Beijing, Boston, San Diego, Buenos Aires, London, New Delhi, Hong Kong, Seoul – April 6, 2022

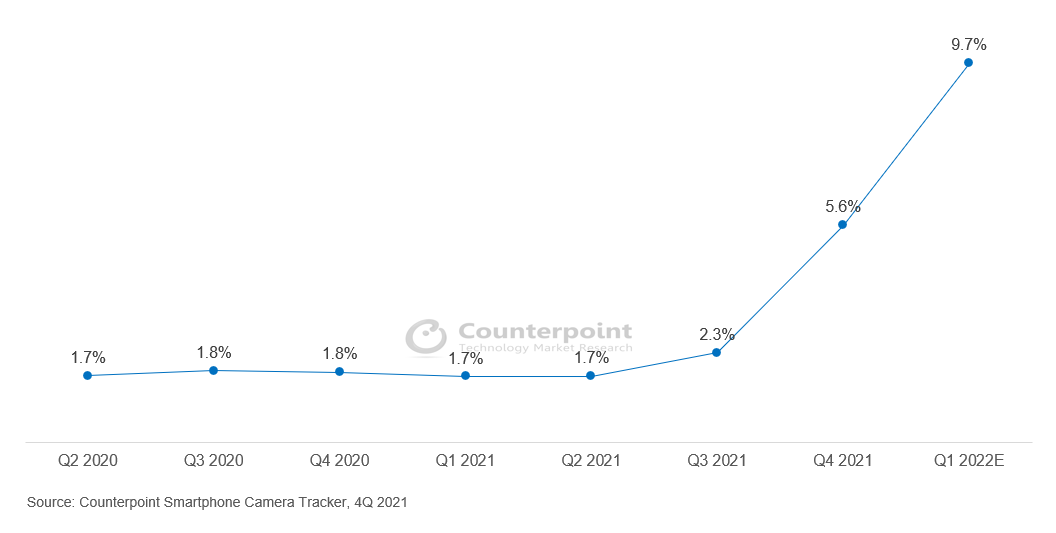

Huawei’s P40 series was the first to use 50MP image sensors in premium smartphone design in March 2020. Other OEMs, including vivo and OPPO, quickly caught up and launched premium phones featuring 50MP sensors. By the second half of 2021, when Samsung’s 0.64µm 50MP S5KJN1 entered mass production, 50MP sensors had become a hot item. The sales share of smartphones featuring a 50MP rear primary camera jumped to 5.6% in Q4 2021 from 1.7% in Q2 2021.

Smartphone 50MP Rear Primary Camera Penetration by Sales

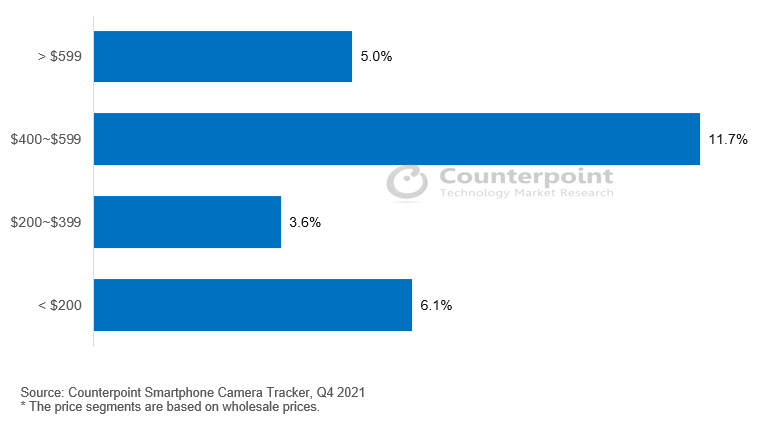

Now, large-pixel 50MP (1.0µm and above) sensors have started to penetrate the mid-to-high-end market due to price cuts. In February 2020, Sony released its custom 50MP IMX700 for Huawei, after which Samsung and OmniVision also launched their 50MP sensors. This led the price of large-pixel 50MP sensors to record a high double-digit drop compared to Q2 2020. As a result, more and more mid-range models, such as the realme GT Master Explorer Edition, started adopting big-pixel 50MP sensors, pushing up the share of 50MP in the $400-$599 segment to 11.7% in Q4 2021 from 4.2% in Q2 2021.

Smartphone 50MP Rear Primary Camera Penetration by Price Band, Q4 2021

Samsung unveiled its small-pixel 50MP S5KJN1 (0.64µm) in June 2021, further bringing the price down to under $5. This convinced OEMs such as vivo, OPPO and Xiaomi to actively deploy the S5KJN1 in their low-to-mid-end models. As a result, the proportion of smartphones with a 50MP rear main camera in the $200-$399 and < $200 segments surged to 3.6% and 6.1% respectively in Q4 2021.

Additionally, there is an emerging trend of OEMs strengthening the ultrawide camera performance by increasing the resolution to 50MP to deliver superior landscape shooting.

Looking into 2022, SK hynix and SmartSens are expected to start mass production of their 50MP image sensors during the year, which will intensify competition and bring prices down. Therefore, we expect stronger demand for 50MP image sensors, with sub-0.7µm offerings accounting for more than three-quarters of total sales.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Alicia Gong

Ethan Qi

Follow Counterpoint Research

press(at)counterpointresearch.com