• TSMC has joined other semiconductor companies in giving conservative guidance due to the expected industry downturn in the next few quarters. This includes declining the capacity utilization rate from Q4 2022, capex cuts in 2022 and 7/6nm order adjustment.

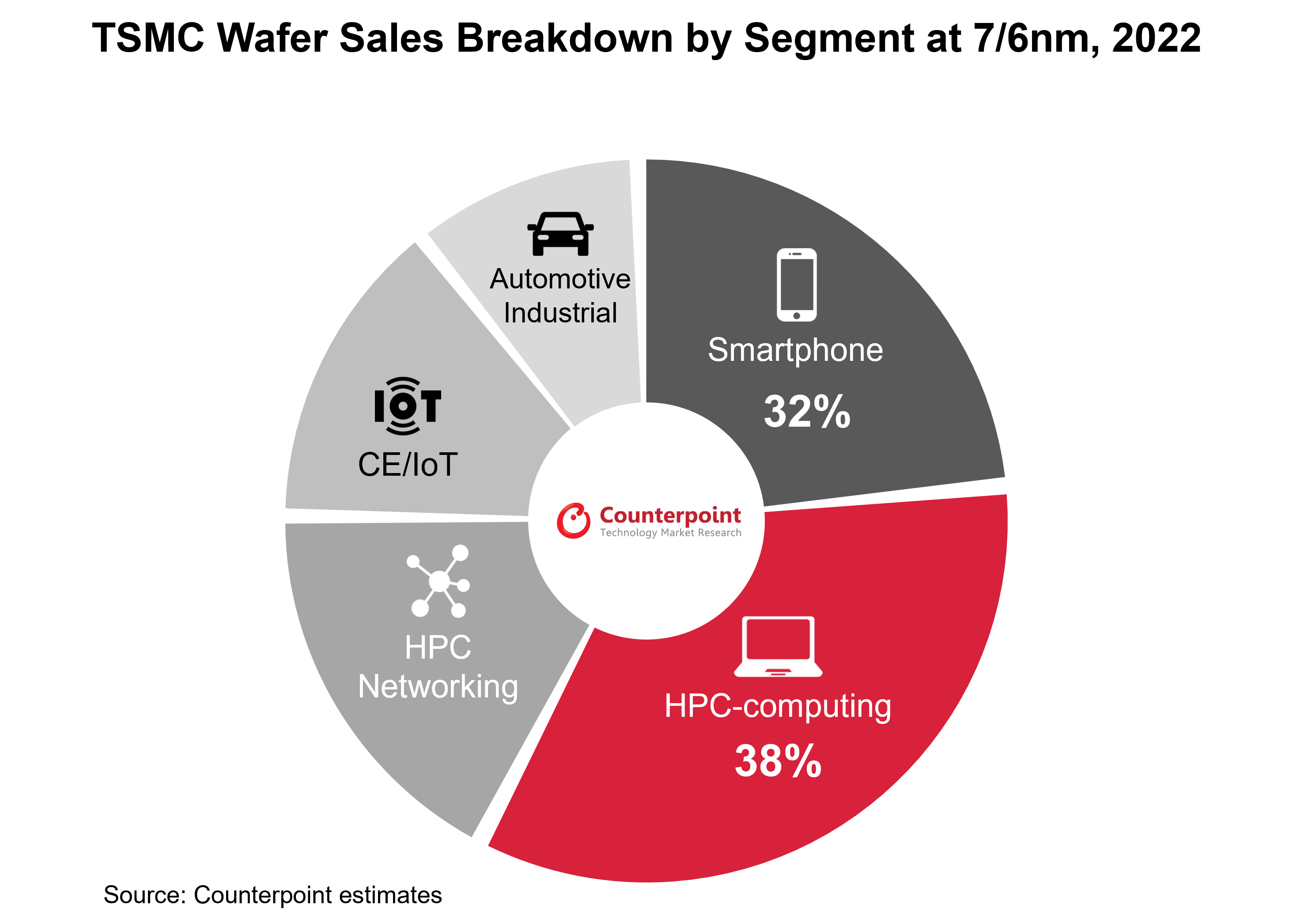

• TSMC’s 7/6nm contributed 26% to the total revenue in Q3 2022. Based on our analysis, smartphone and HPC-Computing (PC and server CPUs, and GPUs) are the two largest segments in this technology node, accounting for 32% and 38%, respectively, of the total wafer shipment volume for 2022.

• TSMC has blamed the 7/6nm softness on cyclical inventory adjustment and product delays from smartphone and PC clients. It looks the inventory cycle will persist into 2023, mainly from AP/SoCs for mainstream 5G smartphones.

• We agree with TSMC’s view on positive drivers of new product migration on the 7/6nm node, like Wi-Fi, RF and SSD controller ICs, after the inventory cycle in 2023.

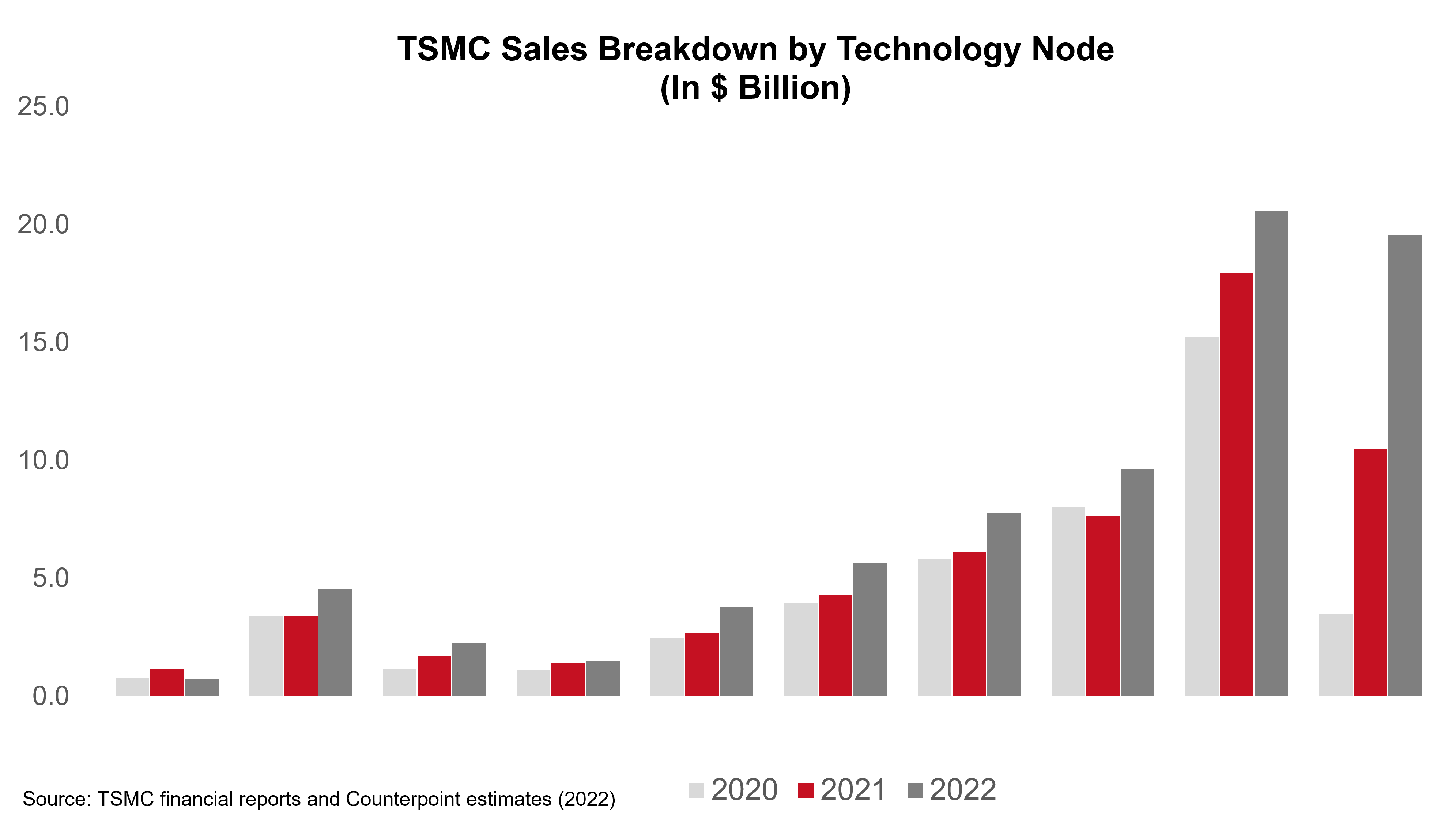

Although TSMC is still confident about its business growth in 2023, the company admitted during its investor conference for Q3 2022 that inventory headwinds would hit its near-term sales outlook with declining utilization rates in certain geometry nodes. The full-year capital expense revision for 2022 from $40 billion to $36 billion echoed its conservative views on delaying new capacity builds amid the global semiconductor downturn, including the withdrawal of the new 7/6nm line in Fab 22 due to uncertain market demand.

While TSMC expected solid demand for its current 5/4nm nodes with a high utilization rate in Q4 2022 too, it gave conservative guidance for 7/6nm on projections of a declining utilization rate in the next few quarters. TSMC attributed this to smartphone weakness, as well as product delays in PC-related chipsets. The company expects the inventory adjustment cycle for all TSMC technology nodes and chip productions to likely persist into 2023.

TSMC’s 7/6nm node was its largest revenue component before Q3 2022, contributing to nearly 30% of its business during the first three quarters of 2022. TSMC owned a total of 145-150 KWPM (thousands of wafers per month) installed capacity on 7/6nm during H1 2022 but will adjust the production plan for some equipment tools in H2 2022, partially taking into account the deteriorating market demand for smartphones and PCs.

By breaking down TSMC’s wafer shipments for 7/6nm products, we found HPC-related products (including PC and server CPUs, discrete GPU, data center accelerator and ASIC/FPGA) accounted for 38% in 2022, followed by smartphone-related (mainly on AP/SoCs) chipsets at 32%. MediaTek, AMD and Qualcomm appeared to be the top three clients in this category.

Supply chain inventory to remain high at 2022 end

Reviewing the inventory level for smartphone AP/SoCs, which is the major application of advanced foundry nodes (10nm and below), we believe the order corrections to chipset vendors will be under greater pressure from H2 2022 amid weakening end-market (sell-through) data point. The chip production lead time is as long as over four months in advanced nodes, leading to a lagged effect of wafer output reductions earliest from Q4 2022 in smartphone AP/SoCs, CPU/GPU and AI processors. Accordingly, the chipset-level inventory cycle appears to have just started from H2 2022 and will persist into the remainder of the year or into the first half of 2023, as TSMC commented during the investor conference call.

More of a cyclical adjustment issue in 7/6nm

As the global foundry industry’s utilization rate has reached its peak level in mid-2022, the downtick will bring down business in all aspects in the next few quarters before any signs of improvement emerge in inventory levels across the semi supply chain. All of TSMC’s technology nodes will be inevitably impacted, particularly 7/6nm with its higher concentration of smartphones and consumer PCs. The utilization rate here will drop to 80%-90% in the next two to three quarters prior to the demand recovery driven by mainstream 5G smartphone AP/SoCs and Intel’s acceleration of its Meteor Lake CPU tile orders on TSMC. Besides, we agree with TSMC’s view on positive drivers of new product migration on the 7/6nm node, such as Wi-Fi, RF and SSD controller ICs, after the inventory cycle in 2023.

For more insights and analyses on global foundry Market, please refer to Infographic: Global Foundry Revenue Share | Q2 2022, which summaries our quarterly views on technology and vendor shares.