AMD Registers Highest Ever Quarterly Revenue

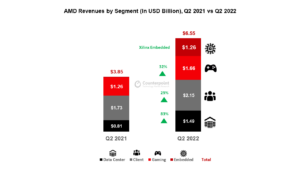

AMD registered its highest ever quarterly revenue in Q2 2022 at $6.6 billion with 70% YoY growth.

- The growth was driven by the company’s data center and embedded segment.

- The gross margin was down 140 bps YoY at 48% due to the amortization of the assets acquired from Xilinx.

- AMD completed the $1.9-billion acquisition of Pensando Systems during the quarter to complement its data center product portfolio with a high-performance data processing unit (DPU) and software stack.

Segment reporting

- Revenue for the data center segment was $1.5 billion, an increase of 83% YoY due to strong support from EPYC processors and lack of competitive products.

- Client segment revenue stood at $2.2 billion, an increase of 25% YoY due to focus on premium notebook portfolio and higher ASP for processors.

- Gaming segment revenue was $1.7 billion, a 32% YoY increase driven by semi-custom chips for console sales. Gaming graphics revenue declined due to consumer inflationary pressure.

- Embedded segment revenue was $1.3 billion, up 2,228% YoY due to the inclusion of Xilinx’s embedded revenue.

Data center segment

- The revenue growth came from the mainstream adoption of EPYC processors across cloud service providers and enterprises.

- The company also launched first ever cloud-based software-as-a-service solution for chip design for Microsoft Azure and Synopsys by deploying Milan-X and 3D-stacked chiplets.

Outlook

- The company is committed to its next-generation chipsets roadmap of launching Genoa, which will be fabricated using TSMC 5nm, in Q3 this year.

Client segment

- The company delivered sequential growth for the ninth quarter straight due to its focus on the premium notebook processor portfolio.

- Consumer OEMs launched ~300 designs while ~50 product launches were made on Ryzen-based systems for the enterprise segment.

Outlook

- The company is committed to its next-generation chipsets roadmap of bringing 5nm Ryzen 7000 desktop processors and AM5 platforms in Q3.

Gaming segment

- The company managed to deliver growth for the segment, which was facing inflationary headwinds, driven by semi-custom console growth.

Outlook

- The company plans to launch in Q3 a high-end RDNA gaming GPU fabbed at 5nm and aiming to provide a 50% improvement in performance per watt.

Embedded segment

- The Xilinx acquisition proved to be the segment’s star as FPGA and custom compute remained in demand. Mission critical nature of the products helped in sailing through the economic headwinds.

- Industries: Communications emerged as the leader due to higher demand in the wired segment from multiple Tier 1 system vendors, while demand in the wireless segment was driven by multiple ramp-ups of ORAN deployments in North America.

- Embedded CPU revenue grew significantly in the quarter due to higher automotive sales and the product ramp of new networking and storage design wins.

Q3 2022 outlook

- The revenue is expected to be ~$6.7 billion, an increase of around 55% YoY, primarily supported by the data center and embedded segments.

- PC segment will decline 13-15% due to inflationary pressures and tightening consumer spending.

- Data Center and Embedded to deliver growth due to product ramps after suffering supply constraints earlier this year.

- Gaming business to decline from graphics revenue perspective but console business to provide the strength