraints.

- Gross margin to be between 49% and 50% due to extra costs related to output capacity increase and unexpected inflationary trends.

- 55 EUV systems to be shipped in 2022 with revenue recognition for only 40 systems in 2022 and for the remaining 15 in 2023.

Key Takeaways

- Increased shipments to Taiwan and South Korea attributed to ramping up of activities on advanced technology nodes.

- Foundries ramping up production of 3nm process nodes by applying Gate-All-Around transistor and FinFET architectures and using EUV technology will help ASML improve its share in the wafer fab equipment market.

- Fall in shipments to China due to restrictions on the supply of DUV machines will aggravate the component shortage crisis.

Related Links

- ASML Net Sales at High End of Guidance; High NA Orders to Drive Long-term Growth

- Applied Materials’ PPACt Play Drives Record Quarterly Revenues

- EUV Technology Leader ASML Etches Successful Earnings Pattern

- Global Wafer Fab Equipment Revenue to Grow 18% in 2022

- Semi Bellwether TSMC’s Q2 Earnings Forecast Sunny Days Ahead

- TSMC Captures 70% Share of the Smartphone AP/SoC and Baseband Shipments in Q1 2022

- TSMC to Boost Capex in 2022 Driven by 5G Applications, High Performance Computing

- Counterpoint Quarterly Reports: Q2 2022

- Wafer Fab Equipment Revenue Tracker