- China’s 2023 VR market shipments mark biggest drop in five years.

- Meanwhile, China’s AR smart glasses market thrived, with TCL-RayNeo and Xreal dominating.

- Apple Vision Pro to inject some positive energy into China’s VR segment in 2024, AR smart glasses market set for further growth.

China’s Virtual Reality (VR) market shipments dropped 61% YoY in 2023, marking its most significant downturn in the past five years. Conversely, Augmented Reality (AR) smart glasses shipments in the country surged 67% YoY. What factors drove this contrasting trend in China’s VR and AR smart glasses market? Looking ahead, what can we expect? This article aims to provide insights into these developments.

China VR Market Analysis, 2023

China’s VR market experienced a steep decline of 56% YoY in H1 2023, worsening to 65% in H2 2023. VR headset shipments in China decreased by 4% in H2 2023 from that in H1 2023. Demand in China’s consumer segment weakened during H2 2023, while demand in the enterprise segment remained relatively resilient.

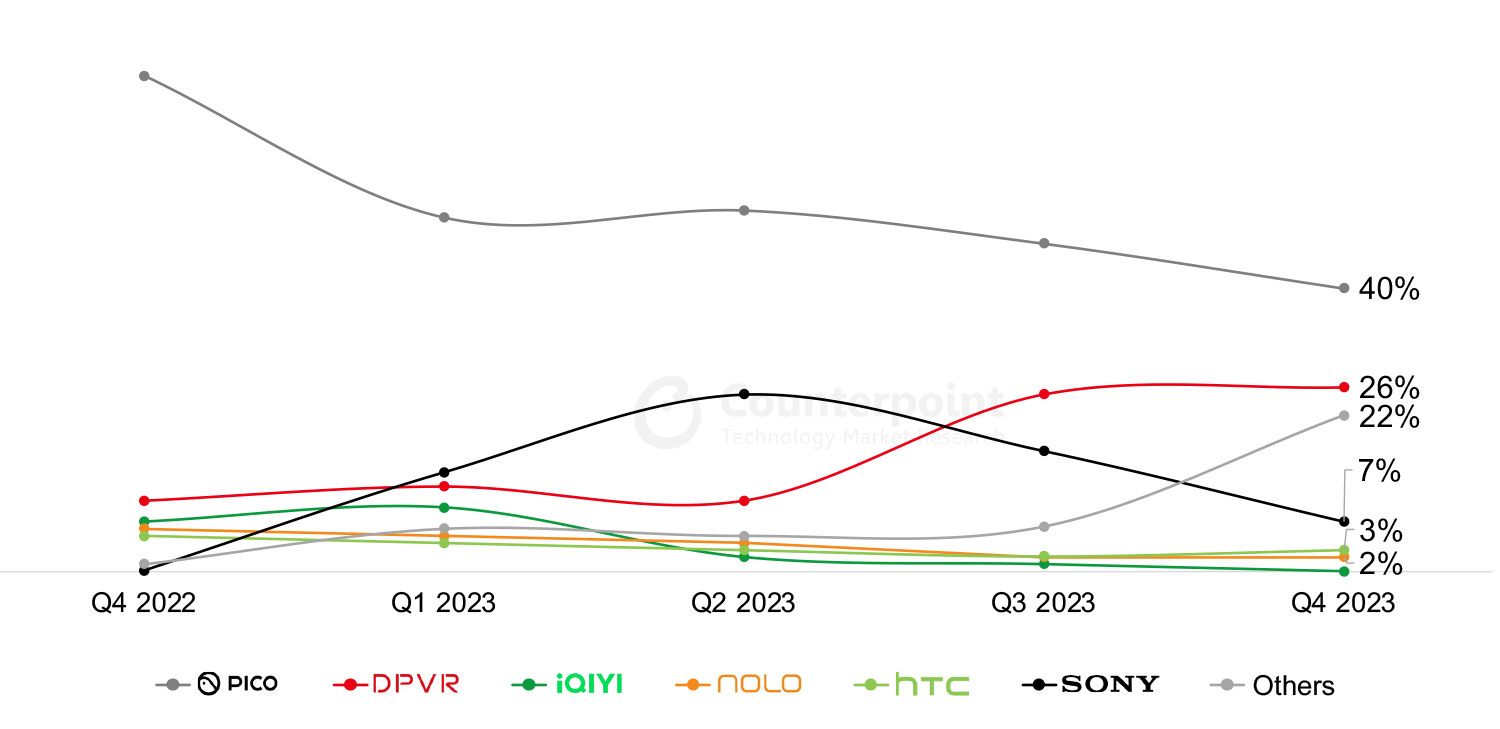

Exhibit 1: Market Share (%) of Top OEMs in China’s VR Market

Shipments of Pico VR headsets in China witnessed a 19% sequential decline during H2 2023, severely hurt by its parent company ByteDance’s strategic shift to reduce investments in XR. Sony’s shipments tumbled 46% sequentially in H2 2023 as the sales momentum of the PSVR 2 faltered in China. DPVR experienced an uptick in sales during H2 2023, with an impressive 121% sequential growth, primarily due to its focus on providing solutions for the enterprise market.

Other developments in China’s VR segment seemed rather subdued.

China AR Smart Glasses Market Analysis, 2023

In contrast to the weakness in China’s VR segment, China’s AR Smart Glasses market thrived in 2023, experiencing a remarkable 64% YoY growth. This growth can be attributed to several factors, including the aggressive release of new products by leading OEMs throughout the year, advancements in optical technologies and ergonomic design, enhanced compatibility with more devices, as well as OEMs’ offline expansion and increased marketing investments.

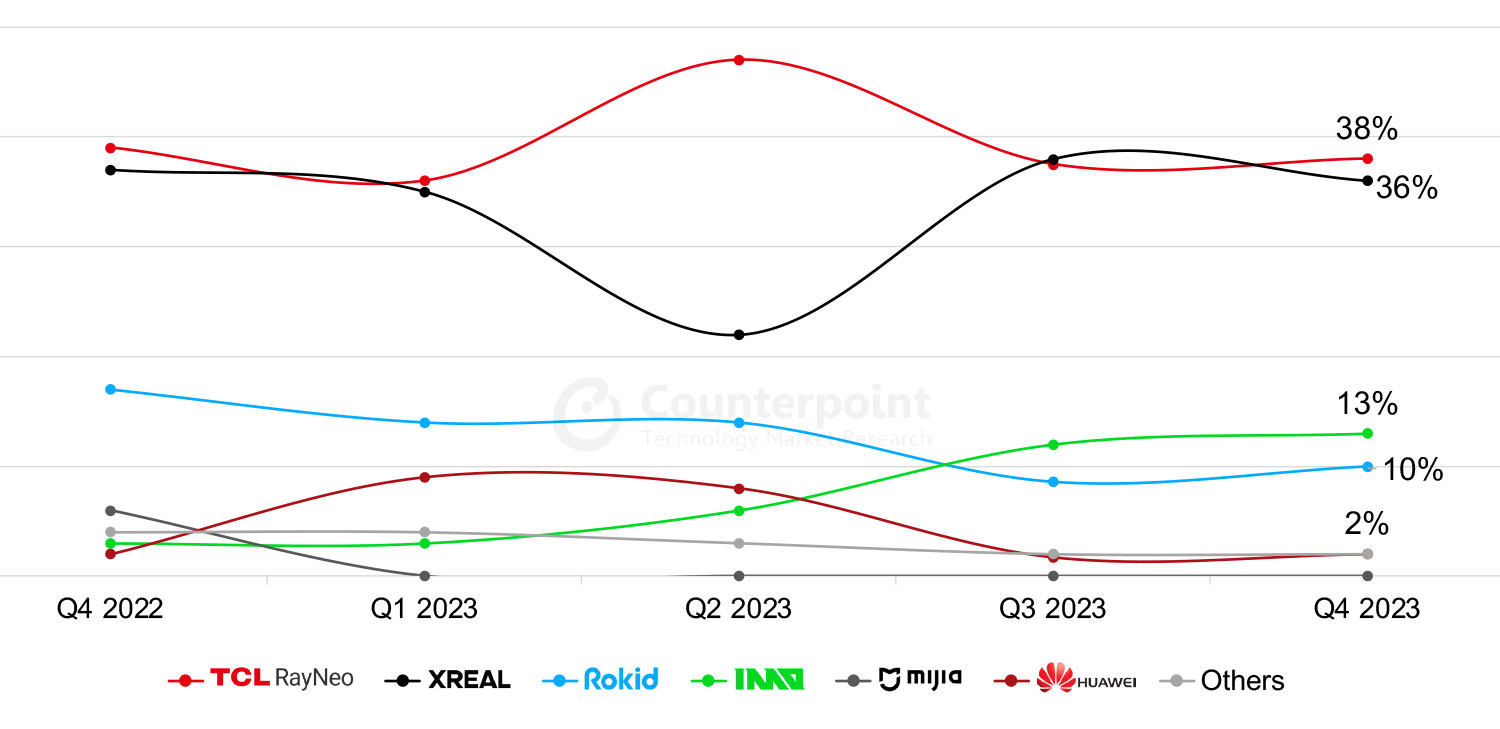

Exhibit 2: Market Share (%) of Top AR Smart Glass OEMs in China

Note: In Counterpoint’s sales tracker, AR smart glasses include glasses that enable optical see-through functionality only. Smart glasses without a display are not included in this classification.

TCL-RayNeo and Xreal maintained their market dominance in China throughout 2023.

- TCL-RayNeo topped China’s AR smart glasses market in 2023 with an impressive 126% YoY growth. The company primarily focused on promoting three key products during the year – the RayNeo Air 1S, RayNeo Air Plus, and RayNeo Air 2. These products quickly rose to the top of China’s best-selling AR smart glass models list within their respective promotional periods.

- Xreal ranked second in China’s AR smart glasses market, achieving 135% YoY growth in 2023. Throughout 2023, Xreal focused on promoting the Xreal Air, Xreal Air 2 and Xreal Air 2 Pro. The company excelled in extending the life cycle of its products through an aggressive marketing strategy.

- Rokid, a pioneer in the enterprise AR segment, maintained its position as the third leading OEM in 2023. Meanwhile, INMO, an early adopter of waveguide solutions for commercial AR products, experienced over 200% YoY growth.

- Alongside the established leaders, several new entrants made strides in China’s AR smart glasses segment in 2023. These newcomers included Meizu with its MYVU glass, ARknovv and its A1 glass and LAWK with its Meta Lens S1 glass.

China’s AR/VR Market Outlook

Apple’s foray into the VR segment in 2023 failed to ignite a new wave of “Metaverse” enthusiasm in China. However, the Chinese industry anticipates that the availability of the Vision Pro in the Chinese market in 2024, along with innovative applications developed by Chinese developers, will inject some positive energy into this segment. Chinese internet giants such as Alibaba and its subsidiary Dingtalk, Tencent, Trip.com, and gaming company miHoYo, have all announced plans to develop spatial computing-based applications for Apple’s Vision Pro. Nevertheless, we expect the Vision Pro, as well as other new VR/MR(Mixed Reality) products set to be released in China in 2024, to only have a limited impact on boosting the sales volume in this sector.

We expect China’s AR smart glasses market to see continued prosperity, although from a relatively small base. We expect more products featuring waveguide-based solutions to be commercialized in 2024, offering an enhanced experience for various outdoor applications and life assistance scenarios. With the ongoing advancements in AR display and optical solutions, processing chips, wireless connectivity with other devices like smartphones and PCs, as well as improvements in user interfaces and applications, the AR smart glasses market is poised for further growth.