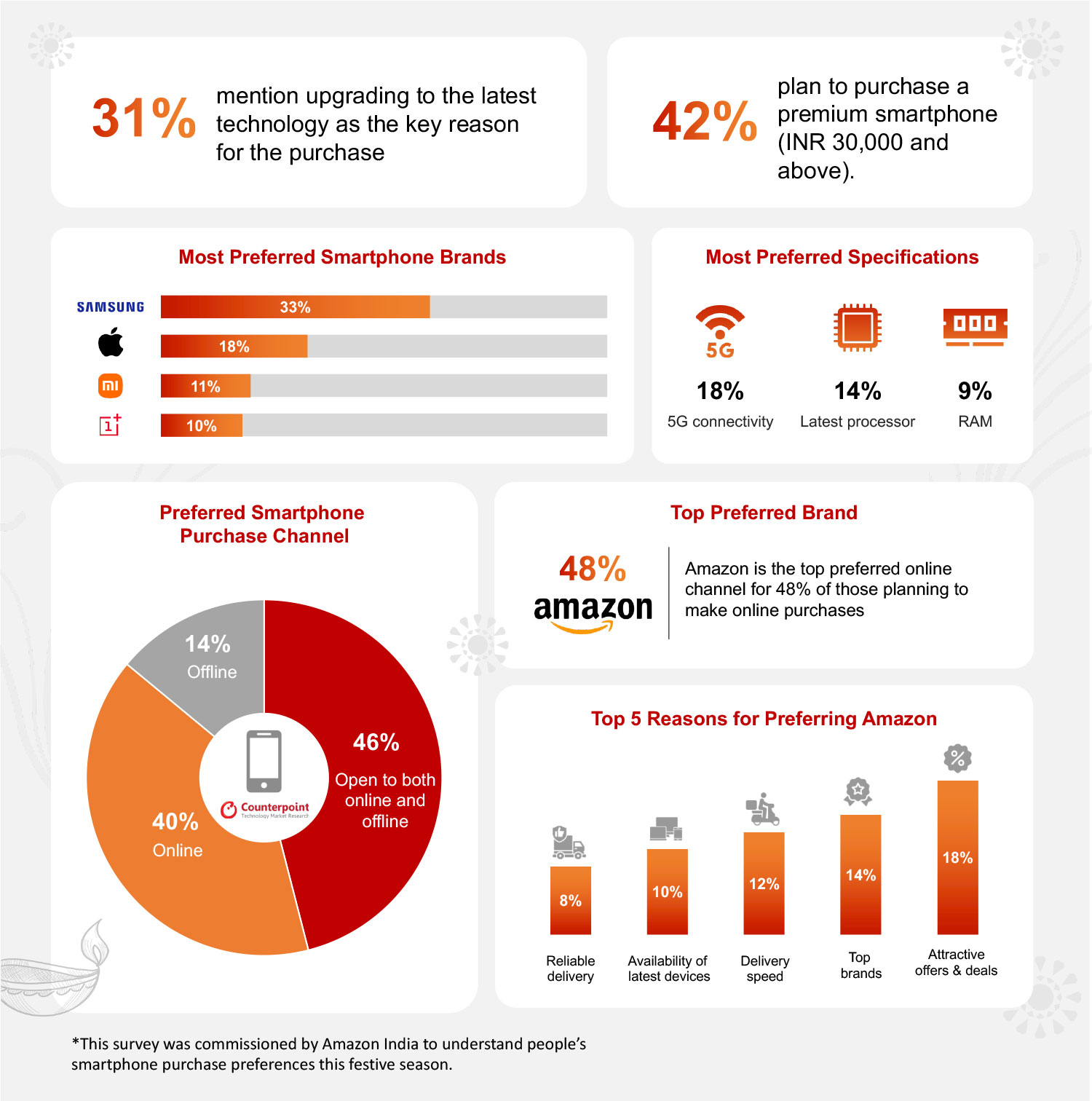

- Of those planning to purchase a smartphone this festive season, 31% mention upgrading to the latest technology as the key reason for the purchase.

- 40% prefer to purchase smartphones online, whereas 46% are comfortable taking either of the two routes.

- Amazon is the top preferred online channel for 48% of those planning to make online purchases (86% of the total respondents).

- Samsung, Apple, Xiaomi and OnePlus are the most preferred brands this festive season.

- 42% of the respondents plan to purchase a premium smartphone (INR 30,000 or ~$360 and above).

- 5G, latest processor and RAM are the top specifications that the respondents will consider when making the purchase.

New Delhi, Buenos Aires, Denver, London, Hong Kong, Beijing, Seoul – October 5, 2023

Of Indian consumers planning to purchase a smartphone this festive season, 31% mention upgrading to the latest technology as the key reason for the purchase according to a survey conducted by Counterpoint Research.

For 18% of respondents, 5G is the top specification to consider, followed by the latest processor (14%) and RAM (9%). In terms of budget, 42% plan to purchase a premium smartphone (INR 30,000 or ~$360 and above). And with respect to channel preference, up to 86% could purchase via online, with Amazon as the top preferred platform.

Conducted in October among consumers in India planning to buy a smartphone this festive season, the survey covers topics like key reasons for making the purchase, brand preference, preferred price point, desired specifications and offers. Further, future preferences combined with the current smartphone purchase journey provide insights into consumers’ switching pattern or loyalty towards brands and purchase channels.

Key Takeaways from India Pre-festive Season Smartphone Consumer Survey

Commenting on the festive season smartphone demand, Senior Analyst Arushi Chawla said, “Many people time their purchases with the festive season keeping in mind the auspiciousness of the occasion and also the competitive offers during the period. With the smartphone becoming the most important electronic gadget, consumers are cautious about its quality and features. That is why they consult multiple sources before making the purchase while increasingly opting for premium smartphones.”

When asked about the top preferred smartphone brand, Samsung was at the top with 33%, followed by Apple (18%), Xiaomi (11%) and OnePlus (10%). In terms of purchase channel preference, 40% prefer to purchase smartphones online, whereas 46% are comfortable taking either of the two routes. Among these 86% of respondents considering the online route, Amazon is the top preferred online channel for 48%, followed by Flipkart with 41%. The top five reasons for people to prefer Amazon are attractive offers, availability of top brands, availability of latest devices, delivery speed and reliable delivery.

Commenting on smartphone purchase preferences, Research Director Tarun Pathak said, “Consumers want the latest technology not only to experience it but also to meet their increasing requirements. This is reflected in our survey where 5G emerged as the top specification desired by consumers. 5G will continue to push smartphone demand in the coming years. Its presence has now reached lower price bands (<INR 10,000 or ~$120). Further, it is interesting to see that 20% of the respondents prefer switching to online platforms from offline modes, with the top reason for 43% of this segment being the availability of the latest devices. During the festive season, the OEMs and platforms aim to attract buyers with competitive offers. We expect this festive season to be better than the last year.”

The survey also finds that 22% of the respondents consider cashbacks/rewards as their top preferred offer when making the smartphone purchase. This is followed by bank offers (21%) and no-cost EMI (16%). And when it comes to the most preferred no-cost EMI tenure, six months is preferred by one-third of the respondents.

Disclaimer

This survey was commissioned by Amazon India to understand people’s smartphone purchase preferences this festive season. Counterpoint Research conducted this survey in Tier 1, Tier 2 and Tier 3 cities to capture a sample size of more than 1,200 respondents. An online survey was performed to collect quantitative insights from those respondents in the 18-35 age group who plan to purchase a smartphone this festive season. We expect the results to have a statistical precision of +/- 4%.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Counterpoint Research

press(at)counterpointresearch.com