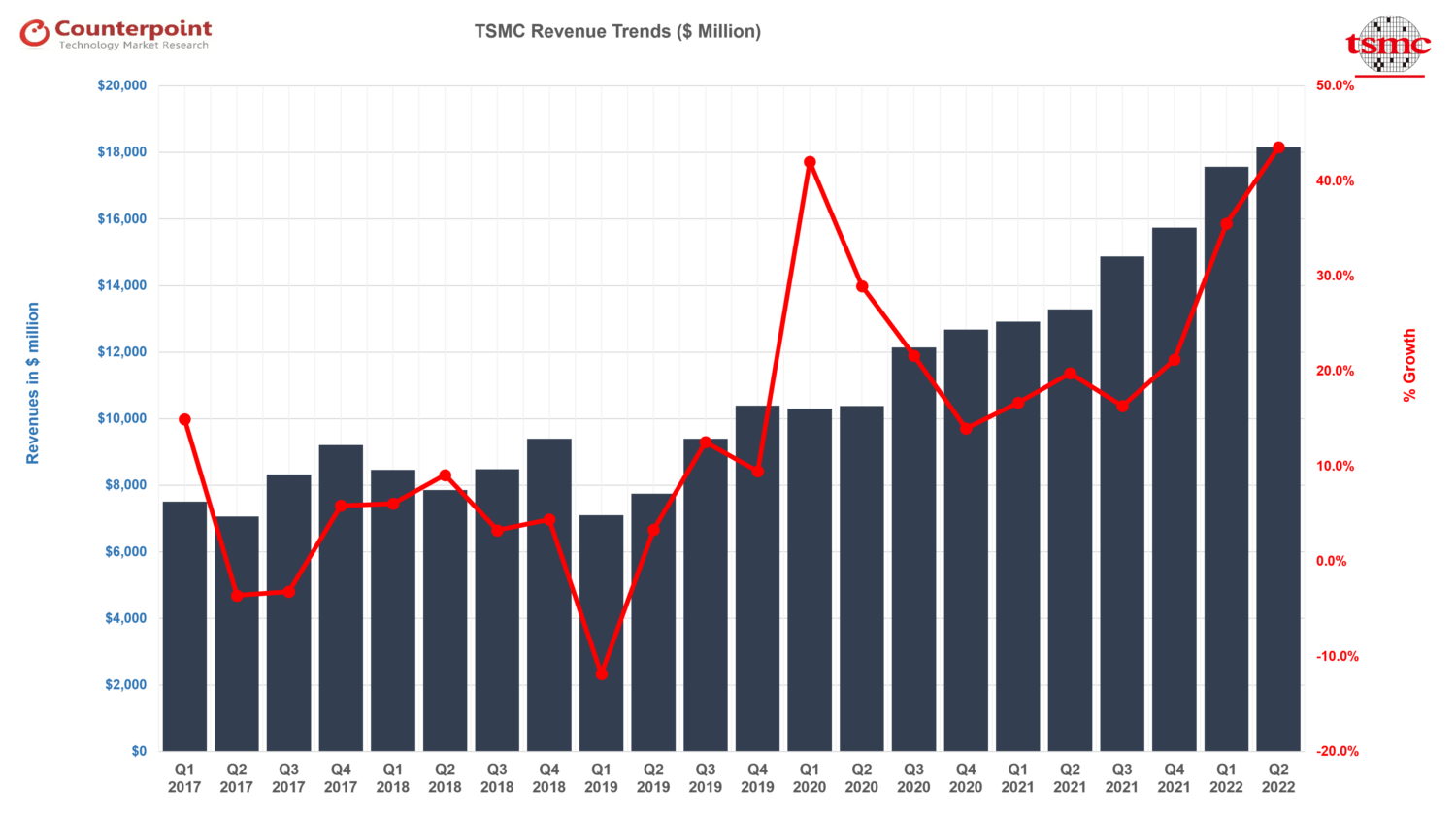

COVID-19, along with the rise of advanced capabilities such as 5G, AI and imaging technologies, has catalyzed the semiconductor demand for the last over two years. Monitoring the contribution of upstream players in the semiconductor value chain, which are actually building technologies and capacities, has become extremely important.

TSMC is a great benchmark for the health of the semiconductor industry considering it manufactures 70% of all key smartphone chipsets. The company posted record earnings in Q2 2022 with growing advanced semiconductor content in processing (AI, GPU, SoC) and connectivity (5G) being the key factors.

Key financial highlights:

- Net revenue increased 37% YoY to $18.2 billion driven by high-performance computing (HPC), IoT and automotive-related demand.

- Gross margin and operating margin were at 59.1% and 49.1% respectively, up 3.5 percentage points on a favorable foreign exchange rate, cost improvement and value selling.

- From the geographical perspective, North America accounted for the highest share (64%) of total net revenue.

TSMC wafer revenues share

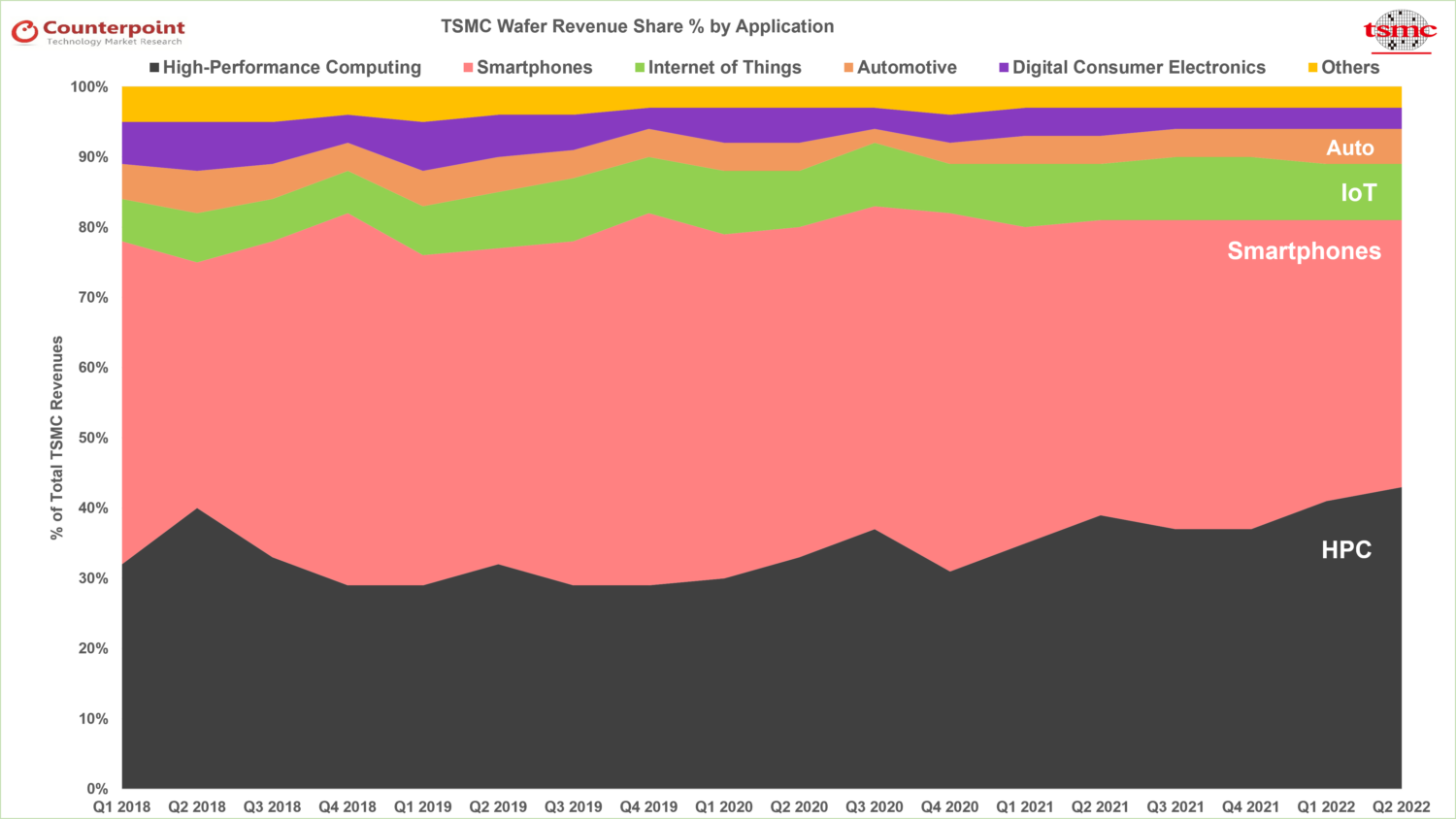

By application

- Smartphones and HPC represented 38% and 43% of net revenues respectively, while IoT, Automotive, Digital Consumer Electronics (DCE) and Others represented 8%, 5%, 3% and 3% respectively.

- HPC surpassed Smartphones in revenues thanks to Nvidia, Intel, AMD and others.

- TSMC’s reliance on Apple, Qualcomm and Mediatek was lesser as HPC surpassed Smartphones in revenue contribution.

- Automotive semiconductor content was the dark horse.

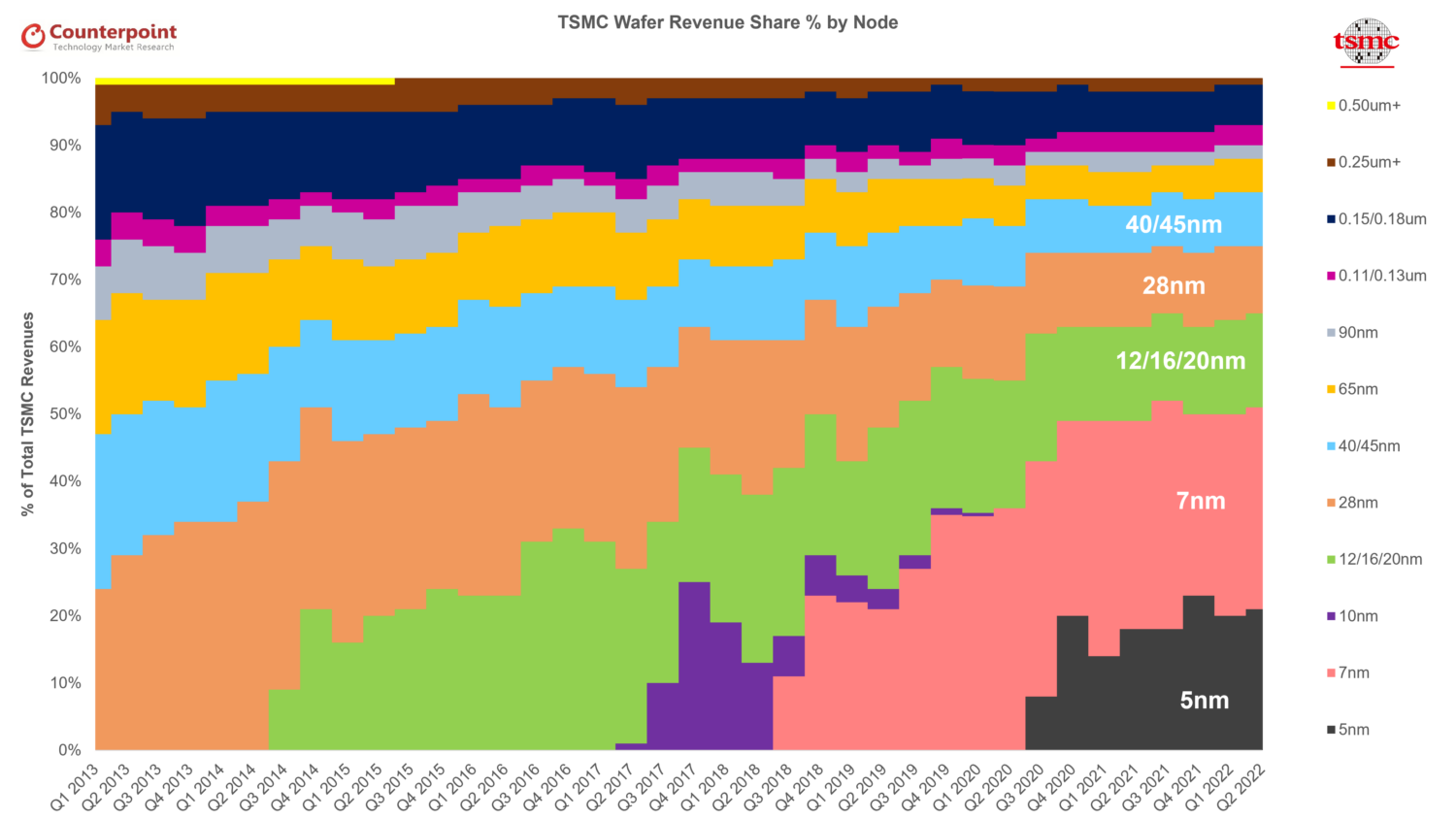

By node

- 5nm process technology contributed 21% of total wafer revenues in Q2 2022 while 7nm accounted for 30%.

- Combined revenue from advanced process nodes with 5nm and 7nm accounted for 51% of total wafer revenues, thanks to growing capex, making it very difficult for current and potential competition to catch up at least in next 10 years.

- Double-digit growth was seen in matured nodes thanks to the rising need for chipsets in the IoT and automotive.

N2 and N3 updates

- N2 node will implement the platform scaling concept wherein benefits of power delivery schemes, advanced packaging and chiplet will be utilized to control cost and have an overall advantage.

- N3 node will be the longest node to be used before migrating to N2 due to the introduction of TSMC FINFLEX architectural innovation, which offers flexibility to customers to create designs precisely tuned for their needs with functional blocks implementing the best-optimized fin configuration and integrated into the same chip.

- The introduction of 3nm nodes will begin in H2 2022 and adoption by customers and revenue contribution will start in Q1 2023. The introduction of 3nm nodes will lower the gross margin by 2%-3% in 2023.

- While the capex is growing, some of it will be spread out over quarters with the WFE vendors struggling with backlogs as building fab equipment also requires semiconductors! This will help TSMC realize healthy margins for the coming quarters and offset any gross margin decline due to N3 introductions.

Key takeaways

- TSMC’s net revenue will cross $75 billion in 2022, which means it will surpass Intel’s revenues.

- HPC will drive TSMC’s revenue growth in the long term and achieve a 15%-20% CAGR.

- 3D IC design solution System on Integrated Chips (SoIC) will account for a significant share of revenue in the long term due to its extensive application in HPC.

- Efforts to resolve tool delivery schedule challenges in advanced and mature nodes through discussions with entire supply chain partners remains a top priority.

- Growing silicon content, shipments and ASP will drive revenue growth in the long term.

- Inventory adjustment will continue till Q1 2023 and ease off by H2 2023. However, long-term semiconductor demand will be firm.

Related Posts