New Delhi, London, Hong Kong, Beijing, San Diego, Denver, Seoul, Buenos Aires – June 2, 2022

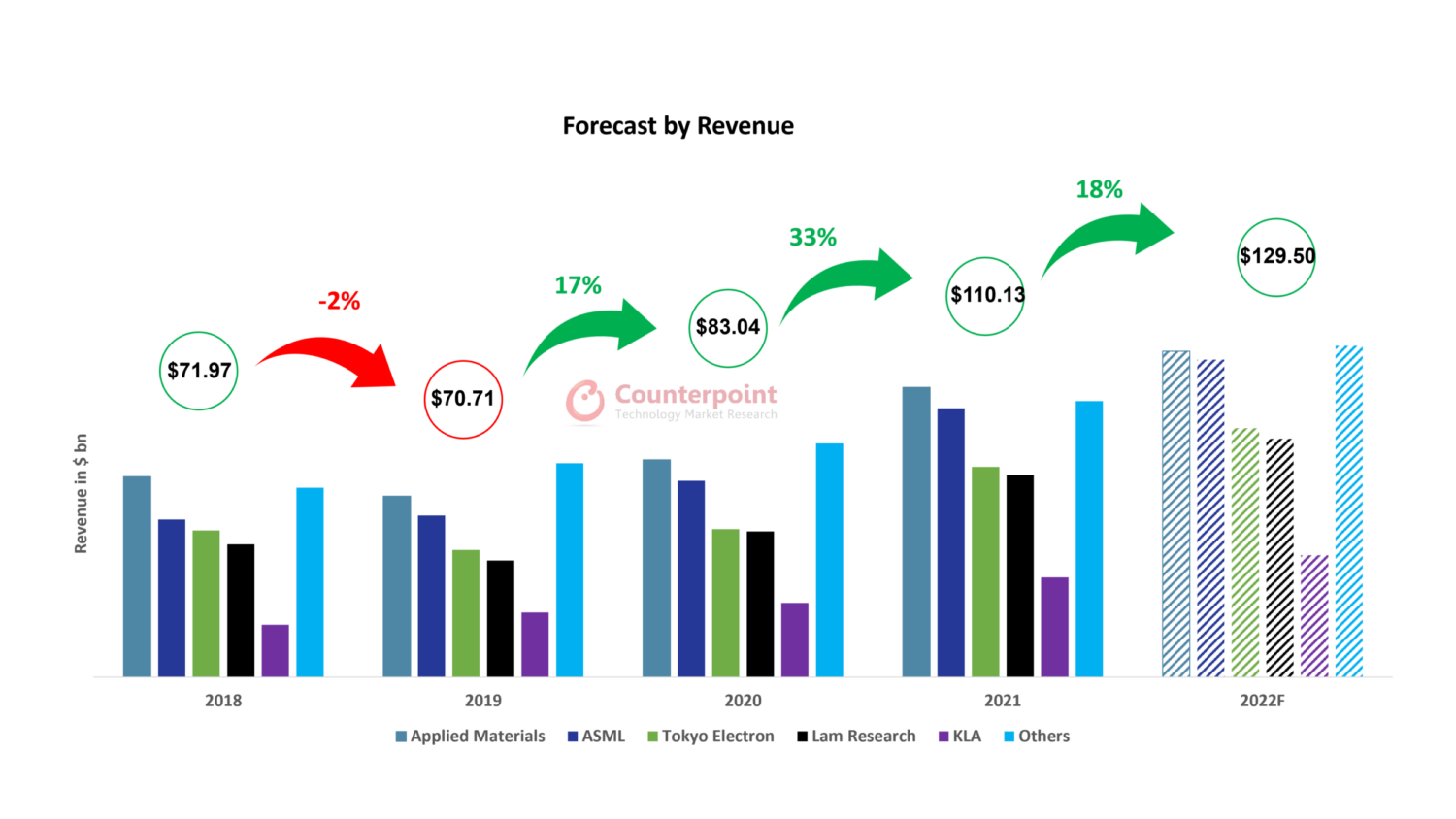

Global Wafer Fab Equipment (WFE) manufacturers’ revenue will grow 18% in 2022 to exceed $129 billion, according to Counterpoint Research’s Wafer Fab Equipment Revenue Tracker. Critical technology transformations, increasing device and manufacturing complexity, aggressive investments in higher semiconductor performance and active investments in production capacity expansion will drive WFE spending in 2022. The chip shortage will continue to be a concern for the WFE supply chain in 2022.

WFE market outlook looks impressive

- Continuous efforts by foundries to increase wafer output, reduce defects and improve yield.

- Demand exceeding supply.

- Increase in wafer-processing steps to produce diverse and complex applications.

- WFE spending limited by supply in 2021, with unmet demand pushed to 2022 and beyond.

- Long-term secular growth drivers including rising semiconductor content and increasing device complexity remain intact.

- Increased capex allocations by customers.

Commenting on the WFE market, Senior Analyst Ashwath Rao said, “Healthy WFE spending outlook, strong semiconductor demand across segments, rising capital intensity and innovative product portfolio will drive Top 5 WFE manufacturers’ revenue past $100 billion in 2022”. At the same time, the availability of components going into WFE subsystems has been hampered due to supply chain disruptions, thereby increasing the equipment lead time and delaying deliveries. This will impact revenue growth in the first half.

WFE Market: 2018 – 2021

- WFE revenue in 2021 reached a record high of $110 billion, an increase of 33% YoY, driven by strength across device segments NAND, DRAM and Foundry/Logic.

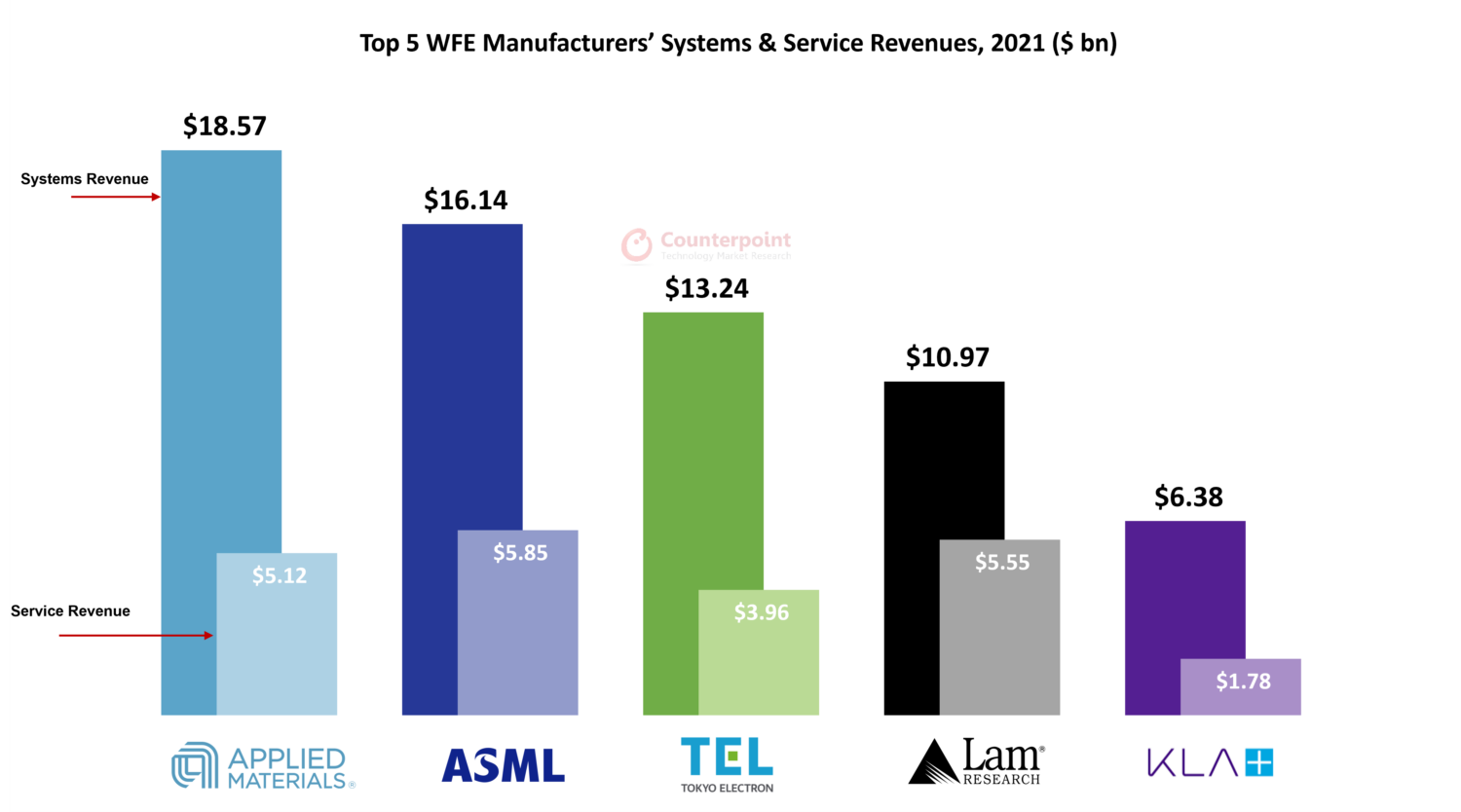

- Service revenue of the Top 5 suppliers’ increased 29% YoY to $22.2 billion.

- In 2020, growth across all segments of the market led by NAND recovery, Foundry/Logic expansion and a slight increase in DRAM helped achieve overall revenue growth of $83 billion, an increase of 17% YoY.

- In 2019, digestion of capacity additions by memory customers in a weaker demand environment and acceleration in ramping of new leading-edge nodes by logic customers led to a decrease in growth.

WFE Market: 2022 Outlook

WFE Market: 2022 Outlook

- 2022 revenues are expected to grow 18% YoY, with the Top 5 WFE suppliers’ revenue surpassing $100 billion.

- Top 5 suppliers’ systems revenue will surpass $75 billion, an increase of 18% YoY, and service revenue will be at $27 billion, an increase of 24% YoY.

- Strong growth in services is expected to continue in 2022, mainly driven by a rapidly growing installed base, increasing complexity of systems, tighter time-to-market requirements for customers, and expansion of service opportunities at trailing edge nodes.

- Investment in R&D and increasing capacity both at customers and equipment manufacturers will remain a top priority in 2022.

Rao said, “A huge order book, record backlog and demand exceeding capacity will enable equipment manufacturers to expand their capacity to address the shortages and generate higher revenue growth”. A gradual recovery in growth will be observed in the second half of 2022 despite supply chain disruptions due to COVID-19 and heightened geopolitical conflicts. But the impact of cost increase due to labor, components from suppliers and freight charges will lower the gross margin in 2022. Trends such as export regulations between regions will also require close monitoring. Therefore, Q2 growth is expected to be muted.

Priority to manage supply chain constraints in partnership with suppliers and chipmakers will help meet current and future demand by

- Actively adding and improving capacity.

- Assigning engineering resources to improve supply chain flexibility.

- Advancing ecosystem collaboration to fight challenges.

- Meeting device performance and cost targets.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Ashwath Rao

Dale Gai

Neil Shah

Follow Counterpoint Research

press@counterpointresearch.com

Related Links

- ASML Net Sales at High End of Guidance; High NA Orders to Drive Long-term Growth

- Applied Materials’ PPACt Play Drives Record Quarterly Revenues

- EUV Technology Leader ASML Etches Successful Earnings Pattern

- Efforts to Diversify Semiconductor Supply Chain Gather Pace

- Global Semiconductor Foundry Market Share: By Quarter

- Smartphone ODM/IDH Companies’ 2021 Shipments Rise 6.4% YoY Despite COVID-19, Component Shortages

- TSMC’s Quarterly High-performance Computing Sales Surpass Smartphones for First Time in Q1 2022

- Wafer Fab Equipment Revenue Tracker

WFE Market: 2022 Outlook

WFE Market: 2022 Outlook