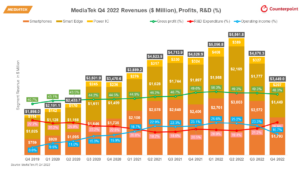

- MediaTek’s revenue was down 25% YoY and 26% QoQ in Q4 2022.

- The mobile phone segment’s revenue declined 25% YoY and 30% QoQ.

- MediaTek has downgraded Q1 2023 revenues to $3.0-$3.4 billion, a decline of 35-40% YoY and 3-12% QoQ.

- The company has guided the inventory levels to normalize by the end of H1 2023.

MediaTek has reported $3.4 billion in revenue for Q4 2022, down 25% YoY and 26% QoQ. For the full year of 2022, the revenue was $18.7 billion, up 6% YoY. MediaTek delivered a strong H1 2022 driven by 5G SoCs but a weak H2 2022 due to macroeconomic headwinds and customer inventory adjustments. The QoQ decline was due to the slow China market, weak consumer demand and inventory correction by smartphone OEMs. The mobile phone segment’s revenue declined 25% YoY and 30% QoQ due to aggressive inventory adjustments by customers. The segment contributed 52% of MediaTek’s Q4 2022 revenue.

Highlights

- The smart edge segment, which contributed 42% to the company’s revenue in the fourth quarter, declined 18% sequentially due to order cuts from telecommunication operators for inventory adjustment. Revenues from enterprise ASIC and automotive products increased due to growing popularity in the US and Europe regions.

- The power IC segment accounted for 6% of MediaTek’s revenue, declining 37% QoQ in Q4 owing to weak demand from consumer devices such as smartphones. But the demand for power ICs from automotive and industrial applications increased in Q4.

- Changing view from the previous quarter’s guidance, MediaTek downgraded Q1 2023 revenues to the range of $3.0-$3.4 billion, a decline of 35-40% YoY and 3-12% QoQ. Gross margins in Q1 2023 are expected to be around 47.5% and the operating expense ratio around 33%. Most smartphone OEMs will follow a conservative approach to maintaining their inventory. Smart TV and Wi-Fi will see a slight increase in demand in the first quarter.

- MediaTek also launched satellite-based connectivity solutions with Bullitt group, to be available in Q1 2023. MediaTek is the third player after Apple and Qualcomm to offer satellite-based connectivity solutions.

- MediaTek guided the inventory levels to normalize by the end of H1 2023. This is in line with our view. In H2 2023, MediaTek expects to see growth in revenues. Currently, Chinese smartphone OEMs have 3-3.5 months of smartphone inventory levels, which will come down to 2-2.5 months by the end of Q1 2023.

- According to Counterpoint Research’s Smartphone AP/SoC Shipment Tracker, MediaTek shipments have declined due to ongoing inventory adjustments, global macroeconomic situation, and a weak China market. LTE SoCs declined more than 5G SoCs in Q4 2022.

Overall, weak guidance from MediaTek for Q1 2023. The first half of 2023 is going to be tough due to inventory correction and macroeconomic uncertainties. We forecast the market to bounce back and inventory levels to come back to normal in the second half. We expect the overall smartphone shipments to be flat in 2023. Therefore, despite the growth in the second half, we forecast smartphone AP SoC shipments to contract in 2023.

Overall, weak guidance from MediaTek for Q1 2023. The first half of 2023 is going to be tough due to inventory correction and macroeconomic uncertainties. We forecast the market to bounce back and inventory levels to come back to normal in the second half. We expect the overall smartphone shipments to be flat in 2023. Therefore, despite the growth in the second half, we forecast smartphone AP SoC shipments to contract in 2023.