- The global gaming console market witnessed a rebound in 2023 with 10% YoY growth.

- Software revenue rose with increasing brand focus on content and other services.

- Hardware revenue of the market is expected to decline in 2024.

- The PS5’s popularity will keep Sony in the leading position in 2024.

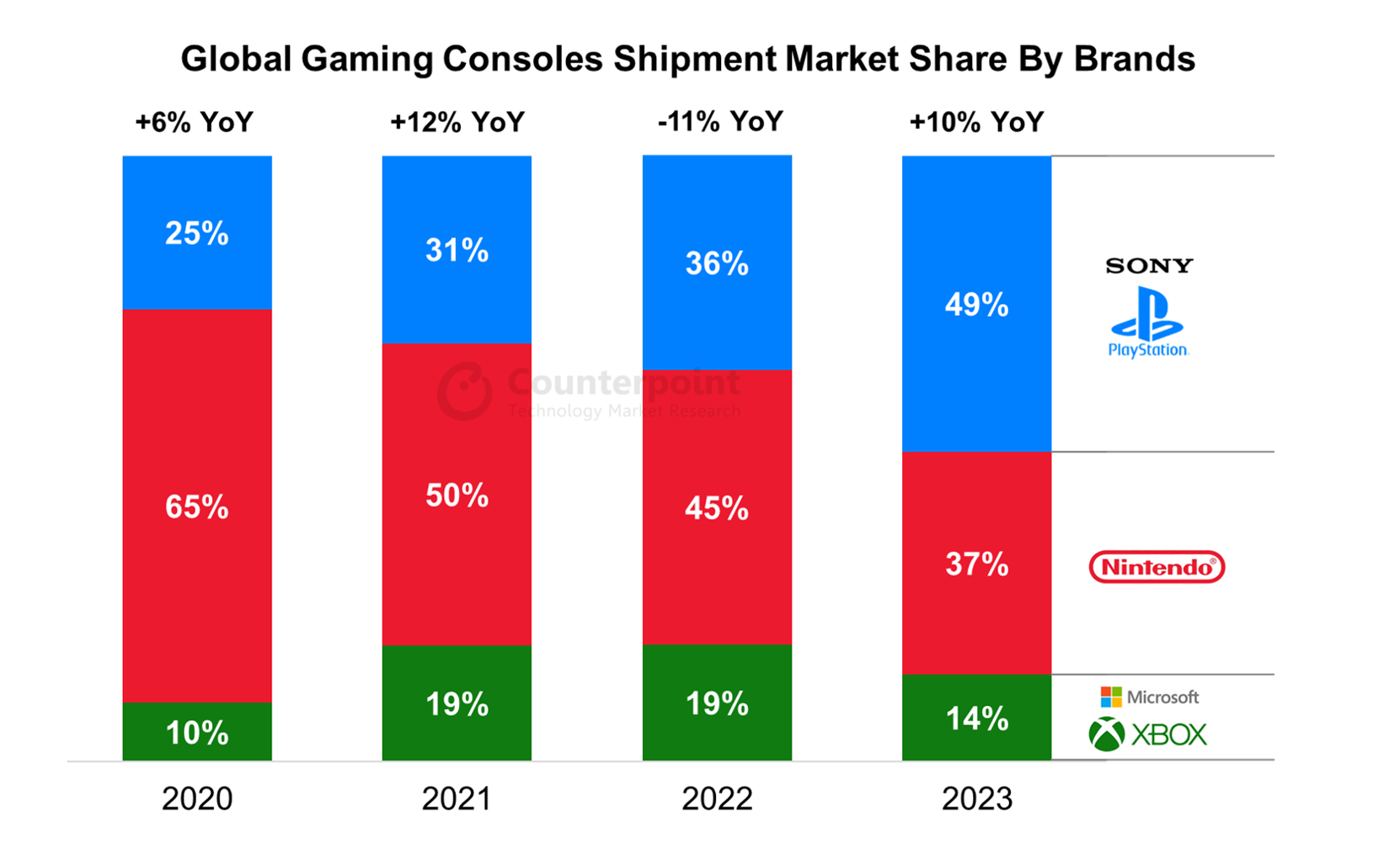

The global gaming console market grew 10% YoY in 2023, primarily due to improvements in the supply chain constraints faced in 2022, rising consumer demand and new releases by Nintendo and Sony. Sony surpassed Nintendo to become the largest player in 2023, owing to the PS5’s popularity.

Market growth and brand share

The global gaming console market’s shipments are cyclical, wherein a pick-up in growth is observed after the launch of new-generation consoles. The latest generation of consoles, launched by Sony and Microsoft in 2020, drove the market up in 2021. Further, the COVID-19 pandemic supplemented the market’s growth because of the time people were forced to spend at home. 2022 witnessed supply chain constraints, which weakened in 2023, resulting in a market rebound.

Hardware updates expected in 2024

In 2024, Microsoft is expected to release the refreshed Xbox Series S and disc-less Series X series, with Wi-Fi 6E support in the second half of 2024. Nintendo, however, has delayed the release of Switch’s successor, again, till early 2025. This will negatively impact its market share. Sony is expected to lead the market again in 2024, driven by its popularity and weak competition. However, mid-cycle revenue is chiefly driven by software and content services.

Software and services revenue

According to our estimates, software and other services revenue constitutes the bulk of gaming console market revenues and is expected to increase further in the coming years. In 2023, software and other services revenue accounted for more than 70% of the entire gaming revenue for Sony and Microsoft.

Microsoft acquired leading video game developer Activision Blizzard in 2023 to expand its gaming portfolio with popular games like Call of Duty, Diablo and World of Warcraft. In October 2023, Sony released Marvel’s Spider-Man 2, which became the fastest-selling PlayStation game in the first 24 hours of its release. Sony also got a software revenue boost in 2023 from the success of games like Alan Wake 2 and Baldur’s Gate 3. Sony expects a gradual expansion of third-party software sales due to the expansion of PS5’s installed base and high user engagement.

Outlook

We expect a single-digit decline in the gaming console market in 2024. The competition will intensify with Microsoft’s portfolio refresh. Nintendo’s further delay in the Switch 2’s release will help Sony and Microsoft gain market share in 2024. Microsoft’s hardware upgrade with Wi-Fi 6E and storage expansion may also help the brand expand its market share. However, Microsoft’s release is expected in the second half of 2024, which will help Sony’s PS5 to maintain its shipment lead in 2024.

In the future, we expect brands to focus more on content and software services. Microsoft recently announced its Xbox Game Pass line-up and listed the games and their release dates in April 2024. On the other hand, Sony will mostly rely on high user engagement as it will not release any major game in 2024.

AI integration is going to be an integral step for the gaming industry’s future growth. Microsoft has already started working on an AI chatbox for Xbox, initially to help with support queries. Sony is also expected to enhance its upcoming PS5 Pro and PS6 devices with AI. AI upscaling is expected to enhance the quality of the content in the PS5 Pro. With the advancements and proliferation of AI across technology segments, its integration into the gaming industry is inevitable.