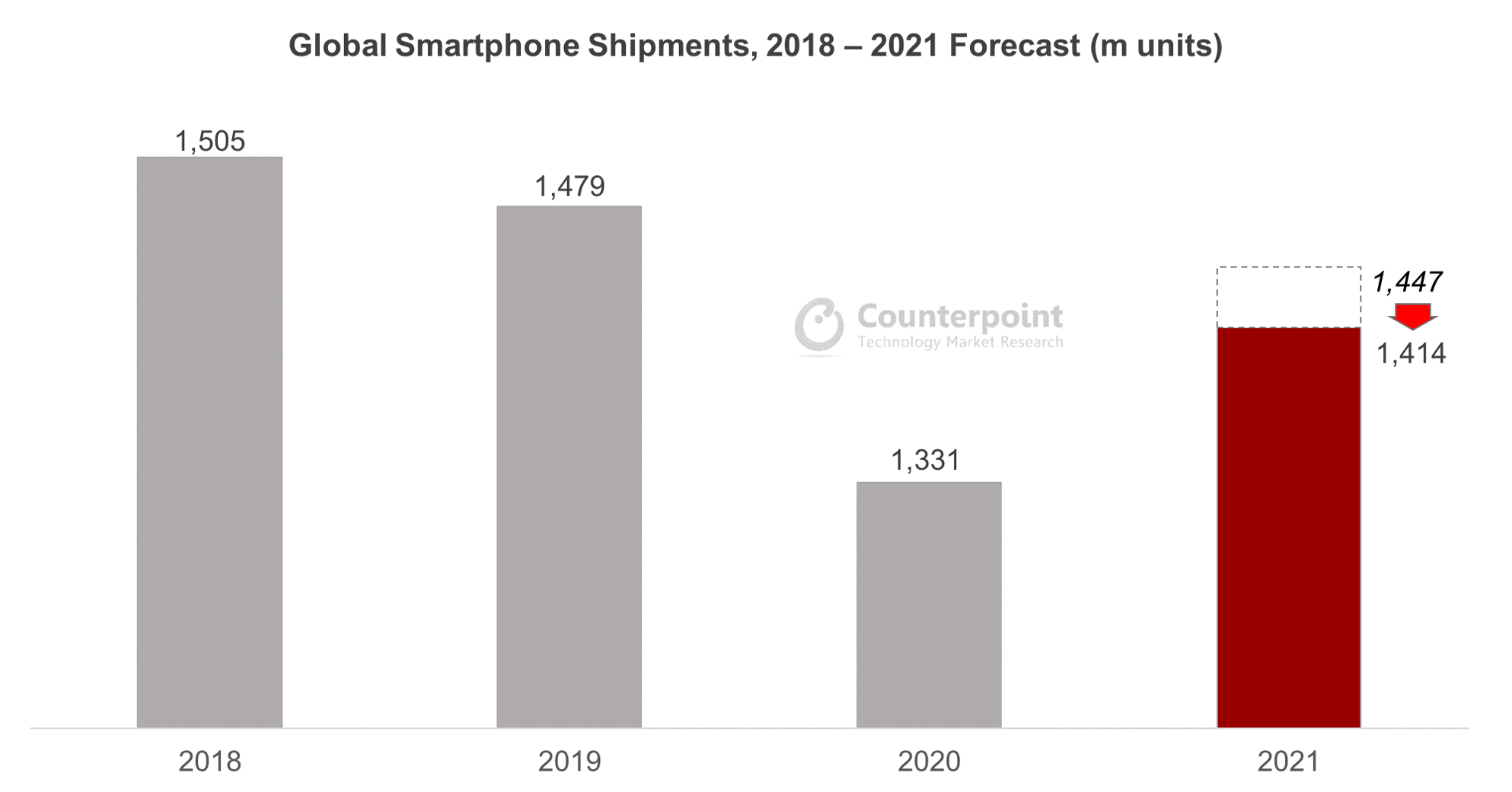

- Smartphone shipment forecast for 2021 lowered to 1.4bn units, or 6% annual growth.

- Our previous forecast was 9% annual growth.

- This is mainly because of semiconductor shortages.

Hong Kong, Boston, London, New Delhi, Beijing, Taipei, Seoul – September 30, 2021

According to Counterpoint Research’s latest Global Smartphone Quarterly Shipment Forecasts, total units shipped for 2021 are expected to grow by only 6% annually to 1.41bn units; Counterpoint had previously called for 9% annual growth to 1.45bn units.

The smartphone industry was set for a strong rebound this year after COVID-19 had hit the market hard in 2020. Smartphone vendors placed large component orders from the end of last year, and consumer demand coming from delayed replacement purchases buoyed the market in the first quarter. However, some smartphone OEMs and vendors are reporting they had only received 80% of their requested volumes on key components during Q2 2021, and the situation seems to be getting worse as we move through Q3 2021. Some smartphone makers are now saying they are only receiving 70% of their requests, creating multiple problems. Counterpoint Research believes 90% of the industry is affected and this will impact the second half forecast for 2021.

Semiconductor shortages had been plaguing the market since Q4 2020, but the smartphone industry had managed to grow despite shortages in components like DDIs and PMICs. This was done by advanced planning and order placing along with hoarding of certain components like Application Processors (AP) and camera sensors which are typically much higher value than DDIs or PMICs.

Semiconductor shortages continue and despite foundries running at full capacity for several quarters, the smartphone industry is being affected. Components that were once fully stored in the warehouse are bottoming and new components are not coming as requested.

In the case of application processors, one of the most crucial elements in smartphones, the shortage was triggered by low yield rates in newly established fab lines. With the situation seeming to persist it caused a chain reaction throughout the industry. AP vendors like Qualcomm and Mediatek rely on these foundries and manufacturing problems result in fewer processors supplied which in turn affects smartphone OEMs.

Tom Kang, Research Director at Counterpoint Research commented, “the semiconductor shortage seems to affect all brands in the ecosystems. Samsung, Oppo, Xiaomi have all been affected and we are lowering our forecasts. But Apple seems to be the most resilient and least affected by the AP shortage situation”.

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry

Follow Counterpoint Research

press(at)counterpointresearch.com

![]()