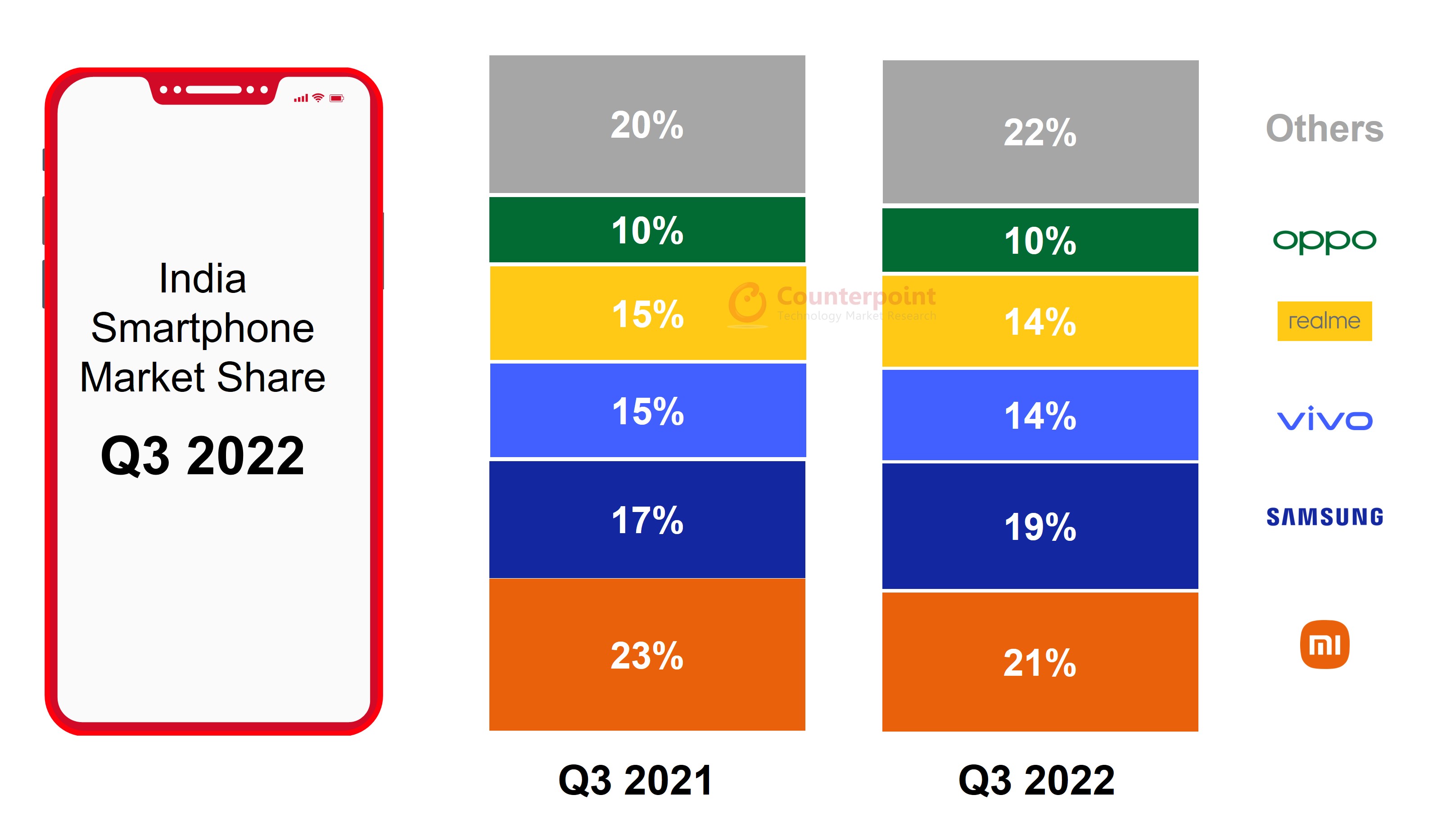

- India’s smartphone shipments declined 11% YoY in Q3 2022 to reach over 45 million units.

- Xiaomi led the market with a 21% shipment share, closely followed by Samsung.

- One in three smartphones shipped during the quarter was a 5G smartphone. Samsung led the 5G smartphone segment with a 20% share, closely followed by OnePlus and vivo.

- Apple led the premium smartphone segment, followed by Samsung.

- For the first time ever, an iPhone (iPhone 13) topped the overall India smartphone quarterly shipment rankings.

New Delhi, Hong Kong, Seoul, London, Beijing, San Diego, Buenos Aires – November 4, 2022

India’s smartphone shipments declined 11% YoY to reach over 45 million units in Q3 2022 (July-September), according to the latest research from Counterpoint’s Market Monitor service. The YoY decline, which is the first ever for a Q3, can be attributed to the high base last year due to the pent-up demand during Q3 2021, as well as lower consumer demand in the entry-tier and budget segments in Q3 2022.

Commenting on the market dynamics, Senior Research Analyst Prachir Singh said, “Consumer demand started increasing in August and peaked in the last week of September during the festive sales, especially in the mid-tier and premium segments. However, as the market exited Q2 2022 with high inventory, and there was modest demand in the entry-tier and budget segments, we saw less than expected shipments during Q3 2022. Almost all the brands were impacted, especially in the entry-tier and budget segments. The unfavourable macroeconomic conditions will continue to affect the Indian smartphone market in Q4 2022 as well, especially after Diwali. However, we may witness a demand uptick during the year-end sales.”

Commenting on the competitive landscape and brand strategies, Research Analyst Shilpi Jain said, “After the 5G network rollout, consumers are quite keen on purchasing 5G smartphones, especially the upgrading users. In Q3 2022, 5G smartphones registered 31% YoY growth and contributed to 32% of the total shipments. In terms of price bands, the premium segment (>INR 30,000) reached its highest ever share of 12% during this quarter. Apple led the premium segment, followed by Samsung and OnePlus. The brand reached its highest ever shipment share in India and the iPhone 13 became the top smartphone model in Q3 2022, a first for Apple in India. The sub-INR 10,000 price band continues to be under pressure due to lower consumer demand and contributed to 27% of the total shipments, down from 31% a year ago.”

Notes: Xiaomi includes POCO; OPPO excludes OnePlus; vivo includes IQOO; Figures not exact due to rounding

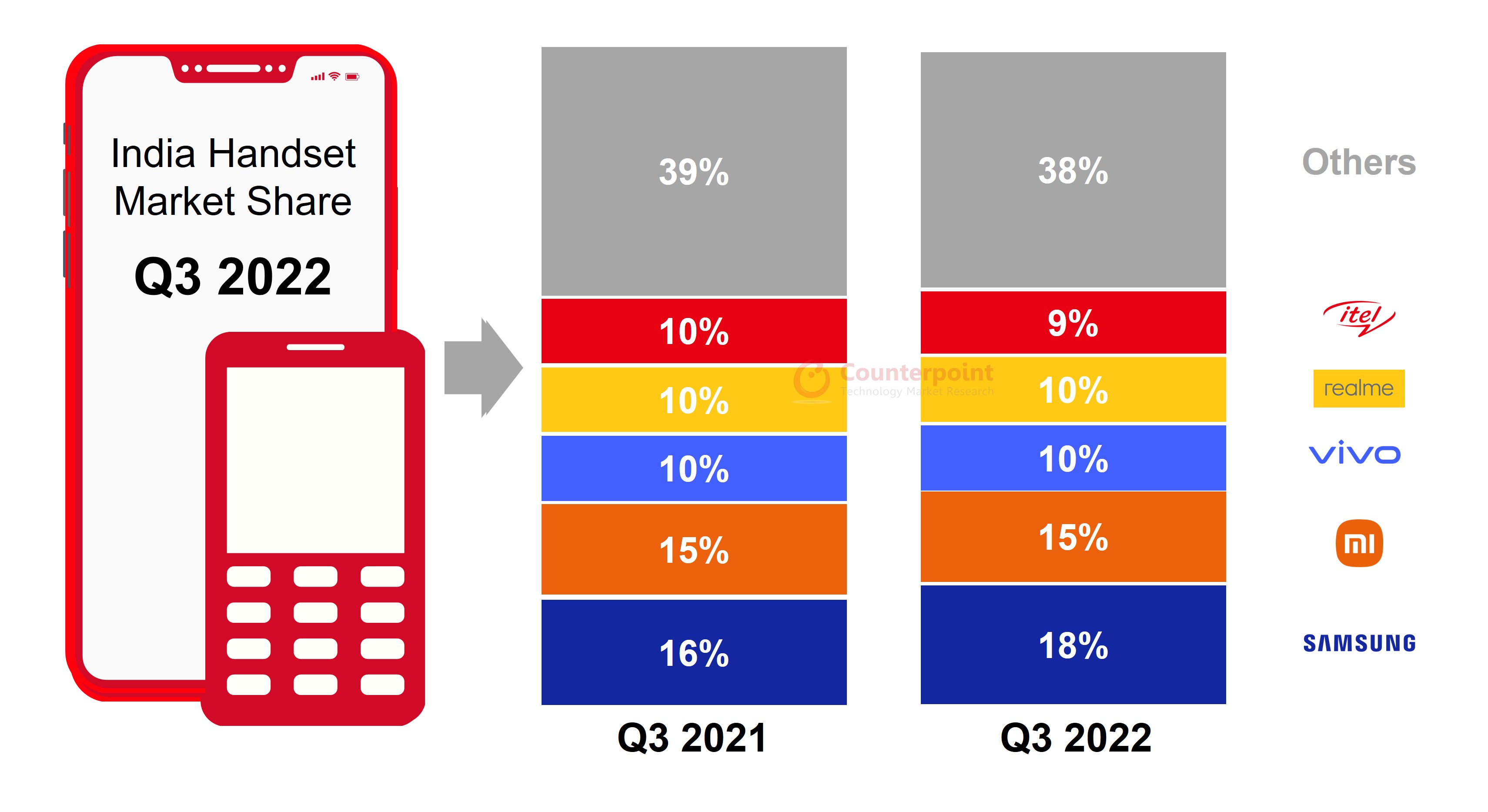

India’s mobile handset market (including both smartphones and feature phones) declined 15% YoY in Q3 2022. The feature phone market registered a decline of 24% YoY due to adverse macroeconomic conditions continuing to impact the bottom-of-the-pyramid users. itel led India’s feature phone market in Q3 2022 with a 28% share. itel has been the top feature phone brand for almost three years in a row now.

Notes: Xiaomi includes POCO; OPPO excludes OnePlus; vivo includes IQOO; Figures may not add up to 100% due to rounding

Market Summary

- Xiaomi led the Indian smartphone market in Q3 2022, though its shipments declined 19% YoY. Weak consumer demand in the entry tier was the major factor behind this decline. However, the new launches during the quarter in the budget and mid-tier segments drove Xiaomi’s shipments and the brand managed to maintain its top position in the market. In the sub-INR 20,000 price band, Xiaomi was the top 5G smartphone brand in Q3 2022.

- Samsung held the second spot in Q3 2022. It was the only smartphone brand among the top five to register an annual growth. Samsung led the handset (feature phone + smartphone) market as well with an 18% share. It also remained the top-selling 5G smartphone brand in India. Aggressive online channel stock replenishment before the festive season with attractive promotions and offers led to this growth. Samsung was the top smartphone brand in September 2022. It led the INR 10,000-INR 20,000 price band driven by the strong performance of Galaxy M-series and F-series models. In the premium segment, Samsung was the fastest growing brand among the top five brands.

- vivo captured the third position even as its shipments declined 15% YoY. Strong focus on the budget segment with the Y01 and Y15s in the offline segment, revamping of the V series and increasing online presence with IQOO and T-series smartphones during the quarter helped vivo maintain its third position. The Y01 was the second best-selling smartphone in the Indian smartphone market in Q3 2022.

- realme remained at the fourth spot in Q3 2022, capturing a 14% share. The brand grew 2% QoQ. Three out of the top 10 models in the INR 10,000-INR 15,000 price band were from realme. realme’s C series accounted for 55% of its portfolio and was the main driver for its shipments in Q3 2022.

- OPPO maintained its fifth position in India’s smartphone market, though it declined 7% YoY in Q3 2022. OPPO is consistently increasing its shipments in the high-tier segments. In Q3 2021, the >INR 20,000 price band contributed to 15% of OPPO’s portfolio, which increased to 22% in Q3 2022. With the Reno 8 Pro, the brand made its re-entry into the ultra-premium segment (>INR 45,000).

- Transsion Group brands (itel, Infinix and TECNO) captured a 12% share in India’s handset market to climb to the third spot. itel led the sub-INR 6,000 smartphone segment with a 56% share driven by strong shipments of the A23 Pro and A27. TECNO captured the third spot in the sub-INR 8,000 smartphone segment driven by strong demand for the Spark Go 2022 and Pop 5 LTE.

- Apple reached its highest ever share of 5% in India’s smartphone market during the quarter driven by a strong channel push ahead of the festive season. The iPhone 13 became the first iPhone to top the overall smartphone shipments in India in a quarter. In the premium segment (>INR 30,000), Apple led the smartphone shipments, capturing a 40% share.

- OnePlus grew 35% YoY in Q3 2022 driven by the Nord CE 2 series and Nord 2T. The brand remained at the third spot in the premium segment (>INR 30,000). OnePlus led the INR 20,000-INR 30,000 price band driven by its Nord portfolio. OnePlus also captured the second spot in India’s 5G smartphone shipments in Q3 2022.

- Nothing launched its first smartphone during this quarter and managed to capture mindshare as well as share in the premium segment. Another brand which made its impact in the premium segment was Google with its Pixel 6a smartphone that performed strongly during August and September.

The comprehensive and in-depth Q3 2022 Market Monitor is available for subscribing clients. Feel free to contact us at press@counterpointresearch.com for questions regarding our latest research and insights.

The Market Monitor research relies on sell-in (shipments) estimates based on vendors’ IR results and vendor polling, triangulated with sell-through (sales), supply chain checks and secondary research.

You can also visit our Data Section (updated quarterly) to view the smartphone market shares for World, US, China and India.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Prachir Singh

Shilpi Jain

Tarun Pathak

Follow Counterpoint Research