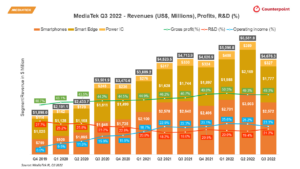

MediaTek‘s revenues fell 8.7% sequentially but increased 8.5% YoY to NT$142.1 billion. On a USD basis, revenues were comparatively flat due to FX weakness. Global macro headwinds, inventory correction, slow China market and weak consumer demand led to the revenue decline and weak outlook. Declining 8% QoQ, the smartphone segment contributed to 55% (NT$ 78.2 in Q3 2022) of MediaTek’s total revenue in Q3 2022. Smartphone segment demand was affected by customers’ inventory adjustments, especially in the 5G mid-range SoCs. Demand for LTE SoCs was strong in QoQ terms.

- The company has expanded its portfolio for the flagship and mid-range segments by launching Dimensity 9000+ and Dimensity 1050, respectively. The newly launched premium SoC has been adopted by top-end gaming smartphones. Also, MediaTek will launch a next-generation flagship SoC in Q4 2022. This will add to its premium segment revenue.

- The Smart Edge segment, which contributed 38% to the company’s revenue in the third quarter, declined 9% QoQ as telecommunication operators cut back on orders, negatively impacting the company’s Wi-Fi and wired businesses. Also, the consumer market weakness affected the tablet, Chromebook and monitor businesses.

- The power IC segment, which accounted for 7% of MediaTek’s revenue in Q3 2022, declined 17% QoQ due to weak demand for power ICs in consumer devices such as smartphones and PCs. But demand for power ICs for automotive and industrial applications remained robust in Q3 2022.

- MediaTek guided Q4 2022 revenues in the range of NT$108 billion to NT$119.4 billion ($3.4 billion to $3.8 billion), a decline of 16%-24% QoQ and a decline of 7%-16% YoY. The gross margin is expected to be around 48.5% and the operating expense ratio is expected to be 31%. LTE SoCs will decline more severely than 5G SOCs in Q4 2022. Wi-Fi, broadband and routers will also be impacted as some of the Wi-Fi operators will slow down their fourth-quarter buy-in. The company also projected a sequential increase in revenues in Q1 2023.

- The inventory level came down in Q3 2022 compared to the previous quarter. For both 4G and 5G, SoC inventory will come down in Q4 2022. Inventory corrections will be normalized in H1 2023.

- According to Counterpoint Research’s Smartphone AP/SoC Shipment Tracker, MediaTek dominated the smartphone AP/SoC market in Q3 2022 with a share of 36.5%, followed by Qualcomm. MediaTek shipments have declined due to order cuts from major Chinese OEMs. MediaTek’s relatively greater dependence on the mid-end and low-end smartphone segments, which are likely to be more affected by the current macroeconomic situation as well as excess channel inventory, will lead to a weaker fourth quarter.

Overall, weak market outlook for Q4 2022 from MediaTek echoes increasingly cautious views from the foundry and IC packaging makers, which are seeing a slowdown in smartphone IC orders in early 2023. We expect 2023 to be challenging with inventory correction going on till H1 2023 and coming down to a normal level (80-90 days) by the end of 2023. The demand outlook for 2023 also looks challenging after inventory corrections due to macroeconomic uncertainty and weak China market. From the technology migration point of view, 5G SoCs are going to be a growth opportunity for the company. MediaTek will focus on maintaining gross margin, following price discipline at a time of uncertainty in the global semiconductor industry.