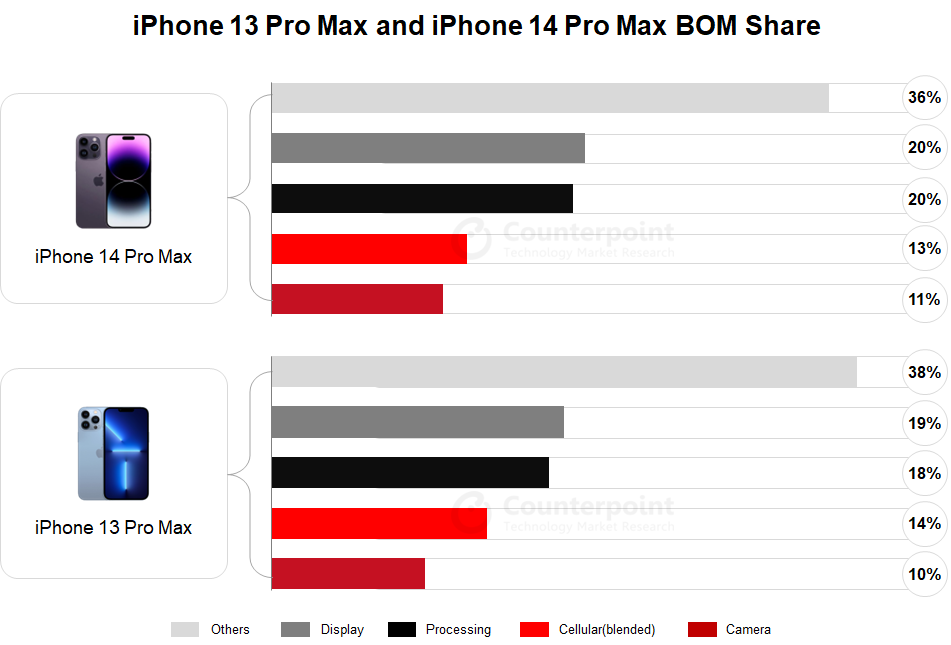

- The blended bill of materials (BoM) cost for the iPhone 14 Pro Max with 128GB Nand flash is about $464, a 3.7% increase from that of the iPhone 13 Pro Max.

- In the iPhone 14 Pro Max, Apple’s self-designed chips accounted for over 22% of the total BoM cost. Apart from the A16 bionic processor, Apple’s self-designed chips include PMIC, audio, connectivity and touch control.

- The upgrade to the A16 Bionic chipset from the A15 Bionic resulted in an $11 cost increase, driving the processing group’s cost share to 20% in BoM.

- The new main camera with a 48MP image sensor and the screen with an always-on display feature drive the cost increase.

Producing a 128GB iPhone 14 Pro Max mmWave smartphone costs Apple up to $474, according to Counterpoint Research’s BoM analysis. The BoM cost of the sub-6GHz model comes to $454. Assuming a 44% mmWave mix (by the end of 2022), the blended materials cost for the iPhone 14 Pro Max is about $464, a 3.7% increase over that of the iPhone 13 Pro Max. The application processor, display and camera are the main categories where cost has increased. These components now also command a larger share in the BoM.

Counterpoint Smartphone BoM Master File

Apple’s first 4nm process-powered application processor

Apple’s new-generation mobile processor, the A16 bionic, contains a whopping 16 billion transistors, a 6.7% increase from the A15’s 15 billion transistors. This facilitates improved CPU, GPU, neural engine and camera ISP performances. Due to its more advanced 4nm process, the application processor alone is estimated to introduce a cost increase of $11, driving the processing category’s share to 20% in BoM cost.

Display upgrade with always-on feature

Apart from upgrading the peak brightness in HDR mode and outdoor mode, Apple has added an always-on display feature in the iPhone 14 Pro Max. The feature makes the display easy to view when the lock screen is on. All the upgrades together have increased the display category’s . The panels used in the iPhone 14 Pro Max are supplied by Samsung.

48MP CIS upgrade on main camera

The iPhone 14 Pro Max has a 48MP main camera with a quad-pixel image sensor with a sensor area that is 65% larger than that in the iPhone 13 Pro Max. The main camera’s sensor-shift stabilization has also been upgraded to the second generation in the iPhone 14 Pro Max. Sony supplies the image sensor for Apple. Sunny Optical, Largan Digital and GSEO are the suppliers for the main camera’s 7P lens, while LG Innotek supplies the module. The front camera has been improved with the addition of the auto-focus feature while its lens has been upgraded to 6P from the 5P present in the iPhone 13 Pro Max. GSEO and Sunny Optical are the main suppliers of the front camera lens. These upgrades together have driven the camera category cost up by $6.30 in the iPhone 14 Pro Max.

Cellular group cost drop

Compared with that of its predecessor, the iPhone 14 Pro Max’s blended cellular group cost share dropped to 13% due to a fall in component prices as 5G cellular technology rises in popularity. Qualcomm, Qorvo, Skyworks, Broadcom and are component suppliers in the cellular category for the iPhone 14 Pro Max.

Diversified sources of supply

Apple continues to diversify its supply sources. KIOXIA and SanDisk supply the NAND flash for the iPhone 14 Pro Max, while SK hynix, Samsung and Micron supply the LPDDR5. NXP and Broadcom remain suppliers of wireless connections, display and touch control solutions for the device. Cirrus Logic, Goertek, Knowles and AAC dominate the audio-related design. TI and ST Micro are major suppliers of power and battery management IC in the iPhone 14 Pro Max.

Self-designed components’ cost share rise

Apple’s self-designed components have a larger share in the overall BoM cost of the iPhone 14 Pro Max than in that of the iPhone 13 Pro Max. Apart from the A16 bionic processor, Apple’s self-designed chips include PMIC, audio, connectivity and touch control. Our estimate suggests that Apple’s self-designed components account for 22% of the overall BoM cost of the iPhone 14 Pro Max.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts: