Boston, Toronto, London, New Delhi, Beijing, Taipei, Seoul – November 18, 2021

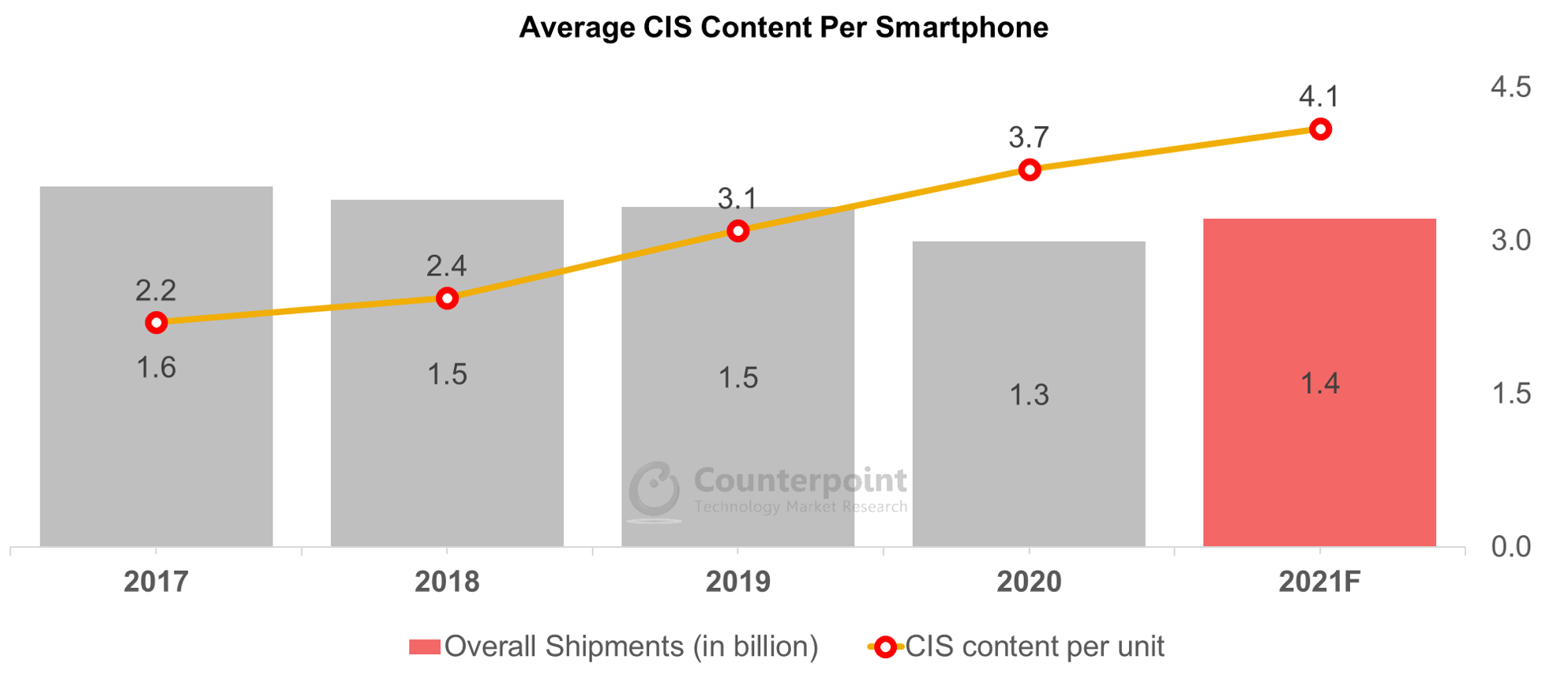

Smartphone imaging systems will continue to see strong hardware upgrades this year, with Counterpoint Research’s latest Global Smartphone Camera Demand-Side Report highlighting CMOS image sensor (CIS) content per smartphone will expand to an average of 4.1. Despite the global components crunch, CIS growth is expected to grow by double digits to reach almost 6bn units in 2021.

“A big driver has been triple-and-above main camera setups, which accounted for two-thirds of all smartphones sold during the first half,” notes Tarun Pathak, Counterpoint’s director of smartphone research. “What’s really interesting is where a lot of that growth is coming from – Africa, Latin America, India and other emerging markets. As we move through post-COVID upgrade cycles, especially in Android heavy markets, we’re seeing OEMs offer increasingly sophisticated camera hardware to their customers across all segments.”

“High-resolution has also been an area of focus, with 48MP-plus becoming standard. Again, we’re seeing emerging markets lead in growth; and 64MP is starting to become a major segment too. High-res is very important for what is the most hotly contested price band globally – the wholesale $100-$399 category. During the second quarter, two-thirds of devices were high-res and we expect further share increases for the full year.”

During an upcoming webinar, Global Smartphone Camera Trends 2022: Innovation Talk, Counterpoint will discuss how camera systems are evolving, and how they have become critical for OEMs as consumers place increasing importance on image capture.

A confluence of factors like more powerful chipsets, breakthroughs in AI image processing and other hardware and software advancements are constantly delivering improved imaging experiences for consumers in all segments. Features that were once only available on ultra-premium devices are now emerging across OEMs’ broader portfolios – from contextual shooting, optical zoom and ultra-high res through to time-of-flight and macro capabilities.

“Whether it’s a regional leader like TECNO catering to Nigerian youth, or Apple delivering DSLR quality pics for SoCal influencers, imaging has become an even more core feature for all OEMs,” observes Yang Wang, Senior Analyst for Africa. “And the bar being set in terms of the camera only gets higher.”

“If you’re a product manager today delivering a quad cam device, then you’re probably thinking of configuring wide + ultrawide + macro + depth. But the playing field changes quickly, and we’re likely to see macro and ultrawide merge, leaving room for even more options like telephoto or time-of-flight. Increasing choice and complexity is why algorithm development has become such a critical factor in the success of camera systems,” states Ethan Qi, Counterpoint’s lead camera components analyst.

“At the end of the day it’s not about camera or mega-pixel counts or how powerful your processor is. It’s a combination of things: How good is the integration? The AI algorithms? Is tuning tweaked appropriately for the market? It’s the sum of parts that delivers the experience,” according to Neil Shah, Counterpoint’s Vice President of Research. “OEMs understand this, but it’s difficult to get right. It’s as much art as it is science.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Contacts:

Follow us on LinkedIn and Twitter

press(at)counterpointresearch.com