Access quarterly data and market insights showcasing the US smartphone market share, spanning from Q1 2018.

Published Date: May 27, 2024

Market Highlights

• US smartphone shipments declined 8% YoY in Q1 2024, the sixth consecutive quarter showing a YoY decline.

• Carriers continued to report YoY worsening upgrade rates, while also seeing improved churn rates which contribute to lower switching behavior in the market.

• Apple’s market share remained flat at 52% in Q1 2024 with the iPhone 15 Pro Max as the top seller.

• Samsung’s market share grew to 31%, its highest Q1 share since Q1 2020. Strong S24 momentum helped the OEM gain share.

• Overall Android shipments decreased YoY however, with the market’s low end continuing to see consolidation and decreasing new product launches due to LTE devices being phased out in favor of 5G models in carrier channels.

• US Q1 2024 smartphone market share rankings (based on shipments):

○ Apple market share 52%

○ Samsung 31%

○ Lenovo* 9%

○ HMD 2%

Click here to read about the US smartphone market in Q1 2024.

| US Smartphone Shipments Market Share (%) | ||||||

|---|---|---|---|---|---|---|

| Brands | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 |

| Apple | 59% | 52% | 55% | 53% | 62% | 52% |

| Samsung | 19% | 27% | 23% | 25% | 17% | 31% |

| Lenovo* | 6% | 8% | 9% | 11% | 9% | 9% |

| HMD | 1% | 1% | 2% | 2% | 2% | 2% |

| Others | 15% | 12% | 11% | 9% | 10% | 6% |

*Lenovo includes Motorola.

**Ranking is according to the latest quarter.

Data on this page is updated every quarter

This data represents the global smartphone market share by quarter (from 2021-2023) by top OEMs. Global smartphone shipments by market share and millions of units are provided.

For detailed insights on the data, please reach out to us at sales(at)counterpointresearch.com. If you are a member of the press, please contact us at press(at)counterpointresearch.com for any media enquiries.

These smartphone market share numbers are from:

Excel File

Published Date: May 2024

This report is part of a series of reports which track the mobile handset market: Smartphone and Feature Phone shipments every quarter for more than 140 brands covering more than 95% of the total device shipments in the industry.

Recommended Reads:

Published Date: Feb 21, 2023

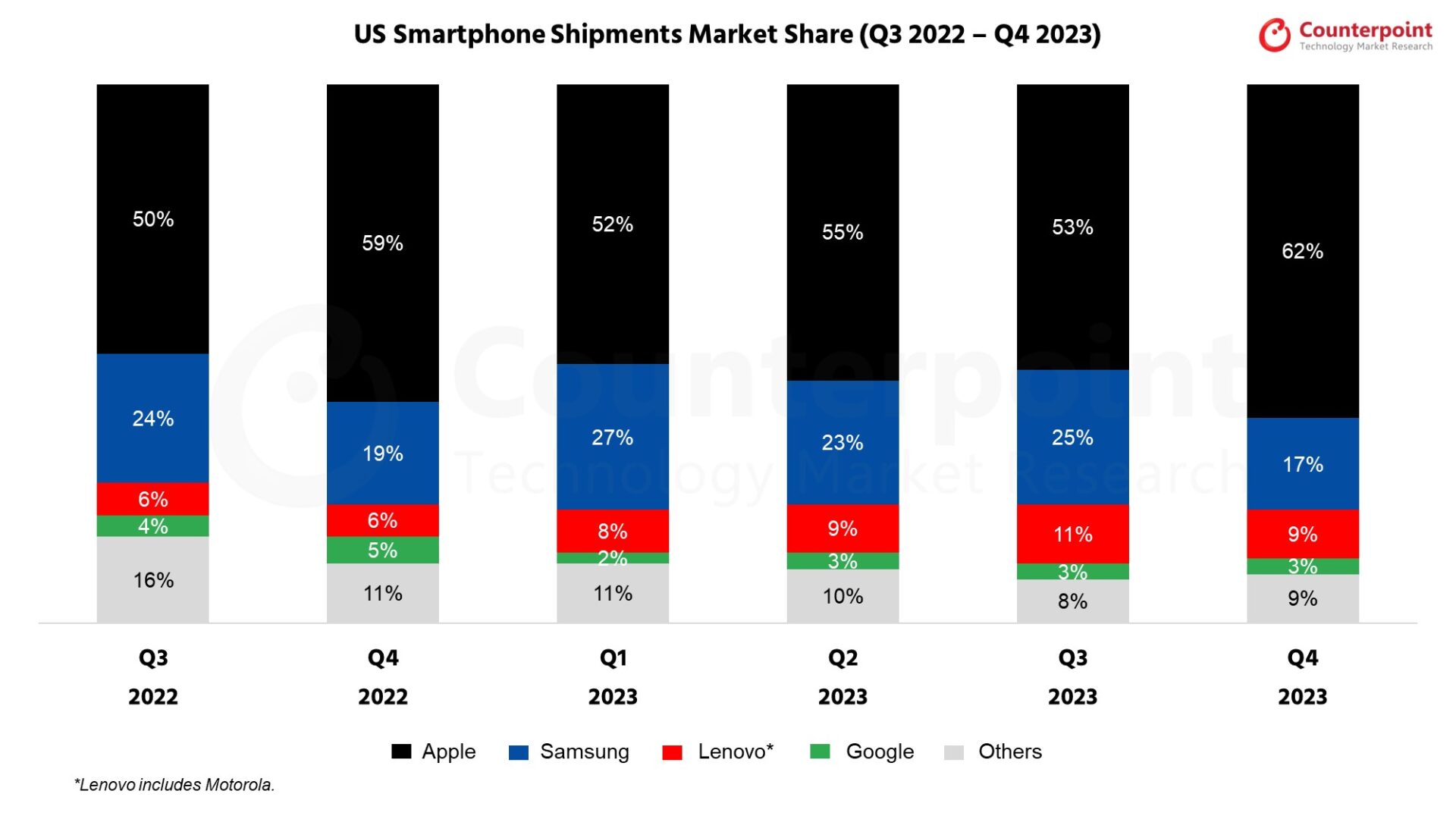

Market Highlights

• US smartphone shipments declined YoY for the fifth straight quarter in Q4 2023 despite end-of-year holiday demand. Carriers continued to cite weak upgrade rates and long holding periods as reasons for the underperformance.

• Apple’s shipment share grew to 62% in Q4 as the OEM was less impacted by weak market dynamics due to the iPhone 15 launch in September.

• Samsung’s share declined YoY to 17%. It saw increased shipments due to the S24 launch in late January but low-end A-series shipments declined.

• Motorola’s share grew, partially due to some increases in premium devices, especially the RAZR 2023.

• Google’s share declined to 3% as Pixel sales were weaker YoY.

• In “others”, Nokia HMD continued to gain share due to a stronger channel presence in prepaid.

Click here to read about the US smartphone market in Q4 2023.

| Brands | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 |

|---|---|---|---|---|---|---|

| Apple | 50% | 59% | 52% | 55% | 53% | 62% |

| Samsung | 24% | 19% | 27% | 23% | 25% | 17% |

| Motorola | 6% | 6% | 8% | 9% | 11% | 9% |

| 4% | 5% | 2% | 3% | 3% | 3% | |

| Others | 16% | 11% | 11% | 10% | 8% | 9% |

*Lenovo includes Motorola.

**Ranking is according to the latest quarter.

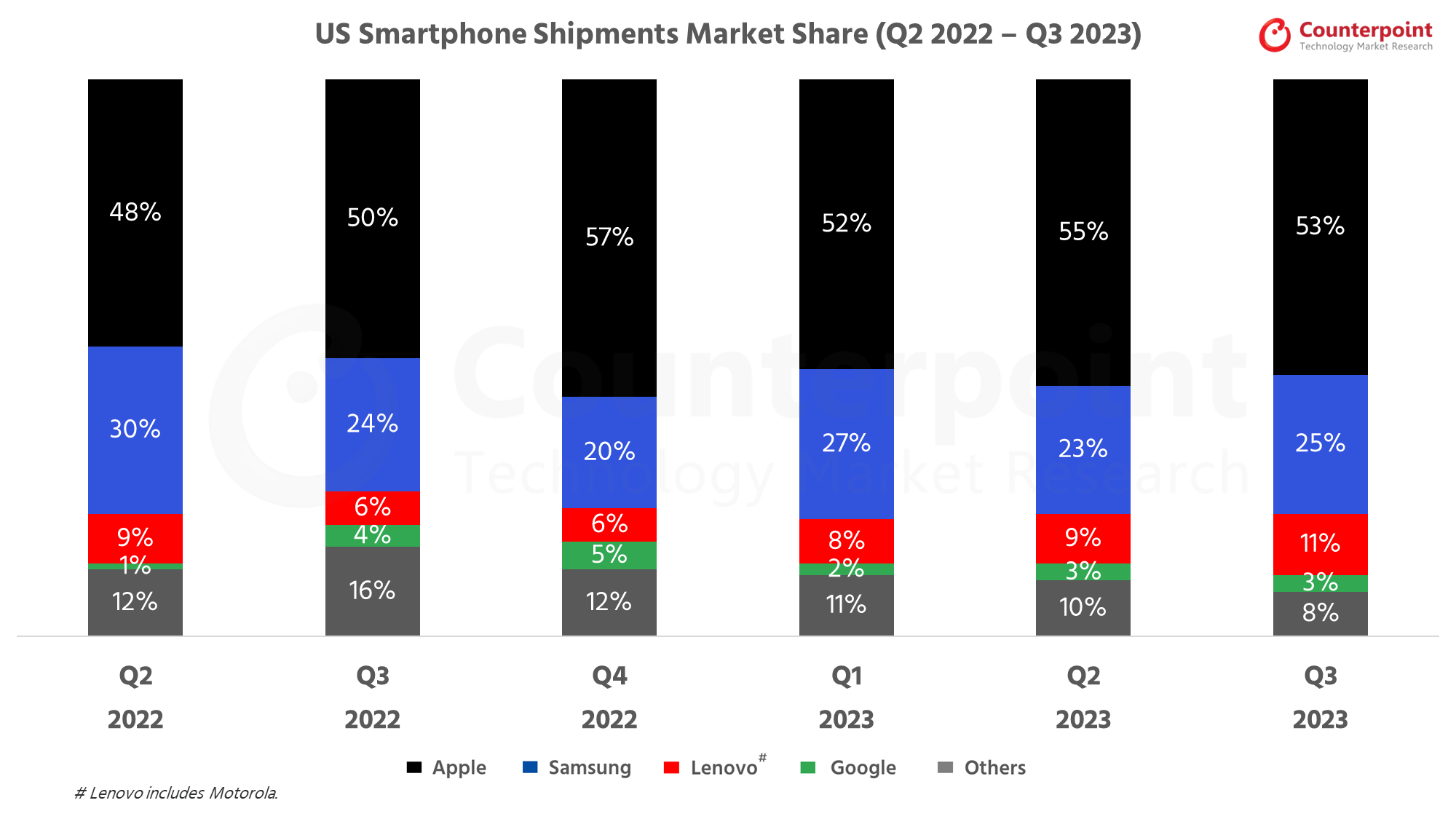

Published Date: Nov 27, 2023

Market Highlights

• US smartphone shipments declined YoY for the fourth straight quarter in Q3 2023 amid weak consumer demand.

• Google, Samsung and TCL were among the brands recording the steepest YoY declines, while Motorola and Nokia HMD managed growth amid a challenging market environment. Motorola increased its shipment share to 11% in Q3.

• Apple’s iPhone shipments declined 11% YoY, in part due to the later launch date of the iPhone 15 series compared to the iPhone 14 series. Its sales share dropped to 53% in Q3 from 55% in Q2.

• Weak upgrade rates at the carriers were the main source of weak smartphone shipments, signaling that consumers are opting to hold on to their devices for longer.

| Brands | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 |

|---|---|---|---|---|---|---|

| Apple | 48% | 50% | 57% | 52% | 55% | 53% |

| Samsung | 30% | 24% | 20% | 27% | 23% | 25% |

| Lenovo# | 9% | 6% | 6% | 8% | 9% | 11% |

| 1% | 4% | 5% | 2% | 3% | 3% | |

| Others | 12% | 16% | 12% | 11% | 10% | 8% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

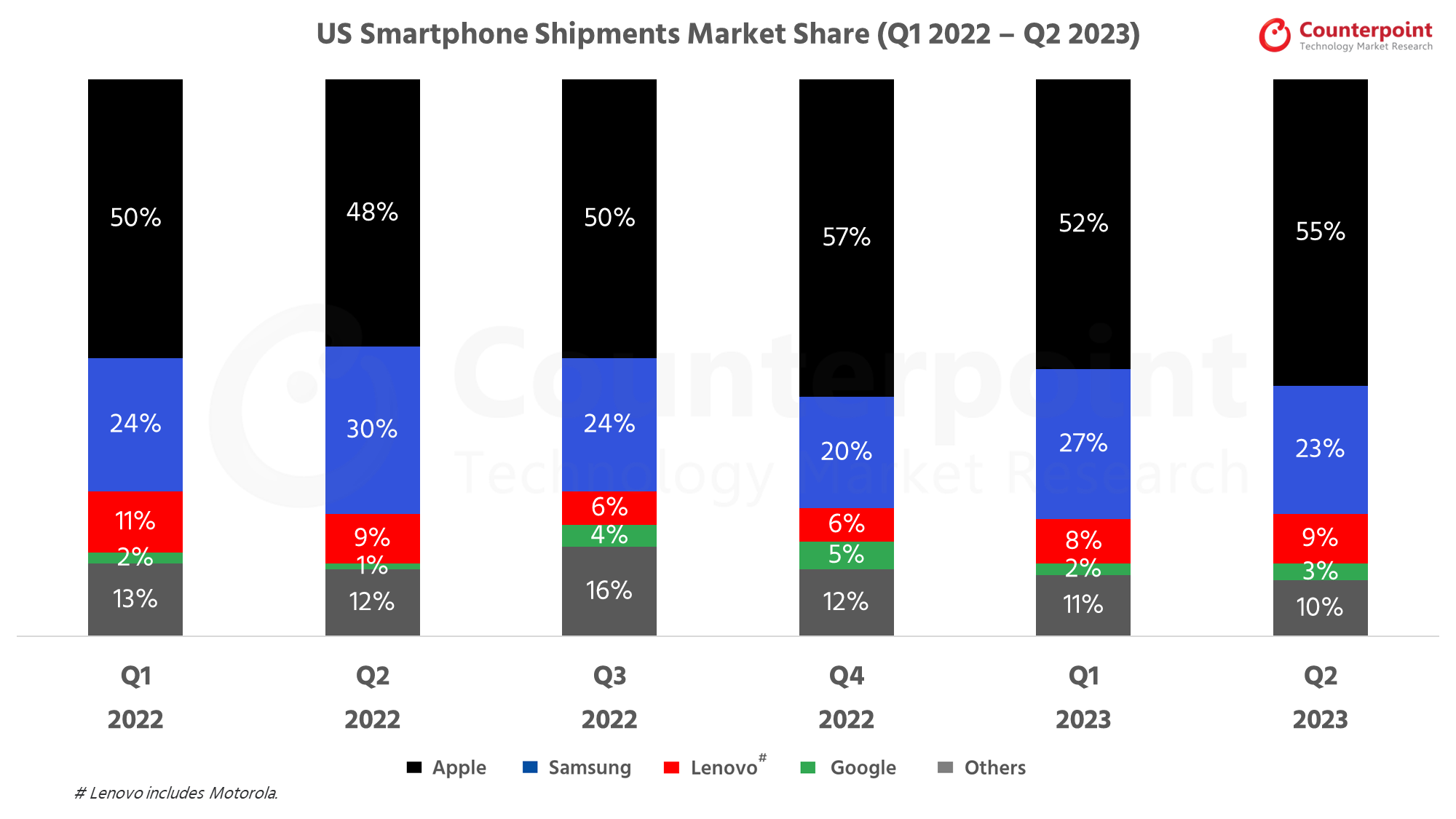

Published Date: Aug 17, 2023

Market Highlights

• US smartphone shipments declined 24% YoY. Low-end smartphone sale declines were the biggest contributing factor to the downturn.

• Samsung’s shares dropped to 23% as competition from other Android OEMs has increased in the prepaid segment, hurt Samsung’s performance.

• Apple was one of the few OEMs that did not see a shipments drop of double digits YoY. Older iPhone 11 and iPhone 12 devices are helping the OEM attract new customers.

• Google’s share rose to 3% due to the earlier launch of the Pixel 7a compared to its predecessor.

• Motorola grew to 9% share capitalizing on Samsung’s weakness, launching new devices including the G Stylus, G 5G and the new Razr+ in Q2.

| Brands | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

|---|---|---|---|---|---|---|

| Apple | 50% | 48% | 50% | 57% | 52% | 55% |

| Samsung | 24% | 30% | 24% | 20% | 27% | 23% |

| Lenovo# | 11% | 9% | 6% | 6% | 8% | 9% |

| 2% | 1% | 4% | 5% | 2% | 3% | |

| Others | 13% | 12% | 16% | 12% | 11% | 10% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

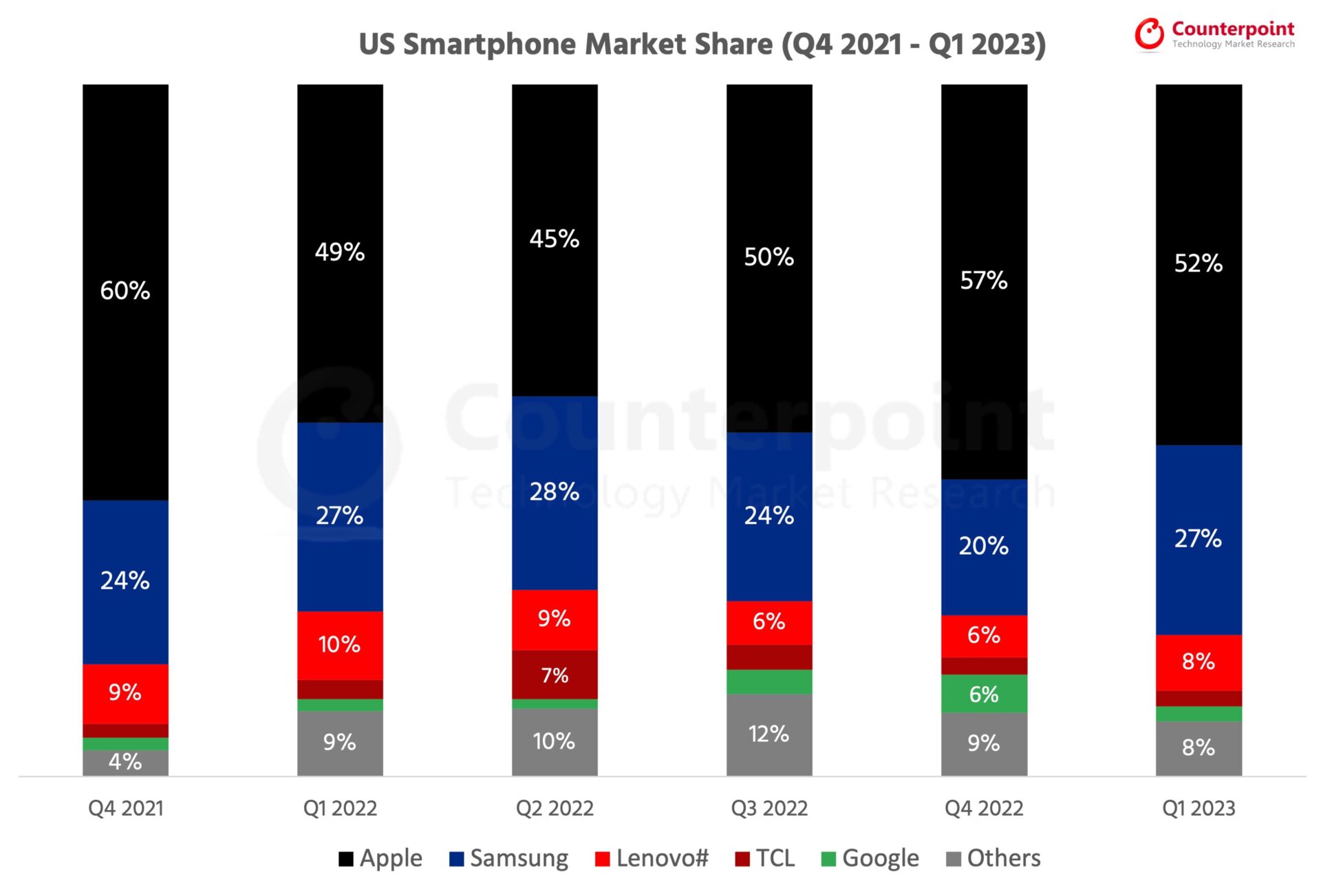

Market Highlights

• US smartphone shipments declined 17% YoY in Q1 2023 due to inventory correction and weak consumer demand.

• Apple market share increased to 52% in Q1 2023 from 49% in Q1 2022 as it began aggressively selling iPhone 11 in prepaid channels.

• Samsung Galaxy S23 shipments were up double digits YoY while the Galaxy A14 5G performed exceptionally well in prepaid resulting in 27% share of shipments.

• Lenovo Group (Motorola) and TCL Group saw shipments decline in Q1 but their overall shipment share grew as OEMs like Nokia HMD and white-label devices saw even steeper declines.

• During Q1 2023, carriers reported very low upgrades. We expect the incumbent postpaid players to increase promotional activity during the second half of the year to combat cable MVNOs, which saw higher net additions than the Big 3 during the quarter, a first for the US smartphone market.

| Brands | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 |

|---|---|---|---|---|---|---|

| Apple | 60% | 49% | 45% | 50% | 57% | 52% |

| Samsung | 24% | 27% | 28% | 24% | 20% | 27% |

| Lenovo# | 9% | 10% | 9% | 6% | 6% | 8% |

| TCL | 2% | 3% | 7% | 4% | 3% | 2% |

| 2% | 2% | 1% | 4% | 6% | 2% | |

| Others | 4% | 9% | 10% | 12% | 9% | 8% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

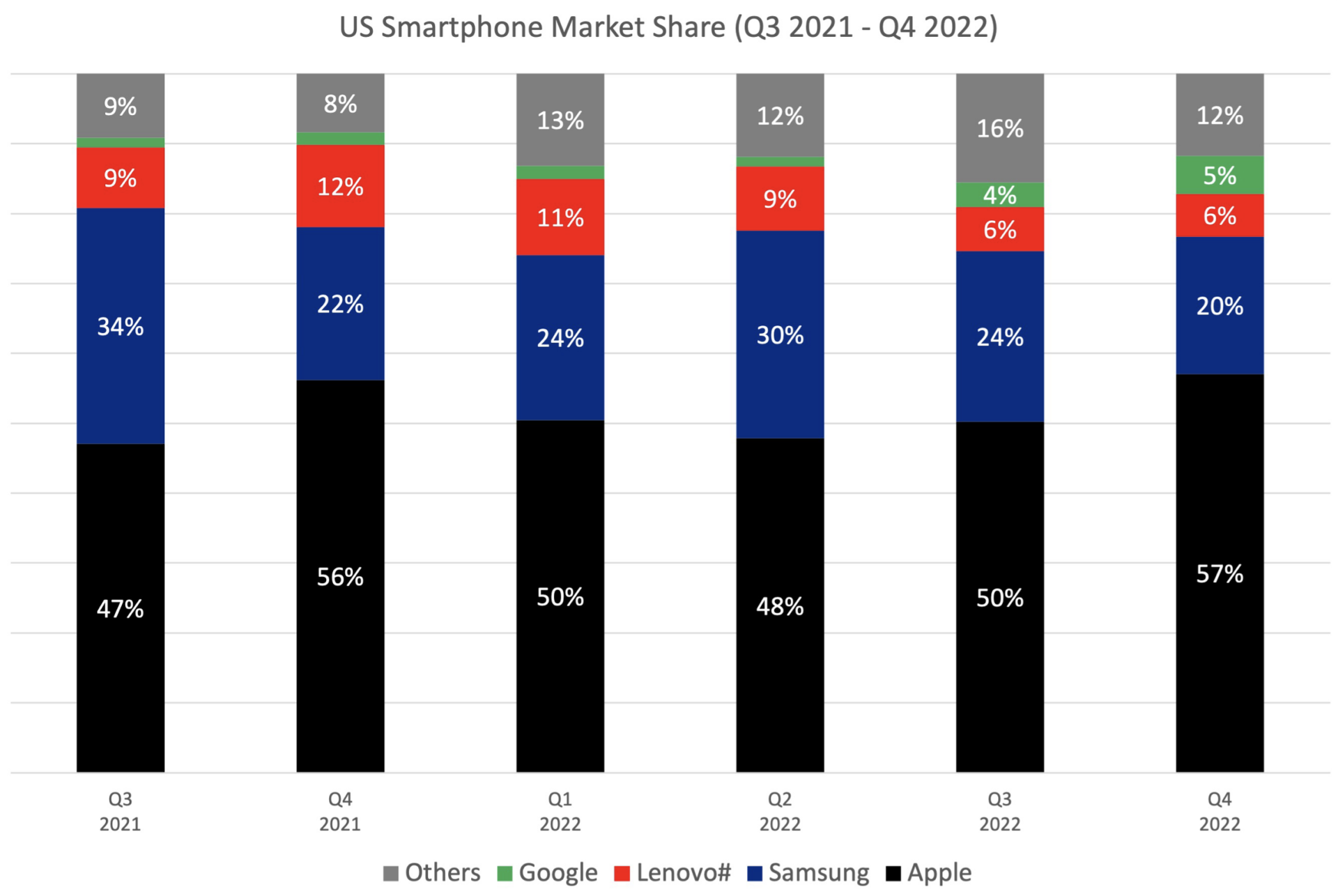

| US Smartphone Market Share (%) | ||||||

| Brands | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 |

| Others | 9% | 8% | 13% | 12% | 16% | 12% |

| 1% | 2% | 2% | 1% | 4% | 5% | |

| Lenovo# | 9% | 12% | 11% | 9% | 6% | 6% |

| Samsung | 34% | 22% | 24% | 30% | 24% | 20% |

| Apple | 47% | 56% | 50% | 48% | 50% | 57% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

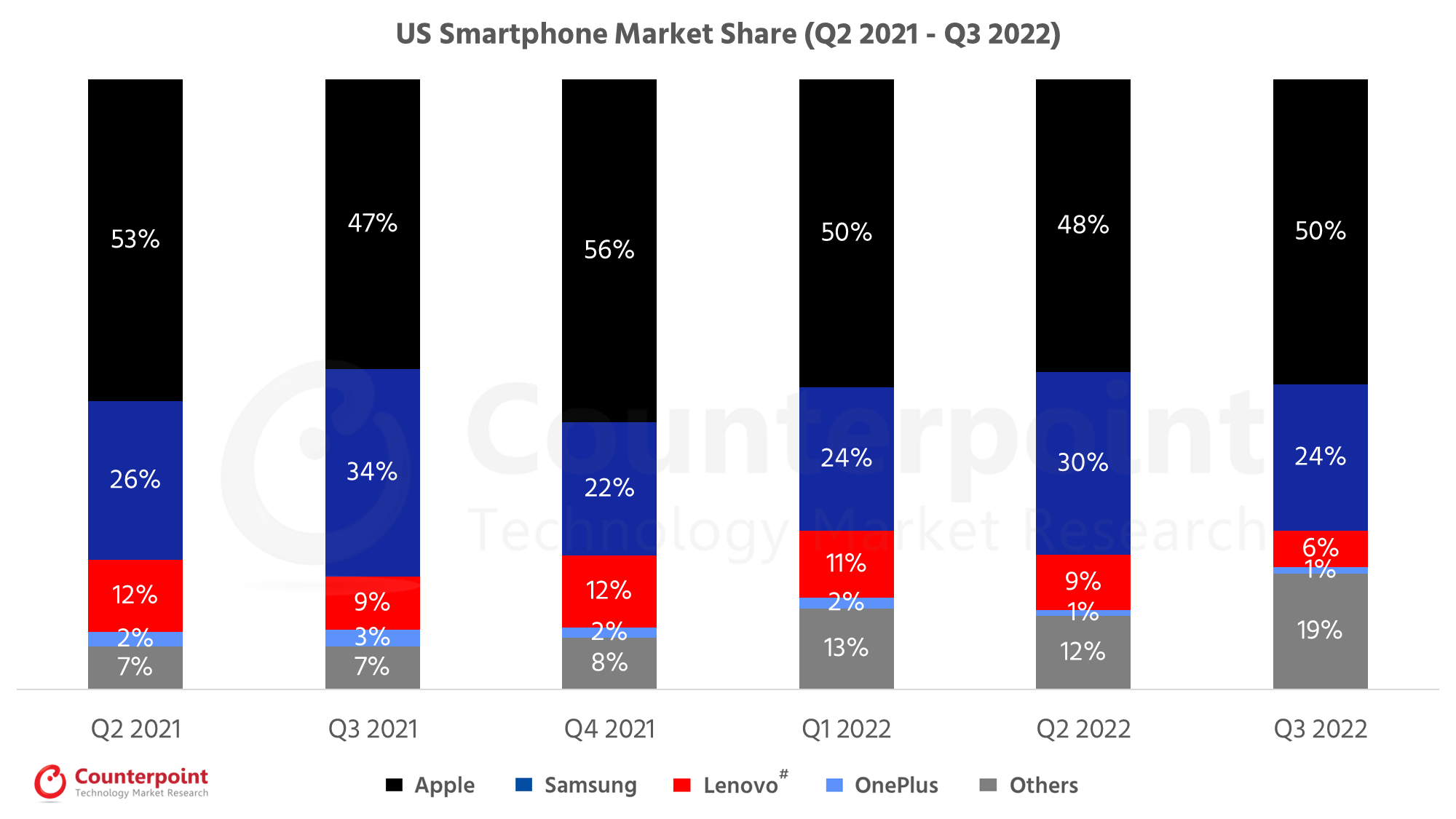

| US Smartphone Market Share (%) | ||||||

| Brands | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 |

| Apple | 53% | 47% | 56% | 50% | 48% | 50% |

| Samsung | 26% | 34% | 22% | 24% | 30% | 24% |

| Lenovo# | 12% | 9% | 12% | 11% | 9% | 6% |

| OnePlus | 2% | 3% | 2% | 2% | 1% | 1% |

| Others | 7% | 7% | 8% | 13% | 12% | 19% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

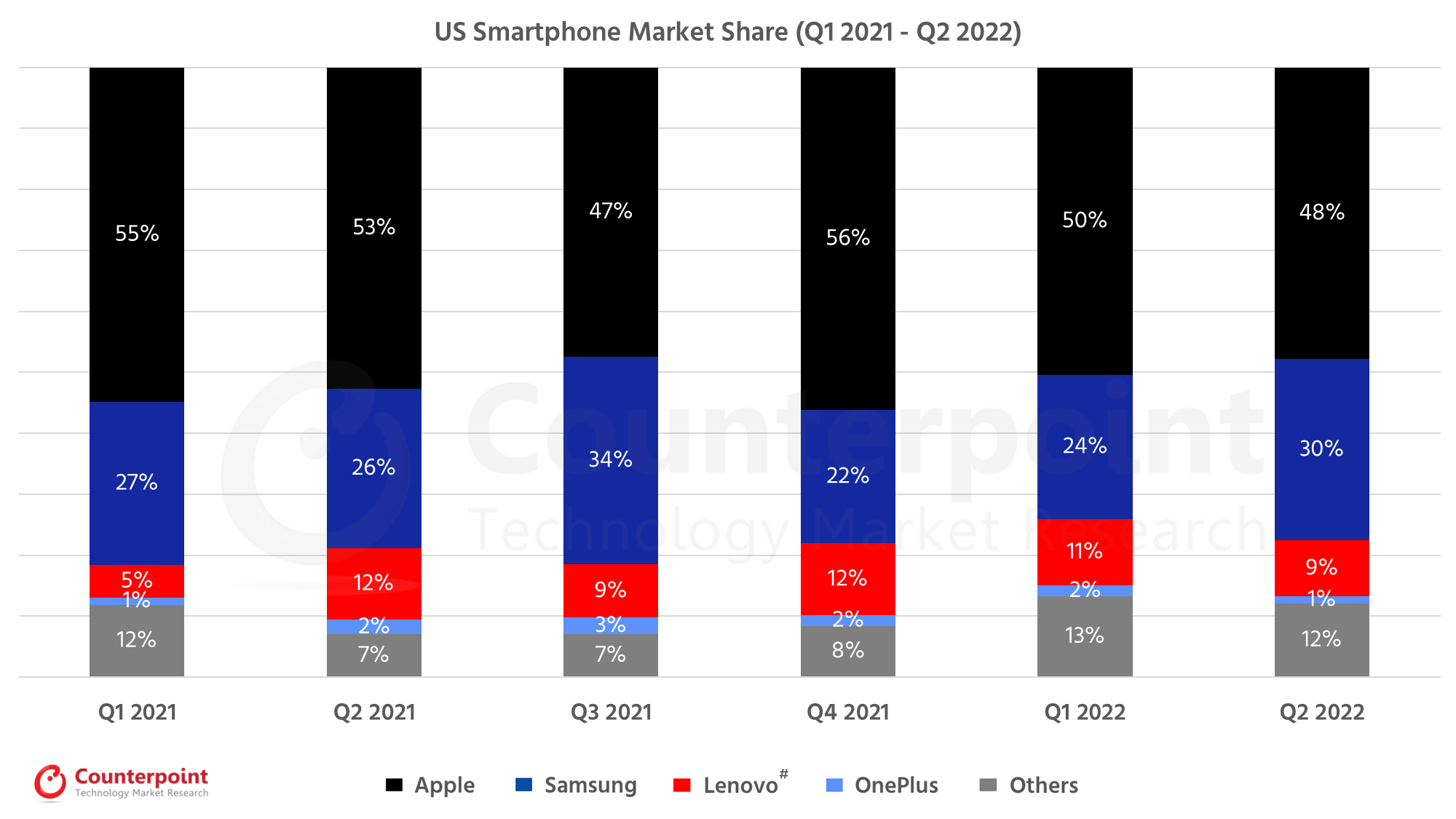

| US Smartphone Market Share (%) | ||||||

| Brands | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 |

| Apple | 55% | 53% | 47% | 56% | 50% | 48% |

| Samsung | 27% | 26% | 34% | 22% | 24% | 30% |

| Lenovo# | 5% | 12% | 9% | 12% | 11% | 9% |

| OnePlus | 1% | 2% | 3% | 2% | 2% | 1% |

| Others | 12% | 7% | 7% | 8% | 13% | 12% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

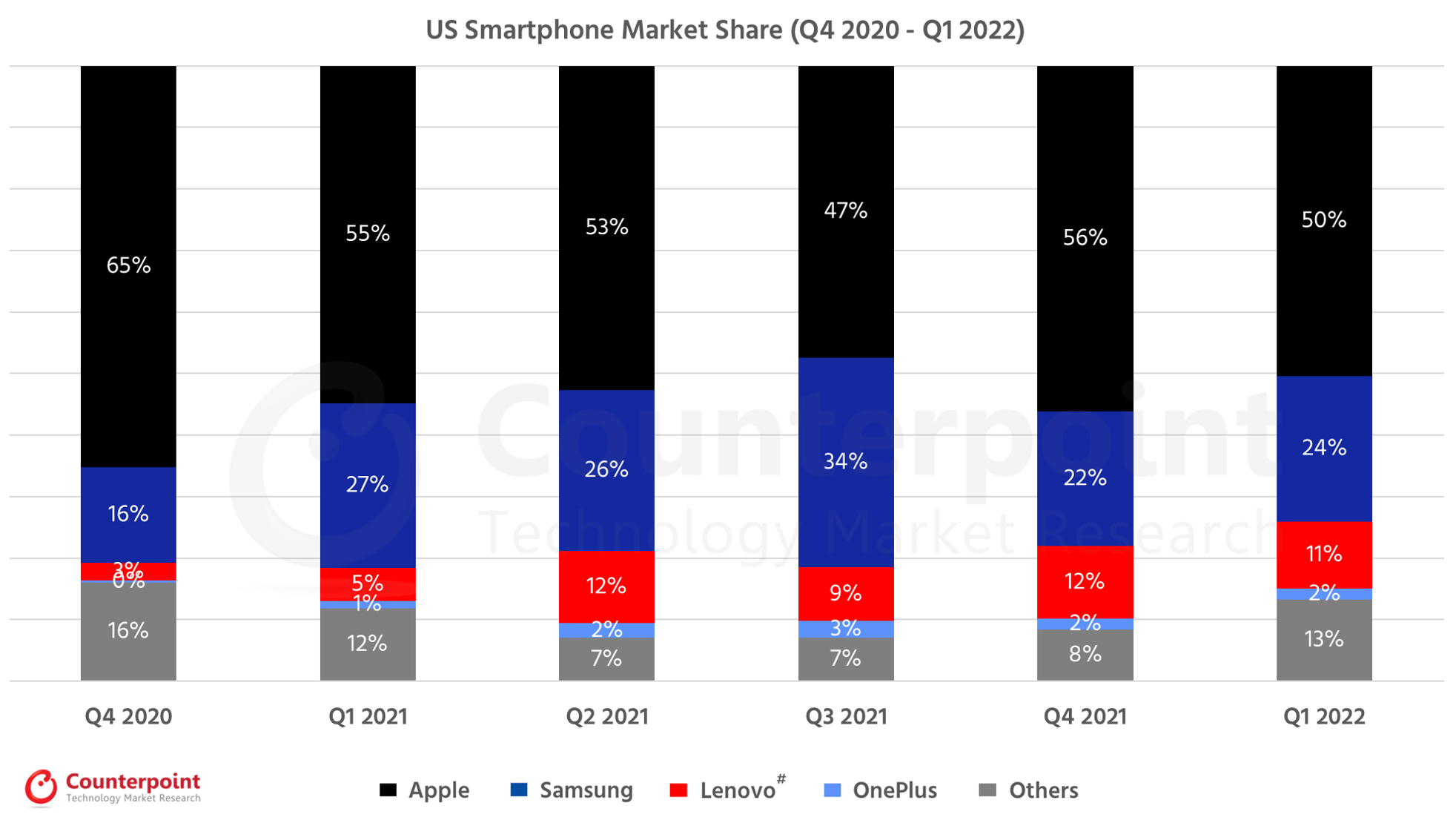

Market Highlights

| US Smartphone Market Share (%) | ||||||

| Brands | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 |

| Apple | 65% | 55% | 53% | 47% | 56% | 50% |

| Samsung | 16% | 27% | 26% | 34% | 22% | 24% |

| Lenovo# | 3% | 5% | 12% | 9% | 12% | 11% |

| OnePlus | 0% | 1% | 2% | 3% | 2% | 2% |

| Others | 16% | 12% | 7% | 7% | 8% | 13% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

Market Highlights

| US Smartphone Market Share (%) | ||||||

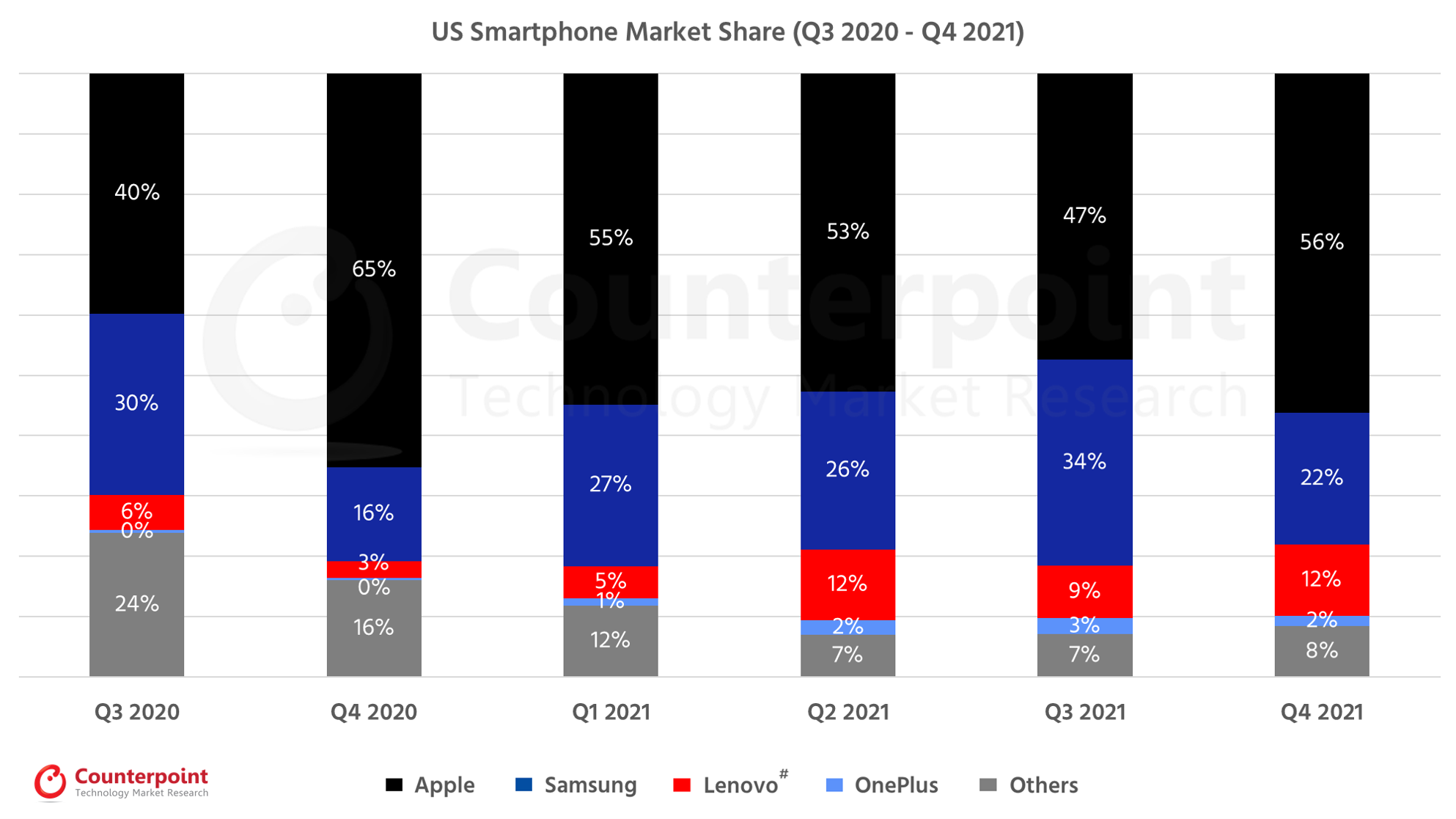

| Brands | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 |

| Apple | 40% | 65% | 55% | 53% | 47% | 56% |

| Samsung | 30% | 16% | 27% | 26% | 34% | 22% |

| Lenovo# | 6% | 3% | 5% | 12% | 9% | 12% |

| OnePlus | 0% | 0% | 1% | 2% | 3% | 2% |

| Others | 24% | 16% | 12% | 7% | 7% | 8% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

Market Highlights

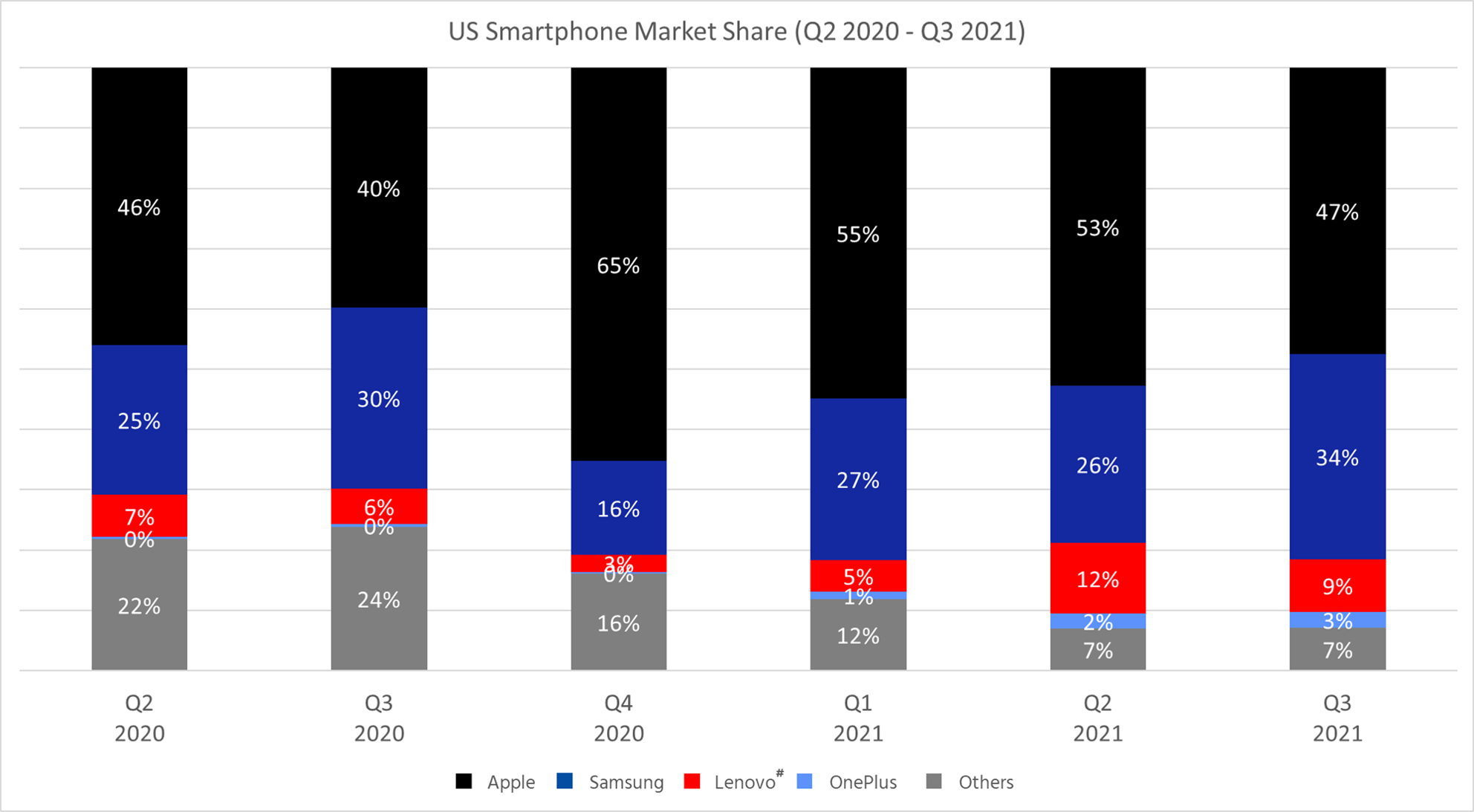

| US Smartphone Market Share (%) | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 |

| Apple | 46% | 40% | 65% | 55% | 53% | 47% |

| Samsung | 25% | 30% | 16% | 27% | 26% | 34% |

| Lenovo# | 7% | 6% | 3% | 5% | 12% | 9% |

| OnePlus | 0% | 0% | 0% | 1% | 2% | 3% |

| Others | 22% | 24% | 16% | 12% | 7% | 7% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

Market Highlights

| US Smartphone Market Share (%) | ||||||

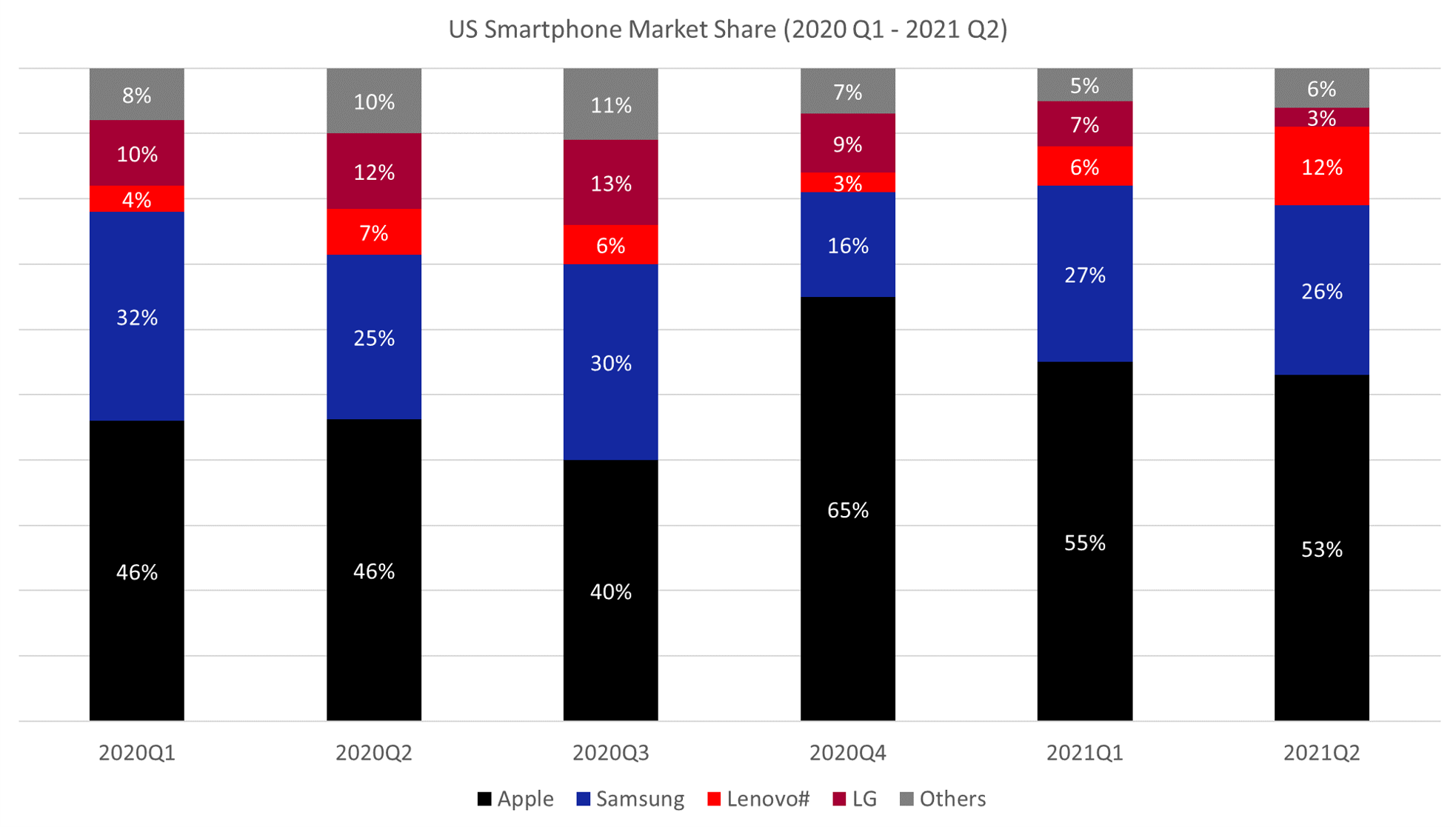

| Brands | 2020Q1 | 2020Q2 | 2020Q3 | 2020Q4 | 2021Q1 | 2021Q2 |

| Apple | 46% | 46% | 40% | 65% | 55% | 53% |

| Samsung | 32% | 25% | 30% | 16% | 27% | 26% |

| Lenovo# | 4% | 7% | 6% | 3% | 6% | 12% |

| LG | 10% | 12% | 13% | 9% | 7% | 3% |

| Others | 8% | 10% | 11% | 7% | 5% | 6% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

Market Highlights

| US Smartphone Market Share (%) | ||||||

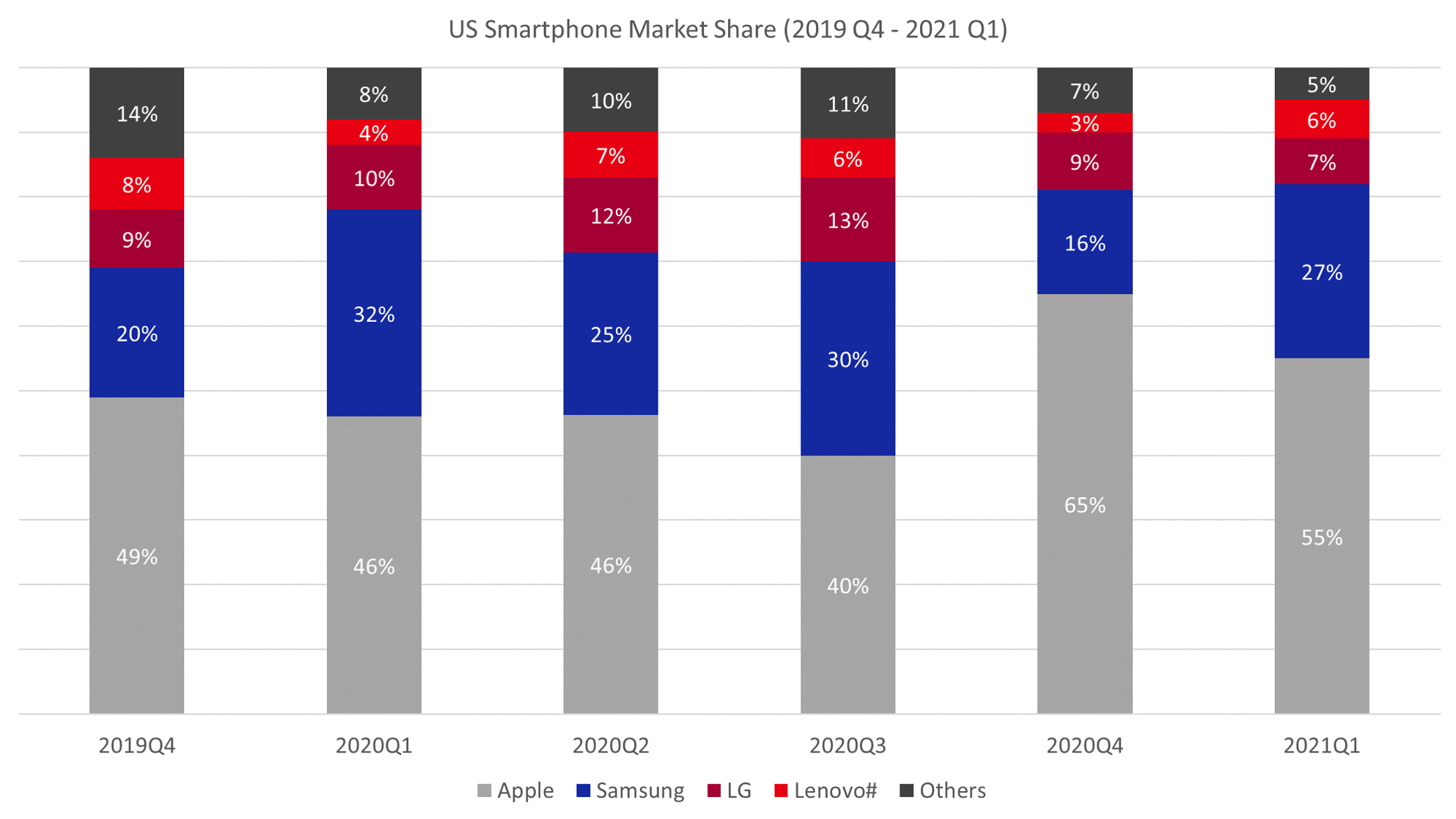

| Brands | 2019Q4 | 2020Q1 | 2020Q2 | 2020Q3 | 2020Q4 | 2021Q1 |

| Apple | 49% | 46% | 46% | 40% | 65% | 55% |

| Samsung | 20% | 32% | 25% | 30% | 16% | 27% |

| LG | 9% | 10% | 12% | 13% | 9% | 7% |

| Lenovo# | 8% | 4% | 7% | 6% | 3% | 6% |

| Others | 14% | 8% | 10% | 11% | 7% | 5% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

Market Highlights

| US Smartphone Market Share (%) | ||||||

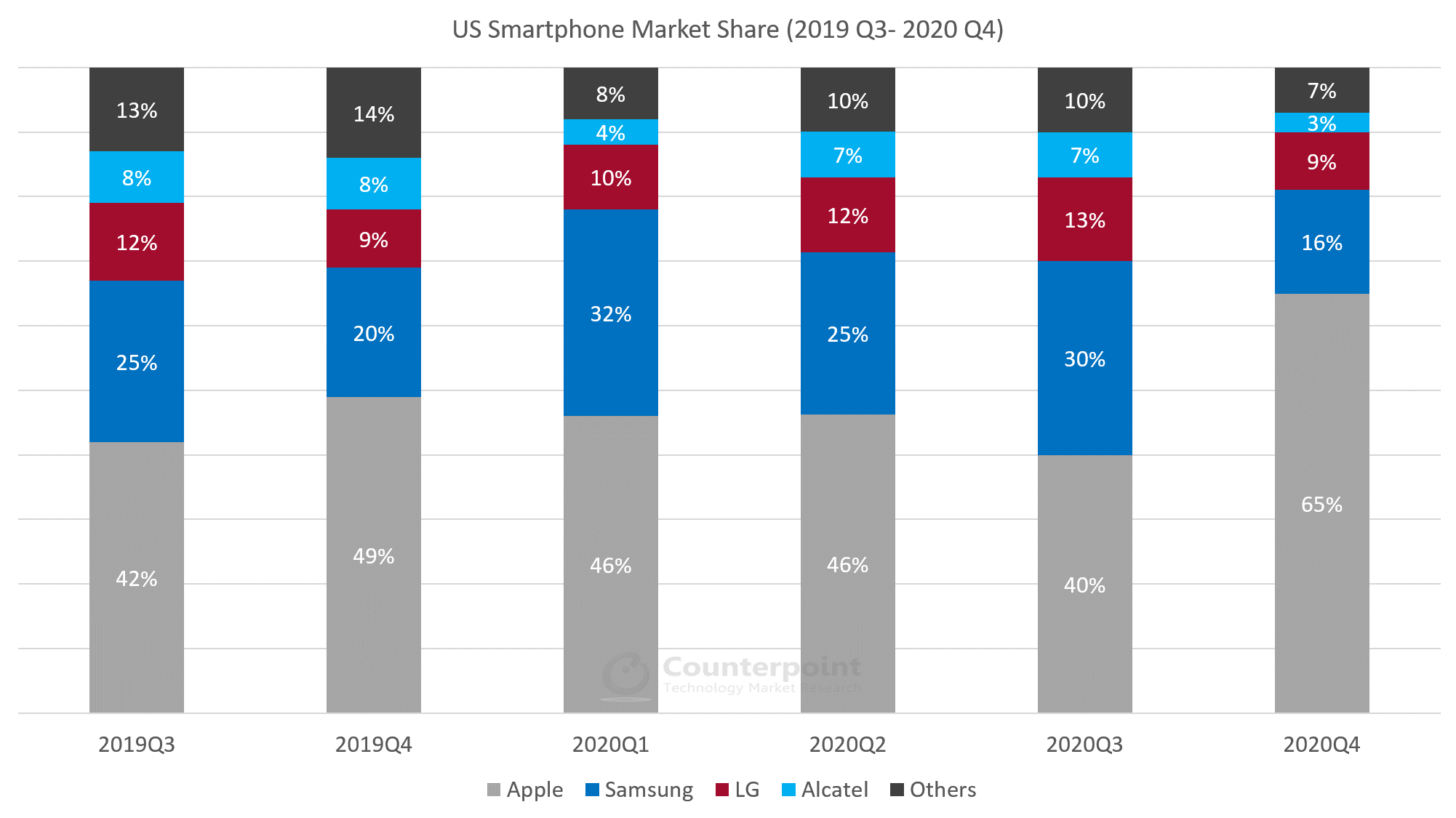

| Brands | 2019Q3 | 2019Q4 | 2020Q1 | 2020Q2 | 2020Q3 | 2020Q4 |

| Apple | 42% | 49% | 46% | 46% | 40% | 65% |

| Samsung | 25% | 20% | 32% | 25% | 30% | 16% |

| LG | 12% | 9% | 10% | 12% | 13% | 9% |

| Alcatel | 8% | 8% | 4% | 7% | 7% | 3% |

| Others | 13% | 14% | 8% | 10% | 10% | 7% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

Market Highlights

| USA Smartphone Market Share (%) | ||||||

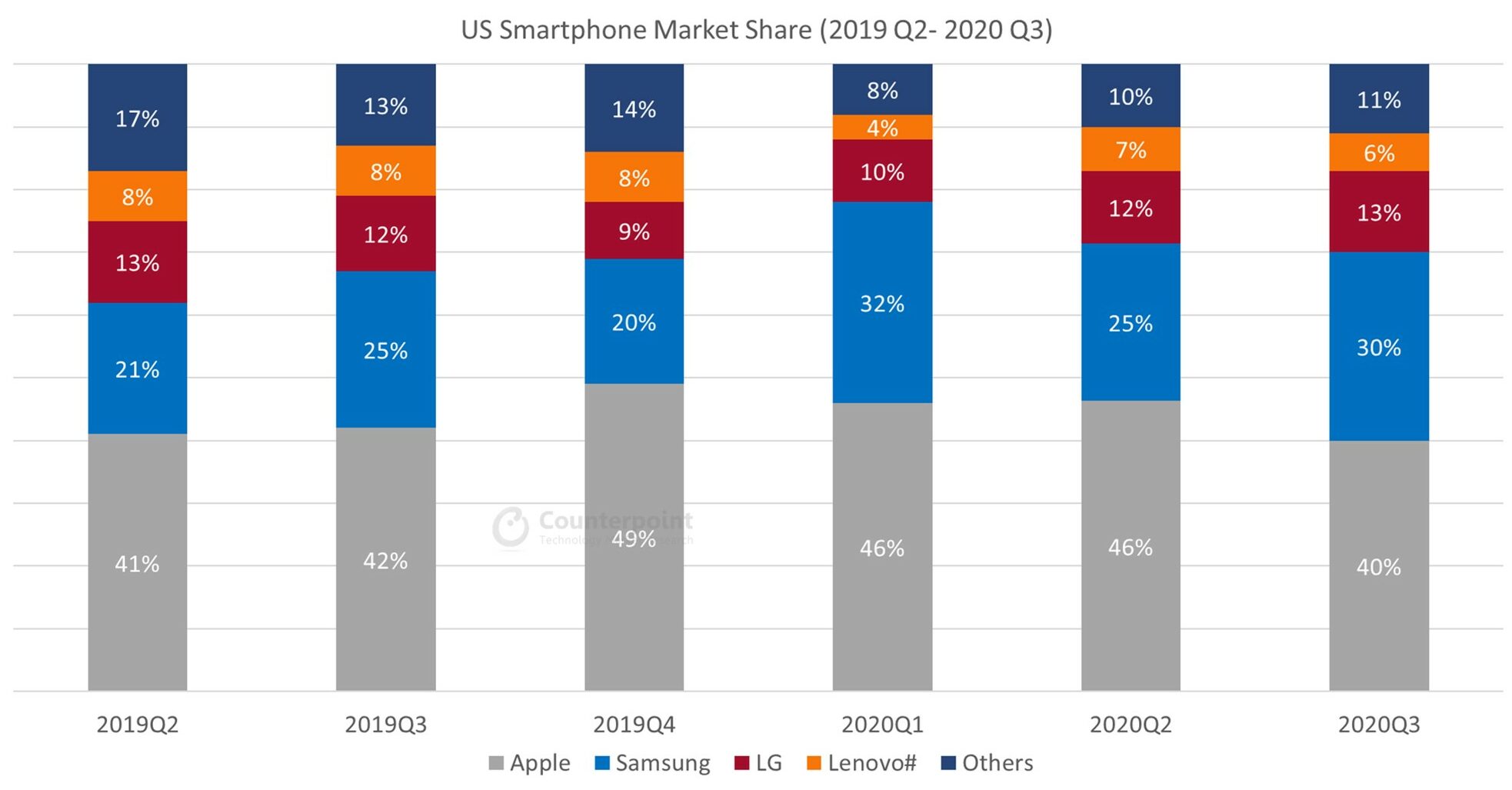

| Brands | 2019 Q2 | 2019 Q3 | 2019 Q4 | 2020 Q1 | 2020 Q2 | 2020 Q3 |

| Apple | 41% | 42% | 49% | 46% | 46% | 40% |

| Samsung | 21% | 25% | 20% | 32% | 25% | 30% |

| LG | 13% | 12% | 9% | 10% | 12% | 13% |

| Lenovo# | 8% | 8% | 8% | 4% | 7% | 6% |

| Others | 17% | 13% | 14% | 8% | 10% | 11% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

Market Highlights

| US Smartphone Market Share (%) | ||||||

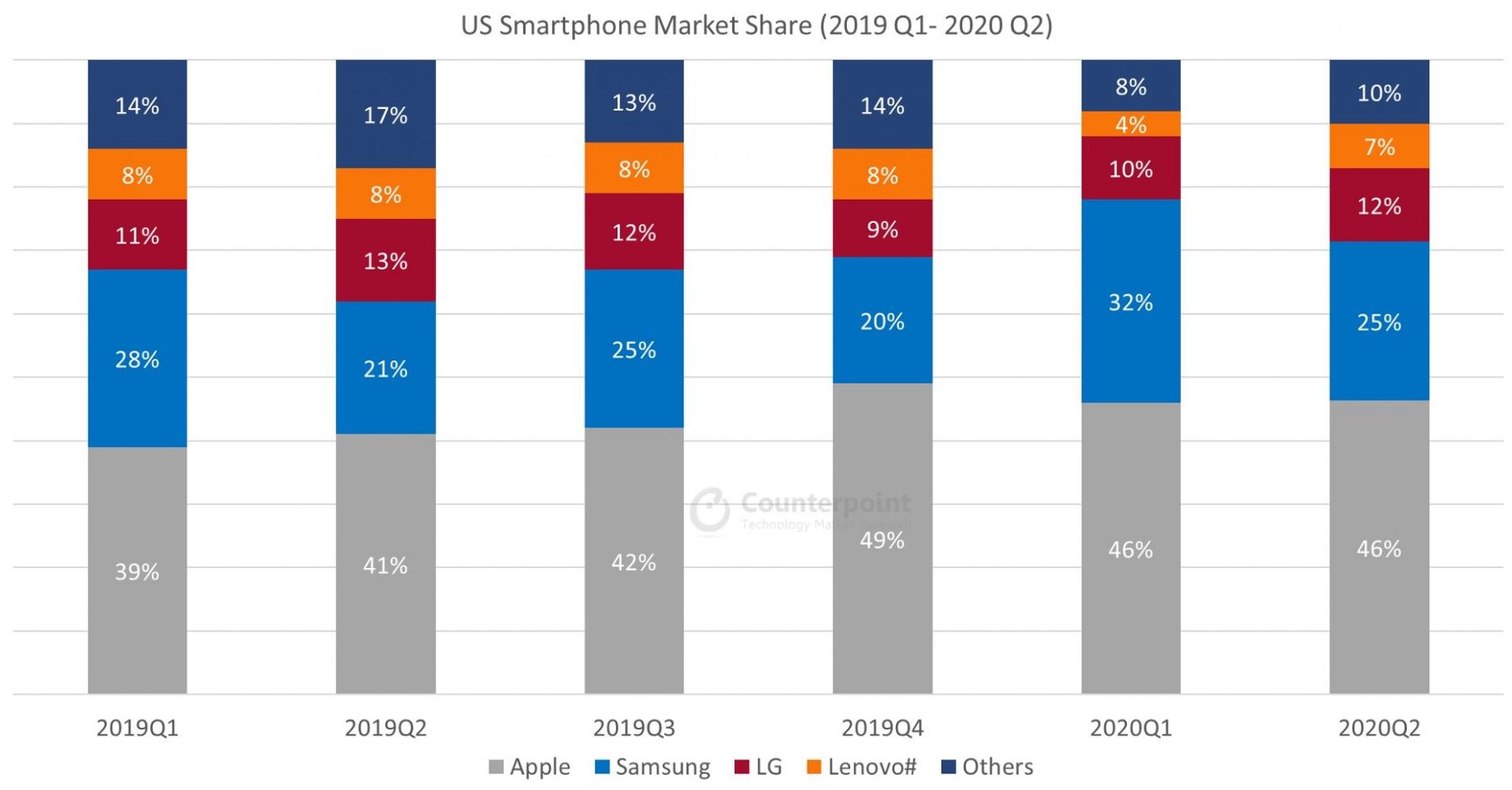

| Brands | 2019 Q1 | 2019 Q2 | 2019 Q3 | 2019 Q4 | 2020 Q1 | 2020 Q2 |

| Apple | 39% | 41% | 42% | 49% | 46% | 46% |

| Samsung | 28% | 21% | 25% | 20% | 32% | 25% |

| LG | 11% | 13% | 12% | 9% | 10% | 12% |

| Lenovo# | 8% | 8% | 8% | 8% | 4% | 7% |

| Others | 14% | 17% | 13% | 14% | 8% | 10% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

Market Highlights

| US Smartphone Market Share (%) | |||||

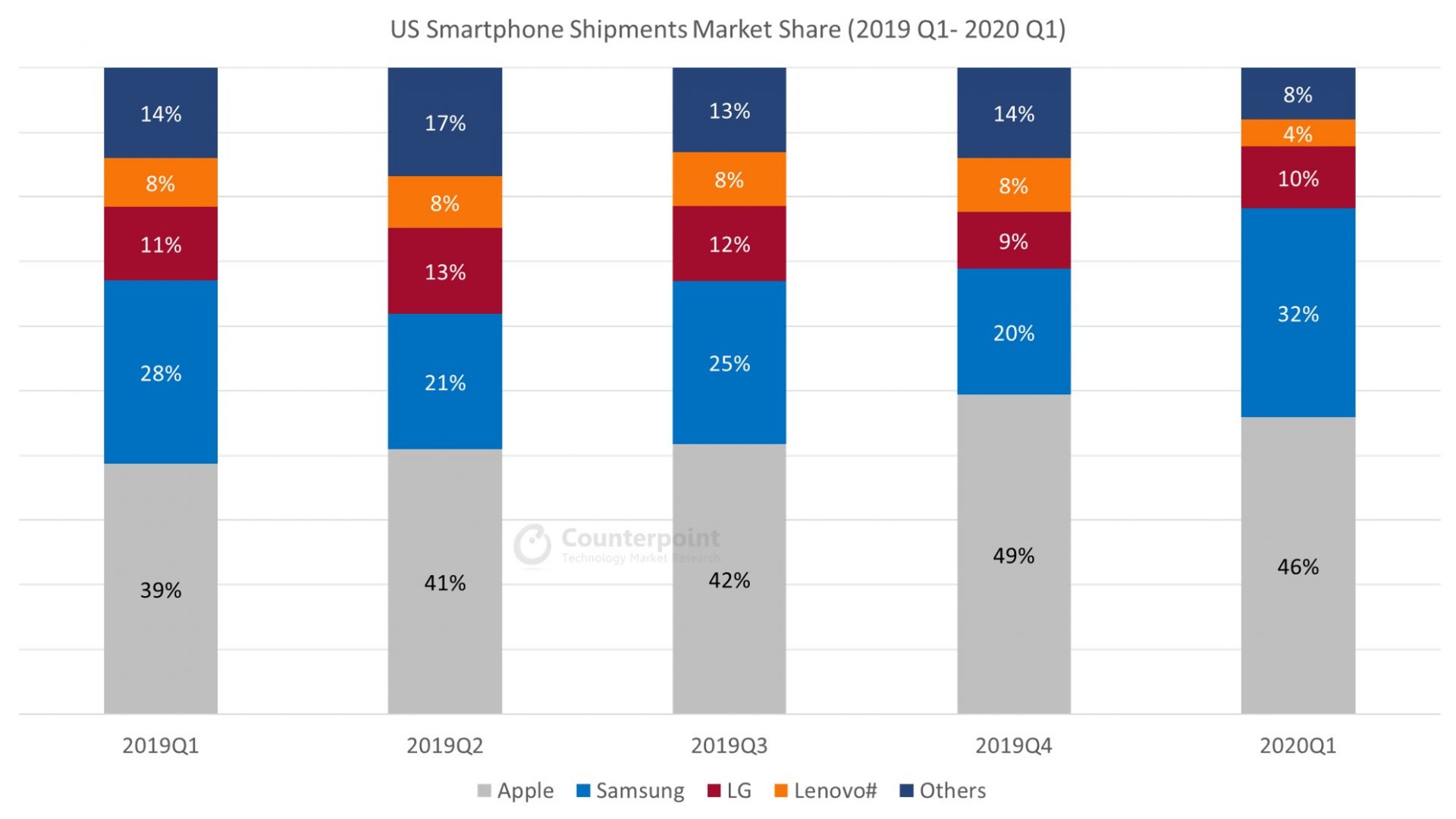

| Brands | 2019 Q1 | 2019 Q2 | 2019 Q3 | 2019 Q4 | 2020 Q1 |

| Apple | 39% | 41% | 42% | 49% | 46% |

| Samsung | 28% | 21% | 25% | 20% | 32% |

| LG | 11% | 13% | 12% | 9% | 10% |

| Lenovo# | 8% | 8% | 8% | 8% | 4% |

| Others | 14% | 17% | 13% | 14% | 8% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

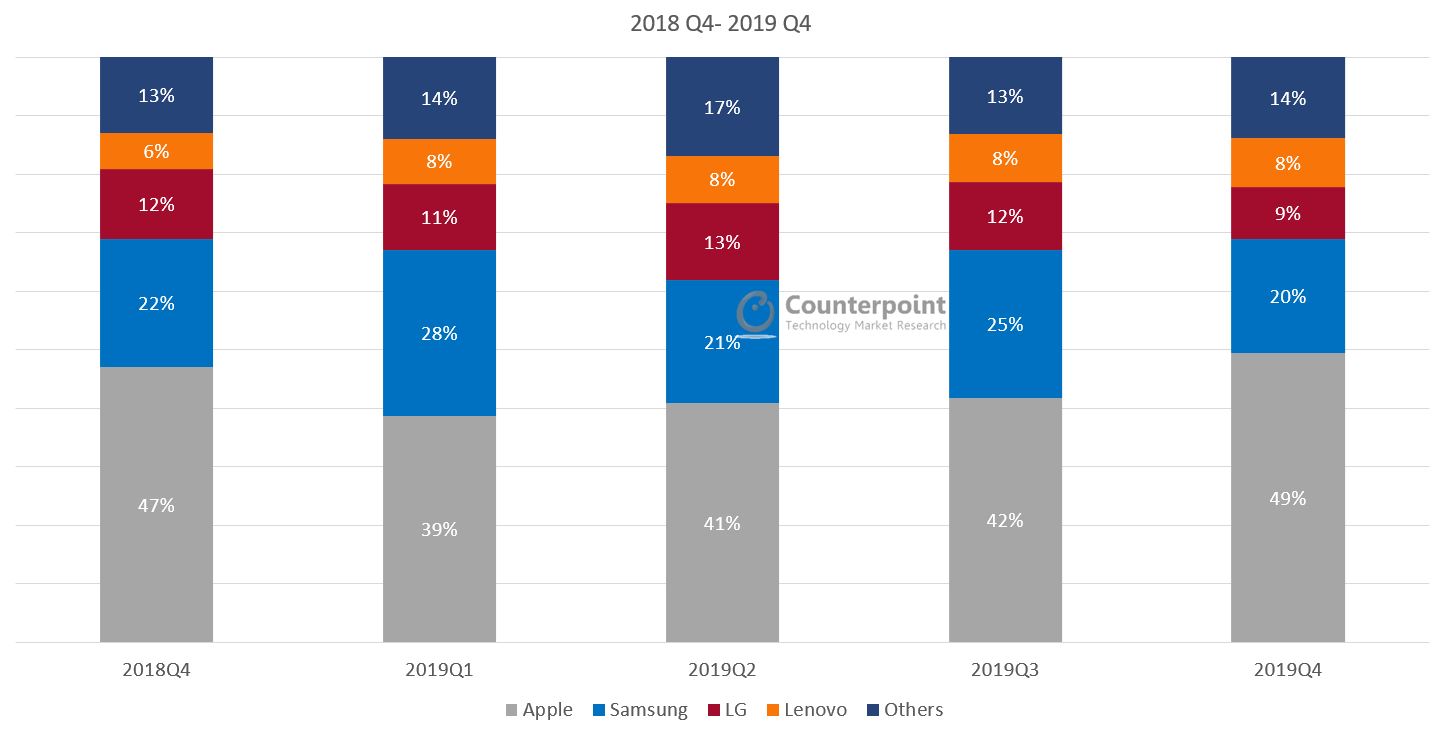

Market Highlights

| US Smartphone Market Share (%) | 2018

Q4 | 2019

Q1 | 2019

Q2 | 2019

Q3 | 2019

Q4 |

| Apple | 47% | 39% | 41% | 42% | 49% |

| Samsung | 22% | 28% | 21% | 25% | 20% |

| LG | 12% | 11% | 13% | 12% | 9% |

| Lenovo# | 6% | 8% | 8% | 8% | 8% |

| Others | 13% | 14% | 17% | 13% | 14% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

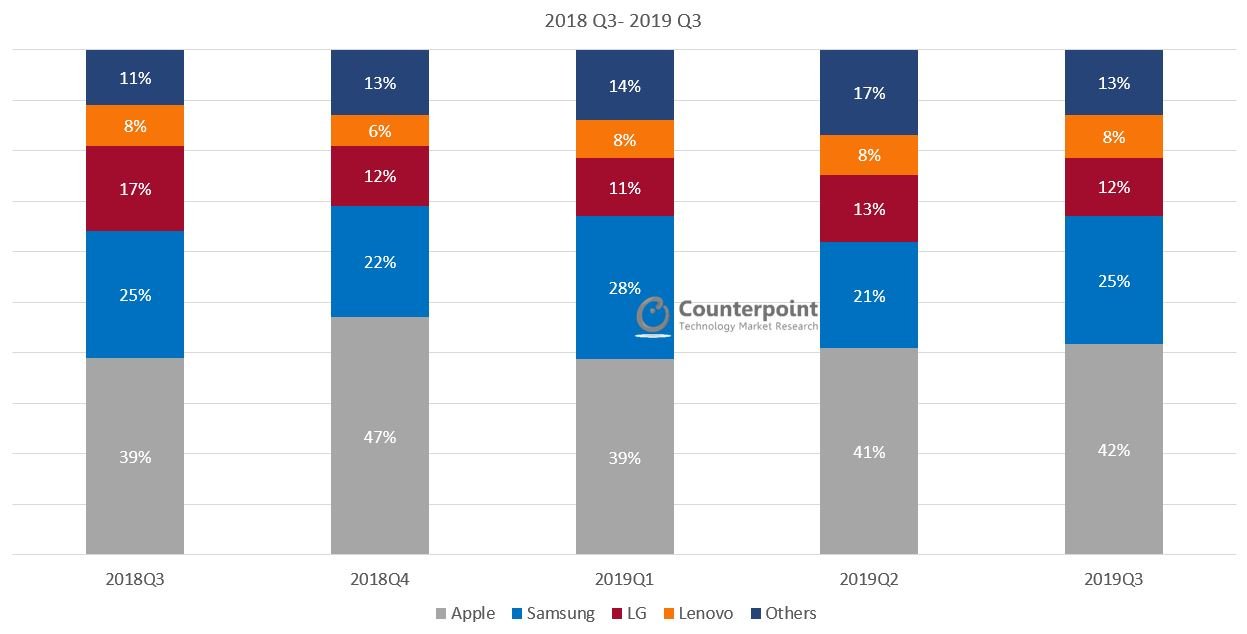

Market Highlights

| US Smartphone Market Share (%) | 2018

Q3 | 2018

Q4 | 2019

Q1 | 2019

Q2 | 2019

Q3 |

| Apple | 39% | 47% | 39% | 41% | 42% |

| Samsung | 25% | 22% | 28% | 21% | 25% |

| LG | 17% | 12% | 11% | 13% | 12% |

| Lenovo# | 8% | 6% | 8% | 8% | 8% |

| Others | 11% | 13% | 14% | 17% | 13% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

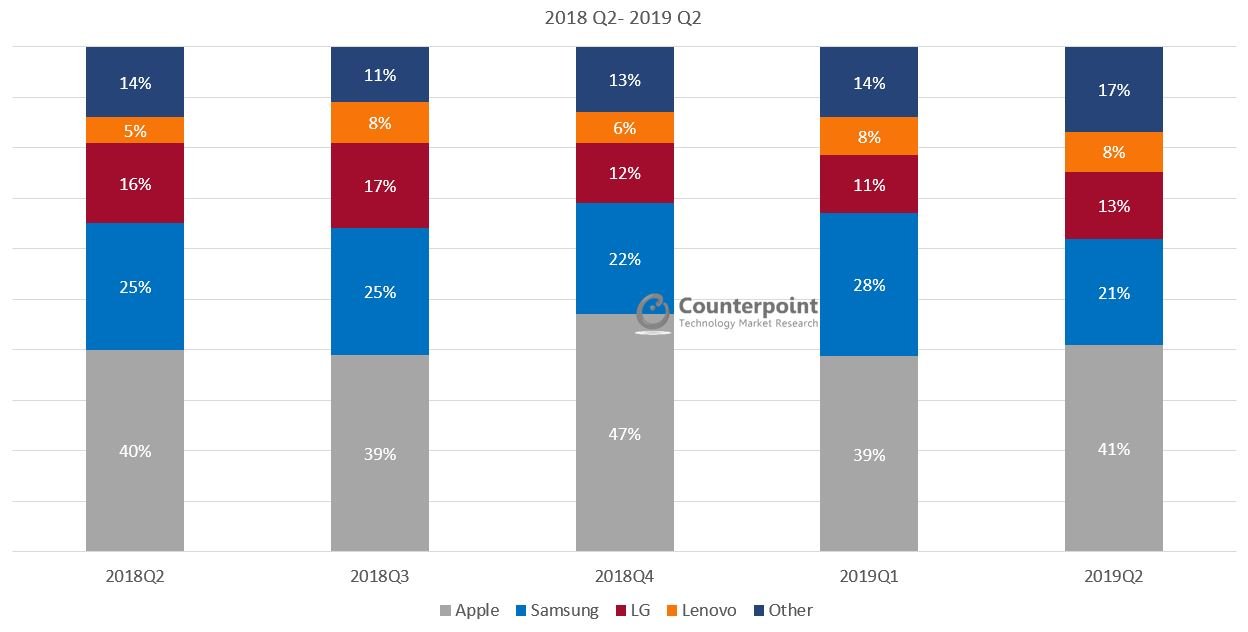

Market Highlights

| US Smartphone Market Share (%) | 2018

Q2 | 2018

Q3 | 2018

Q4 | 2019

Q1 | 2019

Q2 |

| Apple | 40% | 39% | 47% | 39% | 41% |

| Samsung | 25% | 25% | 22% | 28% | 21% |

| LG | 16% | 17% | 12% | 11% | 13% |

| Lenovo# | 5% | 8% | 6% | 8% | 8% |

| Other | 14% | 11% | 13% | 14% | 17% |

#Lenovo includes Motorola.

**Ranking is according to the latest quarter.

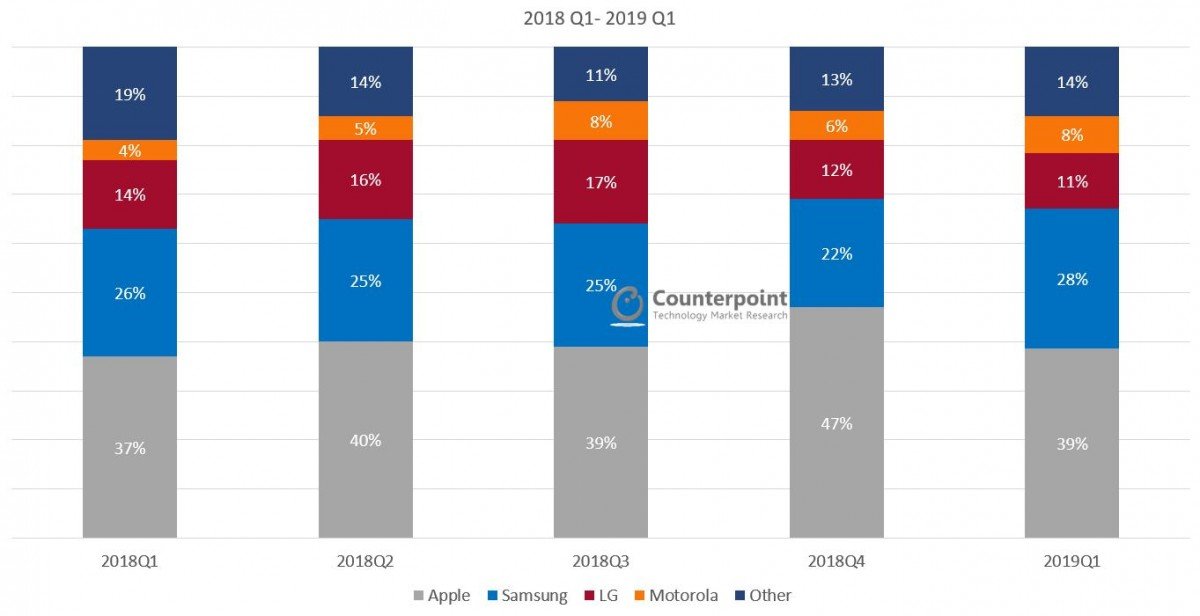

Market Highlights

| US Smartphone Market Share (%) | 2018

Q1 | 2018

Q2 | 2018

Q3 | 2018

Q4 | 2019

Q1 |

| Apple | 37% | 40% | 39% | 47% | 39% |

| Samsung | 26% | 25% | 25% | 22% | 28% |

| LG | 14% | 16% | 17% | 12% | 11% |

| Motorola | 4% | 5% | 8% | 6% | 8% |

| Other | 19% | 14% | 11% | 13% | 14% |

**Ranking is according to the latest quarter.

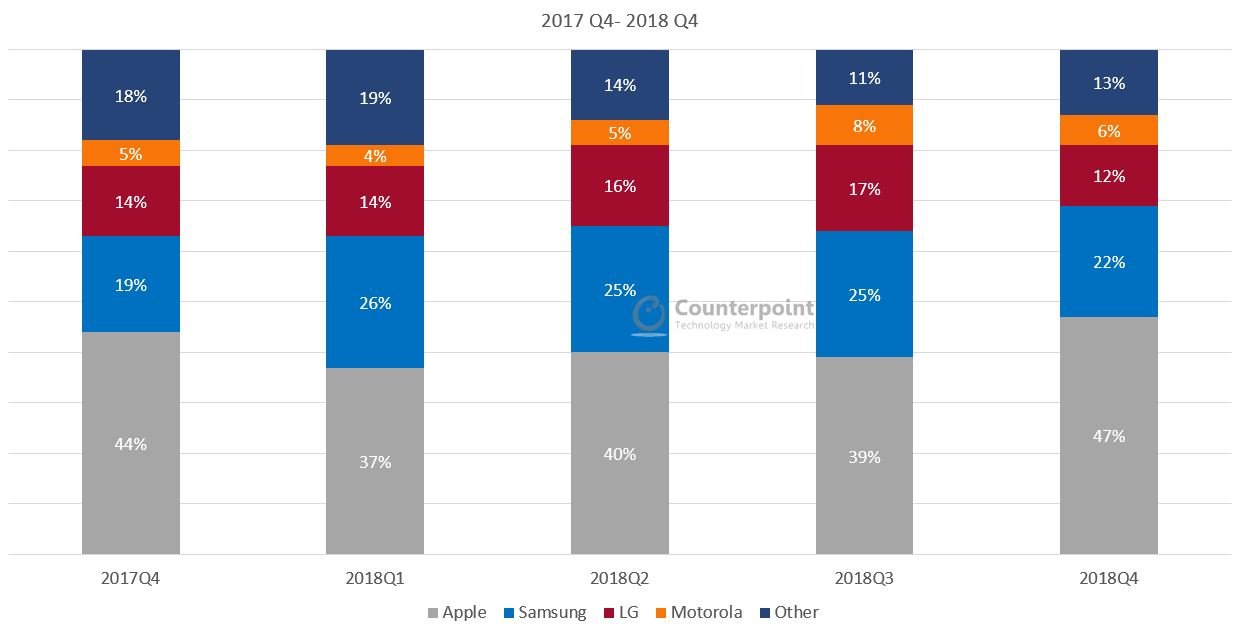

Market Highlights

| US Smartphone Market Share (%) | 2017Q4 | 2018Q1 | 2018Q2 | 2018Q3 | 2018Q4 |

| Apple | 44% | 37% | 40% | 39% | 47% |

| Samsung | 19% | 26% | 25% | 25% | 22% |

| LG | 14% | 14% | 16% | 17% | 12% |

| Motorola | 5% | 4% | 5% | 8% | 6% |

| Other | 18% | 19% | 14% | 11% | 13% |

**Ranking is according to the latest quarter.

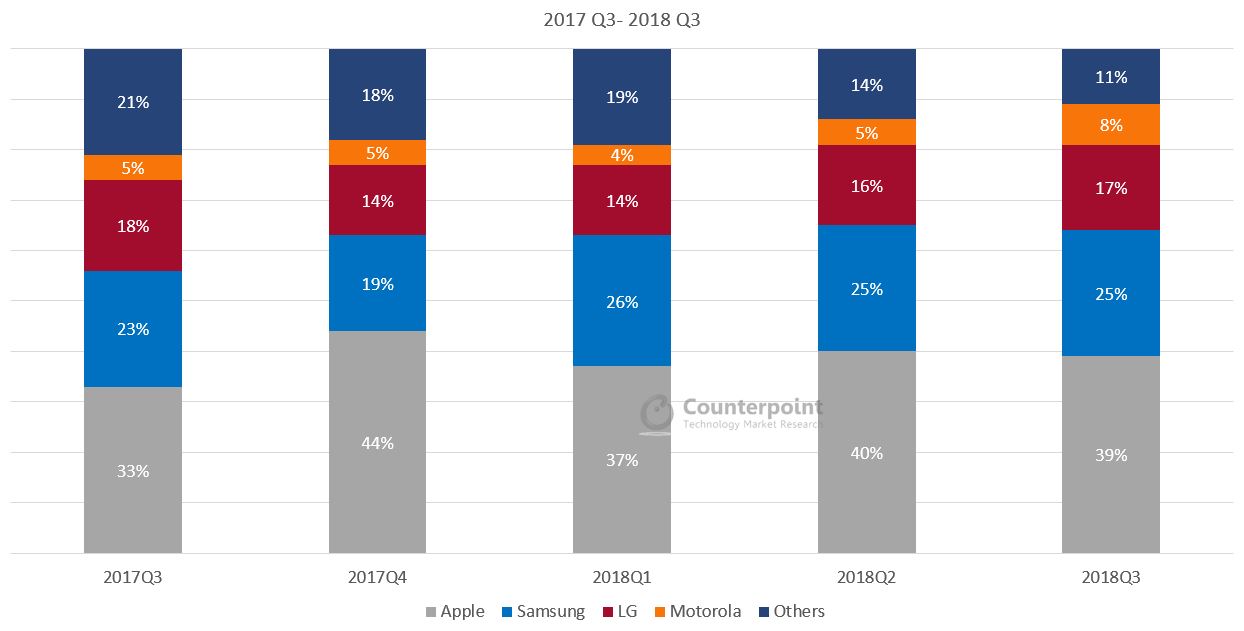

Market Highlights

| US Smartphone Market Share (%) | 2017Q3 | 2017Q4 | 2018Q1 | 2018Q2 | 2018Q3 |

| Apple | 33% | 44% | 37% | 40% | 39% |

| Samsung | 23% | 19% | 26% | 25% | 25% |

| LG | 18% | 14% | 14% | 16% | 17% |

| Motorola | 5% | 5% | 4% | 5% | 8% |

| Others | 21% | 18% | 19% | 14% | 11% |

**Ranking is according to the latest quarter.

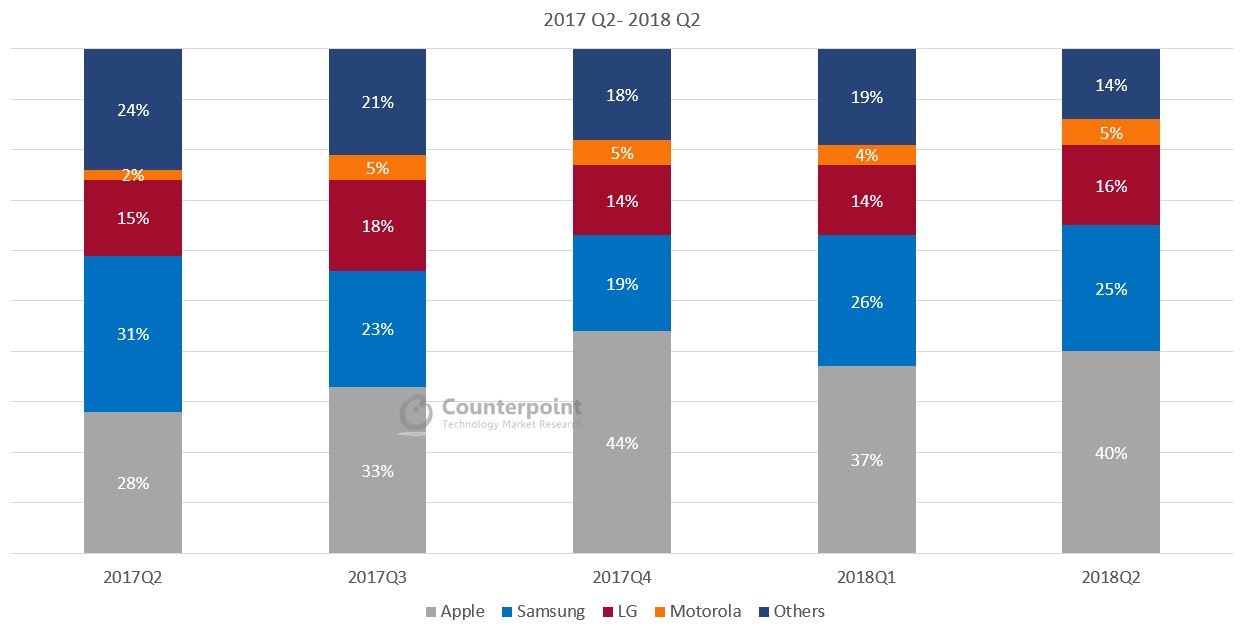

Market Highlights

| US Smartphone Market Share (%) | 2017Q2 | 2017Q3 | 2017Q4 | 2018Q1 | 2018Q2 |

| Apple | 28% | 33% | 44% | 37% | 40% |

| Samsung | 31% | 23% | 19% | 26% | 25% |

| LG | 15% | 18% | 14% | 14% | 16% |

| Motorola | 2% | 5% | 5% | 4% | 5% |

| Others | 24% | 21% | 18% | 19% | 14% |

**Ranking is according to the latest quarter.

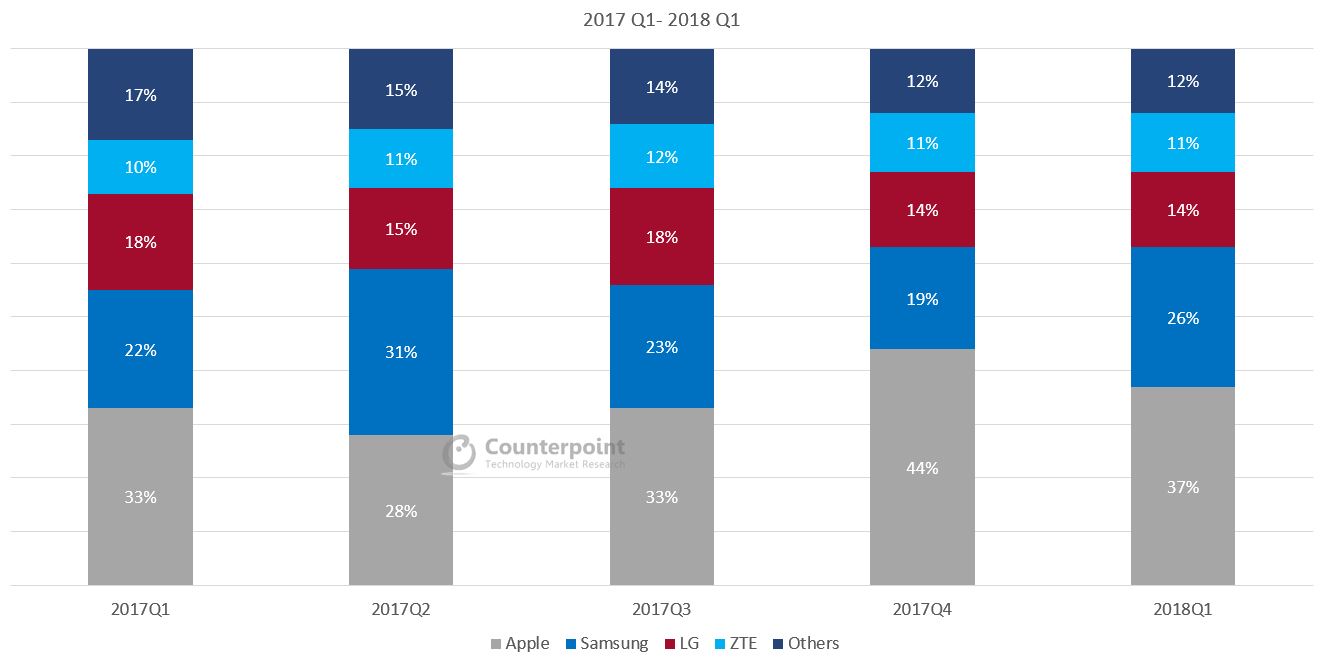

Market Highlights

| US Smartphone Market Share (%) | 2017Q1 | 2017Q2 | 2017Q3 | 2017Q4 | 2018Q1 |

| Apple | 33% | 28% | 33% | 44% | 37% |

| Samsung | 22% | 31% | 23% | 19% | 26% |

| LG | 18% | 15% | 18% | 14% | 14% |

| ZTE | 10% | 11% | 12% | 11% | 11% |

| Others | 17% | 15% | 14% | 12% | 12% |

**Ranking is according to the latest quarter.

Copyright ⓒ Counterpoint Technology Market Research | All rights reserved