- Global handset revenues declined 3% YoY despite a subdued market where shipments fell 12% YoY.

- A steeper revenue decline was prevented by a 10% YoY revenue growth of Apple.

- Consequently, the 5G revenue share reached an all-time high of 80%.

- With China being the single biggest market for OPPO* and vivo, the ongoing COVID-19 and economic issues in the country resulted in a significant revenue decline YoY.

London, New Delhi, Hong Kong, Seoul, Beijing, San Diego, Buenos Aires – December 21, 2022

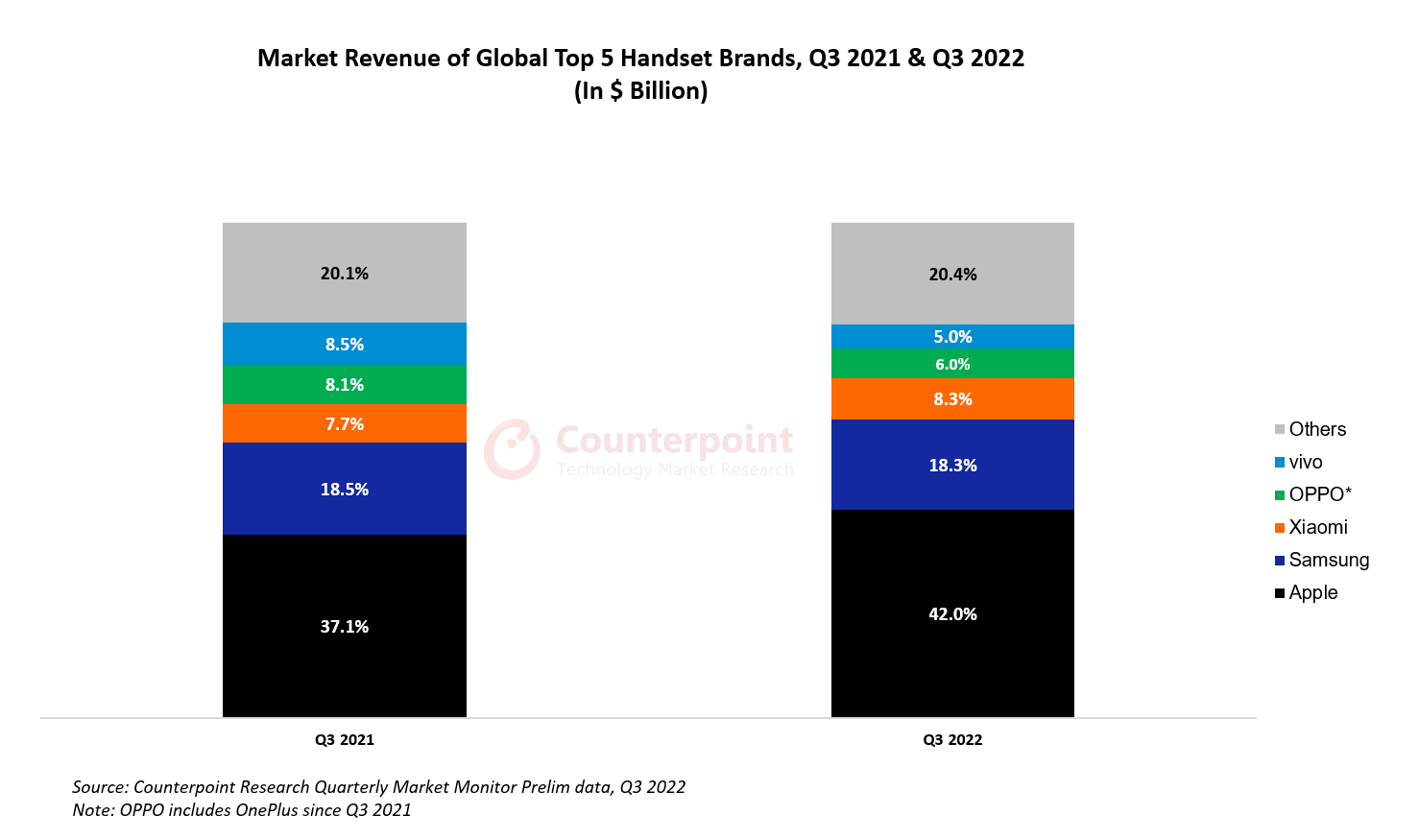

The global smartphone handset market’s revenue declined 3% YoY in Q3 2022 to just above $100 billion, according to the latest research from Counterpoint’s Market Monitor Service. A 10% YoY growth was seen in the average selling price (ASP) thanks to the premium handset segment’s greater resilience to economic uncertainty. The record shipment contribution (46%) of 5G handsets, which cost five times an average non-5G handset, also added to the ASP and revenue growth. In terms of shipments, the overall handset market saw a 12% YoY decline during the quarter.

Commenting on the 5G effect on ASP growth, Senior Analyst Harmeet Singh Walia said, “At over $80 billion, the revenue contribution of 5G handsets reached an all-time high of 80% of global handset revenues, up from 69% in the third quarter of last year. In the same period, LTE handsets’ revenue contribution fell 10% to $19 billion. This shift from 4G to 5G has been led by Apple, which alone makes up for over half of all 5G revenues as over 95% of its phones are 5G-enabled. Apple saw a 10% YoY revenue growth and 7% YoY ASP growth in Q3 2022, contributing to an overall increase in global handset ASP. This is thanks in part to the launch of the iPhone 14 series as well as the Pro models, especially from the previous generation, doing well.”

Samsung, the second biggest handset OEM in terms of revenue, saw a relatively modest ASP increase of 2% YoY in Q3 2022 despite an almost doubling of the shipments of its premium Flip and Fold series in the same period as well as a 27% YoY revenue growth of its 5G smartphones. The lower growth of its ASP can be attributed to a shift in its focus from the more successful S22 series to the still upcoming foldable series. Consequently, Samsung’s revenue declined 4% YoY in Q3 2022.

Xiaomi’s handset revenue grew 4% YoY, a significant portion of which came from the low-to-mid price bands. The shipment share of the over-$300 price band declined by close to 1.5%. There was, however, a significant shift from the sub-$200 to $200-$299 price band. Consequently, Xiaomi’s ASP grew 14% YoY to $205.

OPPO*, on the other hand, saw an ASP as well as a revenue decline of 5% and 27% YoY respectively. The revenue decline was primarily caused by OPPO’s shipment decline in COVID-hit China, which contributed over 40% to its total shipments in Q3 2022. Given that China contributed over half of vivo’s total shipments, its revenue took an even bigger hit of 43% YoY despite growing 4% QoQ.

*OPPO includes OnePlus from Q3 2021

Feel free to reach us at press@counterpointresearch.com for questions regarding our latest research and insights.

You can also visit our Data Section (updated quarterly) to view the smartphone market share for World, US, China and India.

Related Posts

- MEA Smartphone Shipments Decline 20% YoY in Q3 2022 as Macro Situation Worsens

- 5G Smartphones Grab 47% Share of Thailand’s Overall Q3 2022 Shipments; Ultra-premium Shipments Jump 32% YoY

- Vietnam’s Q3 2022 Smartphone Shipments Up 34% YoY on Increased Economic Activity

- Philippines Smartphone Shipments Flat in Q3 2022; Premium Segment Surges 115%

- iPhone Reaches Highest Ever Monthly Market Share in China

- Premium Smartphone Shipments Grow 29% YoY in Q3 2022 in Key SEA Markets

- Europe Smartphone Market Down 16% YoY in Q3 2022; Sequential Growth Hints at Stabilisation

- Quarterly Firsts: India Smartphone Shipments Show YoY Q3 Decline, iPhone Model Tops India Shipment Chart

- 2023 Smartphone Shipments to Remain Flat on Macro Woes While Replacement Cycle Hit Record This Year

- Transsion Updates Q3 2022: Revenue Stays Resilient, But Profit Declines Sharply as Costs Balloon

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Harmeet Singh Walia

Amulya Pulstya

Tarun Pathak

Jan Stryjak