- Yet to see strong recovery signs in PC, smartphone, and consumer applications due to a slower pace of inventory digestion.

- Automotive application remains on a growth trajectory but may have peaked in Q1 2023.

- 28nm continues as one of the key bright spots within the expected utilization rate back to 90% higher by the end of 2023.

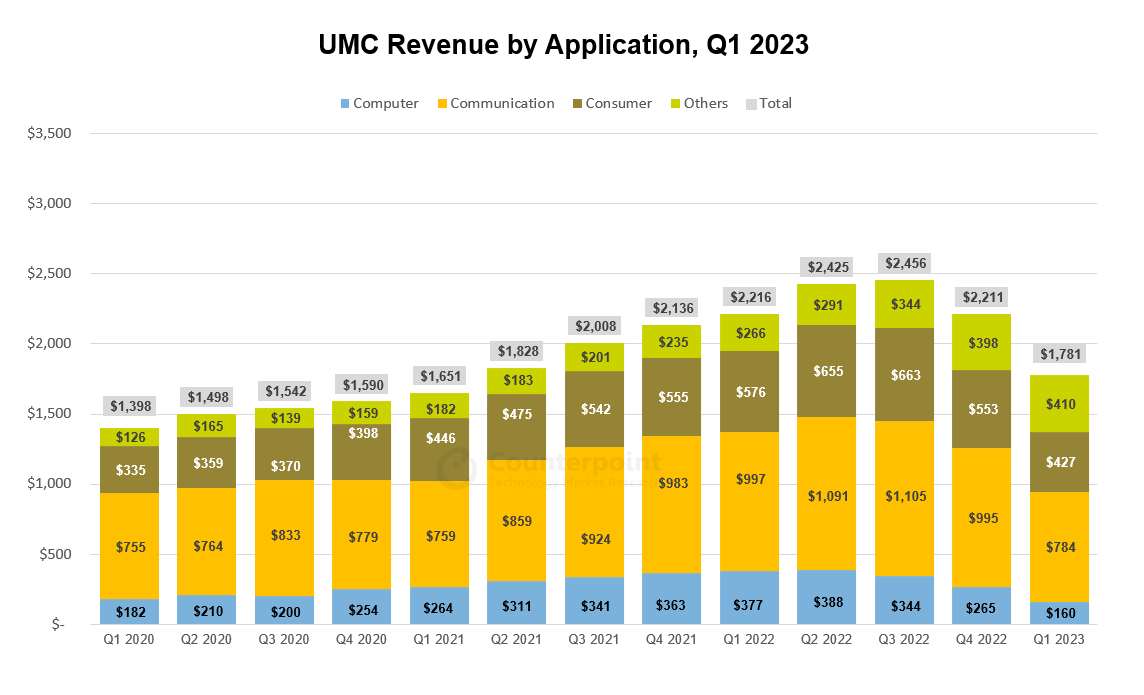

United Microelectronics (UMC) reported $1.78 billion in revenue for Q1 2023, down 14.5% YoY and 20.1% QoQ, constrained by sluggish wafer demand and the continuing customer inventory digestion. Despite the utilization rate dropping to 70%, the average selling price (ASP) was still stable. The gross profit margin remained firm at 35.5% due to cost reduction and product mix optimization. The management indicated that demand recovery has not been strong in PCs, smartphones and consumer applications, and customer inventory digestion has been slower than expected.

Automotive stood out but might not be sustainable in coming quarters

The automotive business was one of the key drivers that posted growth in Q1 2023, contributing to 17% of total revenue in the quarter. Revenue from integrated device manufacturer (IDM) customers also increased to 23% in Q1 2023 from 19% in Q4 2022 helped by growth in the automotive business. However, management pointed out that revenue from automotive applications may have peaked in Q1 2023 because it has been strong for three consecutive quarters since H2 2022. Nevertheless, the automotive segment is still a long-term growth driver for UMC.

Remains positive in 28nm outlook

The utilization rate of 28nm node in Q1 2023 was relatively higher compared to other nodes despite inventory correction in the communication segment. The management guided 28nm’s utilization rate to gradually improve and exceed 90% level by the end of 2023, supported by the demand for OLED display driver ICs, digital TVs and Wi-Fi 6/6E. UMC 28nm delivers better power consumption and performance versus competitors, which strengthens the company’s value proposition to customers. The management believes the technology leadership will reflect on its 28nm market share.

2023 capital spending guidance unchanged

UMC reiterated its capital spending guidance of $3 billion for 2023. As for allocation, 90% will be used for 12-inch wafers and 10% for 8-inch wafers. Most of the capital spending will be on 12A P6 for the 28nm capacity. The capacity will reach 12kwpm by the end of 2023 with customer commitments on track, echoing the management’s positive demand outlook for OLED display driver ICs, digital TVs and Wi-Fi 6/6E. The remaining capital will be spent on 12i P3 in Singapore.

2023 outlook

UMC has forecasted wafer shipment and ASP to be flat QoQ in Q2 2023 with utilization rate guided at low 70% and gross margin at mid-30%. The management pointed out that customer inventory digestion in semiconductors will continue to linger in Q2 2023 with limited visibility into H2 2023. However, the management is still positive on the 28nm demand outlook and the structural long-term growth trend in automotive applications driven by electrification and digitalization. The company will continue to work on cost control and product mix optimization to improve profitability during the semiconductor down cycle.