ASML has reported Q1 2022 net sales at the higher end of its guidance. Outlook for the long term is positive due to leading-edge EUV systems and their dominance across the entire product line for older lithography systems, especially DUV, the workhorse of the semiconductor industry in mature nodes.

Q1 2022 update:

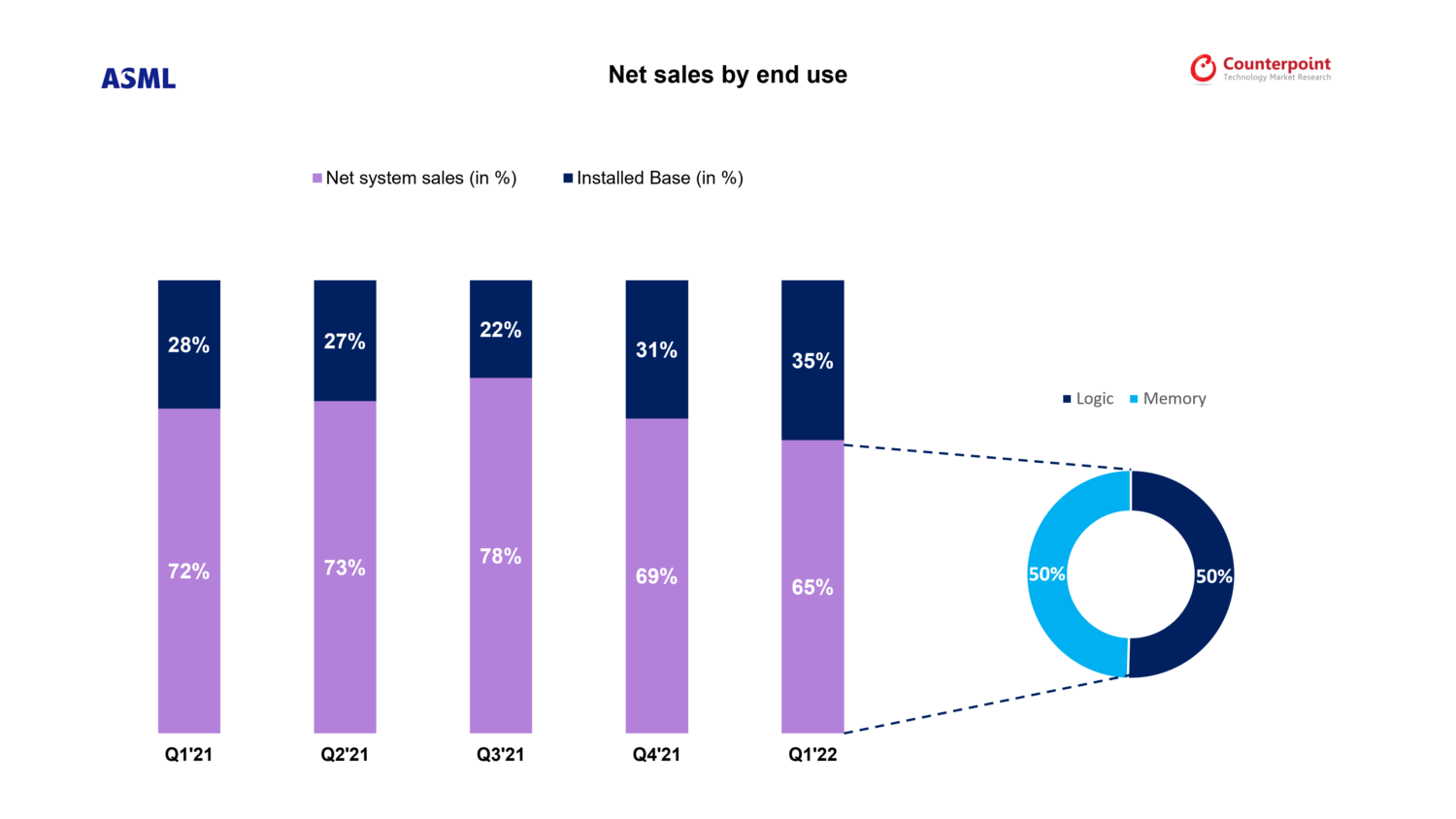

- Installed base as a percentage of net sales highest for any quarter.

- Net sales of €3.5 billion. Gross margin of 49% as guided.

- Net bookings at €7 billion, an increase of 47% YoY. €2.5 billion in EUV orders, including High-NA, and DUV at €4.5 billion.

- Net system sales at €2.3 billion.

- Installed base business (service and field option sales) at €1.2 billion.

- Installed base business as a percentage of net sales at 35%, an increase of 7% YoY, the highest in any quarter.

- Shipped nine EUV systems, an increase of 28% YoY.

- Higher ASP for EUV systems.

- Lower net sales as revenue shift of six EUV systems to subsequent quarter due to fast shipments.

- Total order book of €29 billion at the end of the quarter.

Breakdown: Net system sales

- Region-wise: Taiwan 22%, South Korea 29%, China 34%

- End use: Logic 50%, Memory 50%

- Lithography units: EUV-3, DUV-ArFi 18, ArFdry 6, KrF 26, I-line 9

Business outlook – 2022

Q2:

- Net sales between €5.1 billion and €5.3 billion, including installed base sales of around €1.2 billion.

- Gross margin 49%-50% due to higher volume both for DUV and EUV, offset by cost pressure and lower ASP for EUV going ahead.

Full year:

- Full-year revenue with around 20% YoY growth will enhance ASML’s prospects of becoming the top wafer fab equipment supplier.

- DUV, metrology and inspection markets expected to grow faster.

- Gross margin to be 54% in the second half due to the volume driven by both EUV and DUV systems in addition to increased gross margin on installed base revenue.

Products and businesses

- EUV revenue for the year will go up about 25%.

- Expect over 20% YoY increase in non-EUV business revenue driven by immersion, dry and metrology systems.

- Memory and installed business will be up around 25% and 10% respectively.

- Logic business will be up more than 20%.

Developments in Q1 2022

- On the commercial side, received multiple orders for High-NA EXE:5200 (EUV 0.55 NA), ASML’s next model High-NA systems, and from three logic and two memory customers.

- On the technology side, integration of the first EUV High-NA system in the new fab at Veldhoven progressing well.

- In applications business, shipped first eScan460 system, which is a next-generation single-beam inspection system with higher resolution and 50% faster throughput than eScan430.

Announcement to watch out

- Capital markets day in the second half of 2022 to revisit medium-term forecast and guidance on growth opportunities beyond 2025.

Impact of increased costs on 2022 margins

An impact of 1% on gross margin is expected for the full year due to cost increases owing to

- Labor cost associated with adding and training staff and strong competition for talent.

- Component price increases from suppliers and incremental cost from service fees to secure parts that are in short supply and high in demand.

- Freight cost going substantially up due to increased fuel prices.

Key takeaways

- Highest ASP for EUV systems in the quarter.

- Received multiple orders for High-NA EXE:5200 systems from both logic and memory customers.

- Increased adoption of EUV in high-volume manufacturing will enable ASML to meet its long-term forecast.

- Record order book of €29 billion and fast shipments will help ASML deliver over 20% YoY net sales revenue growth in 2022 and further enhance ASML’s prospects of becoming the top wafer fab equipment supplier.