- Top 5 wafer fab equipment manufacturers’ revenue declined to $93.5 billion in 2023.

- Revenue from the foundry segment grew 16% YoY in 2023.

- Shipments to China accounted for around one-third of total system sales in 2023.

- Revenue from the memory segment fell 25% YoY in 2023 on a weak NAND end market. Technology upgrades in NAND and strong DRAM will help memory revenue growth in 2024.

- Strong DUV and EUV sales drove ASML to the top position in 2023.

Seoul, Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi – March 6, 2024

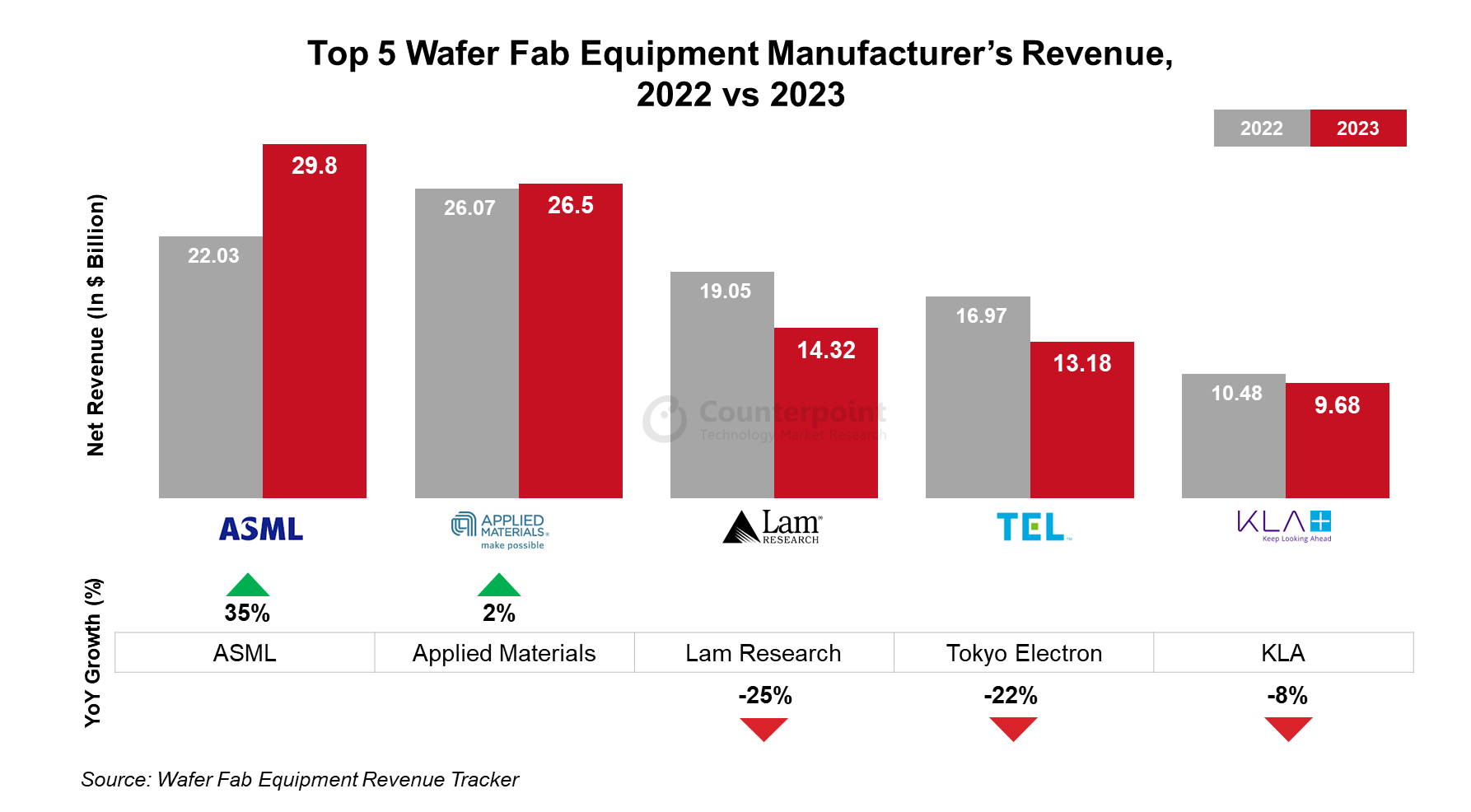

Top 5 wafer fab equipment (WFE) manufacturers’ revenue declined 1% YoY in 2023 to reach $93.5 billion due to weak memory spending, macroeconomic slowdown, inventory adjustments and low demand in the smartphone and PC end markets. Out of these five WFE vendors, ASML and Applied Materials managed to post YoY growth in 2023 while Lam Research, Tokyo Electron and KLA’s revenues declined 25%, 22% and 8% YoY respectively. Strong DUV and EUV sales drove ASML to the top position in 2023.

Inventory adjustments and memory downtrends had a significant impact on the overall revenue in H1 2023. However, inventory normalization and demand uptick in DRAM in H2 2023 helped restrict the overall full-year revenue decline.

Revenue from the foundry segment grew 16% YoY in 2023 due to the ramping up of gate-all-around transistor architecture and strength in investments by customers for mature node devices across segments, including IoT, AI, cloud, automotive and 5G.

Revenue from the memory segment declined 25% YoY due to weak overall memory WFE spending, especially NAND. However, the decline was checked by the strength in DRAM in the latter half of 2023.

A big push for self-sufficiency in China, increased trailing-edge DRAM shipments, DRAM demand and mature-node growth investments drove a 31% YoY increase in shipments to China, which accounted for around one-third of total system sales in 2023.

Gate-all-around technology ramp-up; growth in AI, automotive and IoT spending; new fabs becoming operational; DRAM technology node transition to support HBM; and improved NAND spending will drive the WFE market’s growth in 2024.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com