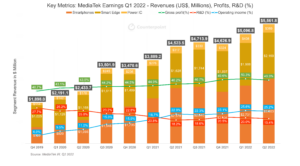

- MediaTek recorded a strong second quarter with revenues of $5.5 billion, an increase of 23.9% YoY and 9.1% QoQ. This growth is primarily driven by the smartphone segment. MediaTek maintained its position despite tough macroeconomic conditions and a slowdown in the China Market.

- The company’s smartphone segment has achieved a revenue of $3 billion in Q2 2022, up by 16.5% annually and 12% sequentially. The growth was driven by the ramp-up of premium 5G smartphone chipsets and demand for 4G. During the quarter, Chinese smartphone OEMs launched phones with the new Dimensity 9000 and Dimensity 8000 series chipsets. Overall, the smartphone segment contributed 54% of the company’s total revenue in Q2.

- The Smart edge segment contributed 38% to MediaTek’s Q2 2022 revenues. This segment has grown by 33% YoY. Key drivers in the smart edge are migration to Wi-Fi 6, 5G modem, ASICs for a gaming console, and demand for wired connectivity. However, the demand for TV and tablets declined due to weak consumer demand. It is also investing in ASICs for 5G infrastructure and enhancing its capabilities in power-efficient ARM-based processors.

- Power IC accounted for 7% of MediaTek’s Q2 2022 revenue. This segment is down by 5% from Q1 2022 owing to weaker demand for power ICs used in smartphones and notebook PCs. The demand for Power ICs in the auto and industrial segments remained stable contributing to 10% of the Power IC’s segment revenue in Q2 2022.

- MediaTek guided weak Q3 revenues in the range of $4.8 to $5.2 billion, a decline of 1% to 9% QoQ. The gross margin is expected to be around 49% and the operating expense ratio 26%. The decline in revenues will be due to ongoing customer inventory adjustments, global macroeconomic conditions, the weak China market and the expected continued negative consumer sentiment. MediaTek’s relatively greater dependence on the mid and low-end smartphone segments, which are likely to be more affected by the current macroeconomic situation aswell as current excess channel inventory is leading to a weaker second half of the year.

- According to Counterpoint Research’s Smartphone AP/SOC Shipment Tracker, MediaTek has led the smartphone AP SOC market with a volume share of 39% in H1 2022, followed by Qualcomm with 28%. MediaTek will continue to dominate the AP SOC market in Q3 2022. We are already seeing order cuts in H2 2022 due to excess inventory. The overall decline for MediaTek is higher than Qualcomm, as the impact of a slowdown in Qualcomm’s more premium-oriented customer base is likely to be somewhat lower.

- Inventory corrections will take two to three quarters to normalize. The OEMs and distribution channels have started to adjust inventory. MediaTek will manage costs and expenses and will also slow down hiring to control operating expenses.

Overall, it was a strong quarter for MediaTek driven by the smartphone segment. We are forecasting a weak H2 2022 due to macroeconomic conditions, inventory corrections and a slow China market. Further, high dependence on smartphones and slow diversification into automotive and IoT (ARM-based PCs, XR, enterprise, etc.) will negatively impact the revenues in H2 2022.