Access quarterly data and market insights showcasing China’s smartphone market share, spanning from Q1 2018.

Published Date: May 21, 2024

Market Highlights

• China’s smartphone shipments rose 2% YoY in Q1 2024, staying on track to low-digit annual growth.

• HONOR emerged as the market leader with a 17% share driven by its mass-market products.

• Huawei’s shipments increased more than 60% YoY with more of its devices being powered by self-developed chipsets.

• Apple’s shipments declined more than 10% YoY due to strong pressure from local competitors in premium price bands.

• China Q1 2024 smartphone market share rankings (based on shipments):

○ HONOR: 17%

○ Huawei: 17%

○ Apple market share: 16%

○ OPPO: 16%

○ vivo: 15%

○ Others: 19%

| Brand | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 |

|---|---|---|---|---|---|---|

| HONOR | 15% | 16% | 15% | 19% | 15% | 17% |

| Huawei | 9% | 10% | 11% | 14% | 17% | 17% |

| Apple | 23% | 19% | 16% | 15% | 21% | 16% |

| OPPO | 17% | 18% | 18% | 16% | 13% | 16% |

| vivo | 18% | 16% | 18% | 16% | 16% | 15% |

| Others | 18% | 21% | 22% | 20% | 18% | 19% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

*Data on this page is updated every quarter. This data represents the Chinese smartphone market share by quarter (from 2020-2023) by top OEMs.

For detailed insights on the data, please reach out to us at sales(at)counterpointresearch.com. If you are a member of the press, please contact us at press(at)counterpointresearch.com for any media enquiries.

These smartphone market share numbers are from:

Excel File

Published Date: May 2024

This report is part of a series of reports which track the mobile handset market: Smartphone and Feature Phone shipments every quarter for more than 140 brands covering more than 95% of the total device shipments in the industry.

Recommended Reads:

Published Date: February 21, 2024

Market Highlights

• China’s smartphone shipments rose 1% YoY in Q4 2023, marking the first quarterly increase in more than two years. This was due to OEMs restocking for newly launched models.

• Though Apple offered big promotions for the iPhone 15 series, it still witnessed a 6% YoY drop in shipments due to fierce competition from Huawei’s return.

• Huawei’s shipments almost doubled YoY driven by the hot-selling Mate 60 series as well as the newly launched Nova 12 series.

• Xiaomi saw a strong 13% YoY increase mainly driven by the newly launched Xiaomi 14 series and Redmi K70 series.

• HONOR also saw a 1% YoY uptick.

| Brand | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 |

|---|---|---|---|---|---|---|

| Apple | 14% | 23% | 20% | 16% | 15% | 21% |

| Huawei | 10% | 9% | 10% | 11% | 14% | 17% |

| vivo | 20% | 18% | 16% | 18% | 16% | 16% |

| HONOR | 17% | 15% | 16% | 15% | 19% | 15% |

| Xiaomi | 13% | 12% | 12% | 14% | 14% | 13% |

| Others | 26% | 23% | 26% | 26% | 22% | 18% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

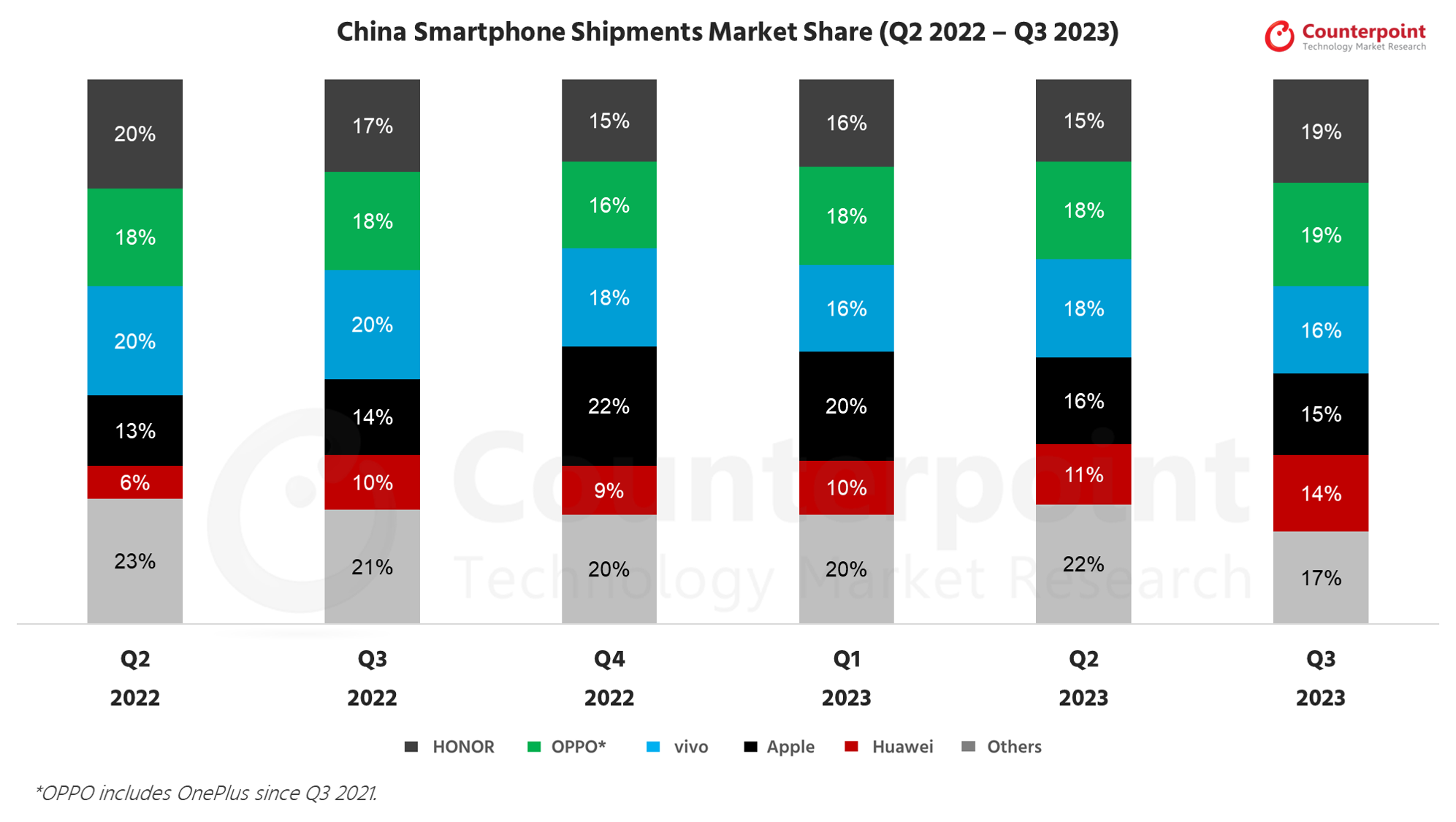

Published Date: November 10, 2023

Market Highlights

• China’s smartphone shipments fell 2% YoY in Q3 2023, narrowing the YoY decline sequentially. This was due to OEMs restocking in preparation for new model launches.

• Huawei’s shipments soared 41% YoY as its newly launched Mate 60 series with Kirin SoC gained momentum immediately after the launch. Apple experienced a slight YoY uptick in shipments driven by the newly launched iPhone 15 series, but the initial supply constraints impacted its overall performance. HONOR also increased YoY mainly driven by the hot-selling HONOR X50 and HONOR 90. OnePlus’ robust growth drove up OPPO’s shipments.

• We expect to see a YoY growth in Q4 2023 as all Chinese OEMs are expected to launch their new models then. It is worth noting that this will come on last year’s low base, as many Chinese cities were still under lockdowns during the same period last year.

| Brands | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 |

|---|---|---|---|---|---|---|

| HONOR | 20% | 17% | 15% | 16% | 15% | 19% |

| OPPO* | 18% | 18% | 16% | 18% | 18% | 19% |

| vivo | 20% | 20% | 18% | 16% | 18% | 16% |

| Apple | 13% | 14% | 22% | 20% | 16% | 15% |

| Huawei | 6% | 10% | 9% | 10% | 11% | 14% |

| Others | 23% | 21% | 20% | 20% | 22% | 17% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

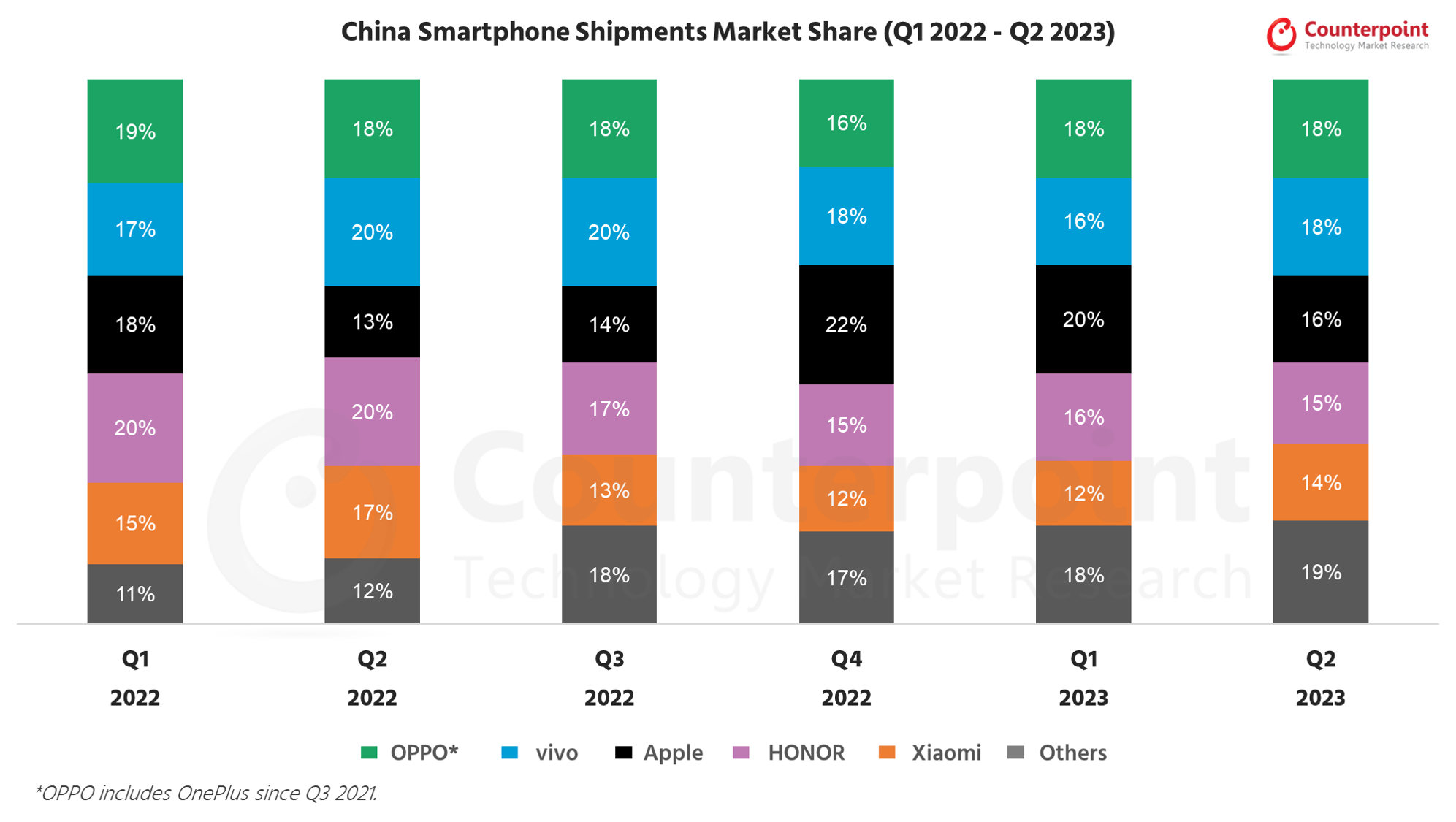

Published Date: August 17, 2023

Market Highlights

• Smartphone shipments in China fell 4% YoY in Q2 2023 though OEMs provided big promotions during the 618 festival. This was due to weak demands resulting from economic headwinds.

• Apple saw the biggest YoY growth in Q2 as the OEM offered generous price-cuts for the iPhone 14 series during the 618 period. Besides, it still has no competitors in the high-end market which has proven to be more resilient during market headwinds.

• OPPO’s share grew slightly (YoY) as OnePlus showed strong growth piggybacking of the channel support from OPPO. OnePlus compensated for OPPO’s limited online presence by using its online-centric business model to effectively tap into the segment.

• vivo and Xiaomi saw YoY declines as weak economy dampened consumer spending.

• HONOR’s share dropped significantly (YoY) partially because Huawei’s growth posted a challenge for HONOR.

• We anticipate an improvement in smartphone shipments during H2 compared to H1, a strong rebound does not seem to be on the horizon as challenges that affected the performance in H1 are likely to persist.

| Brands | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 |

|---|---|---|---|---|---|---|

| Apple | 22% | 18% | 13% | 14% | 22% | 20% |

| OPPO* | 17% | 19% | 18% | 18% | 16% | 18% |

| vivo | 16% | 17% | 20% | 20% | 18% | 16% |

| HONOR | 17% | 20% | 20% | 17% | 15% | 16% |

| Xiaomi | 16% | 15% | 17% | 13% | 12% | 12% |

| Others | 12% | 11% | 12% | 18% | 16% | 17% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

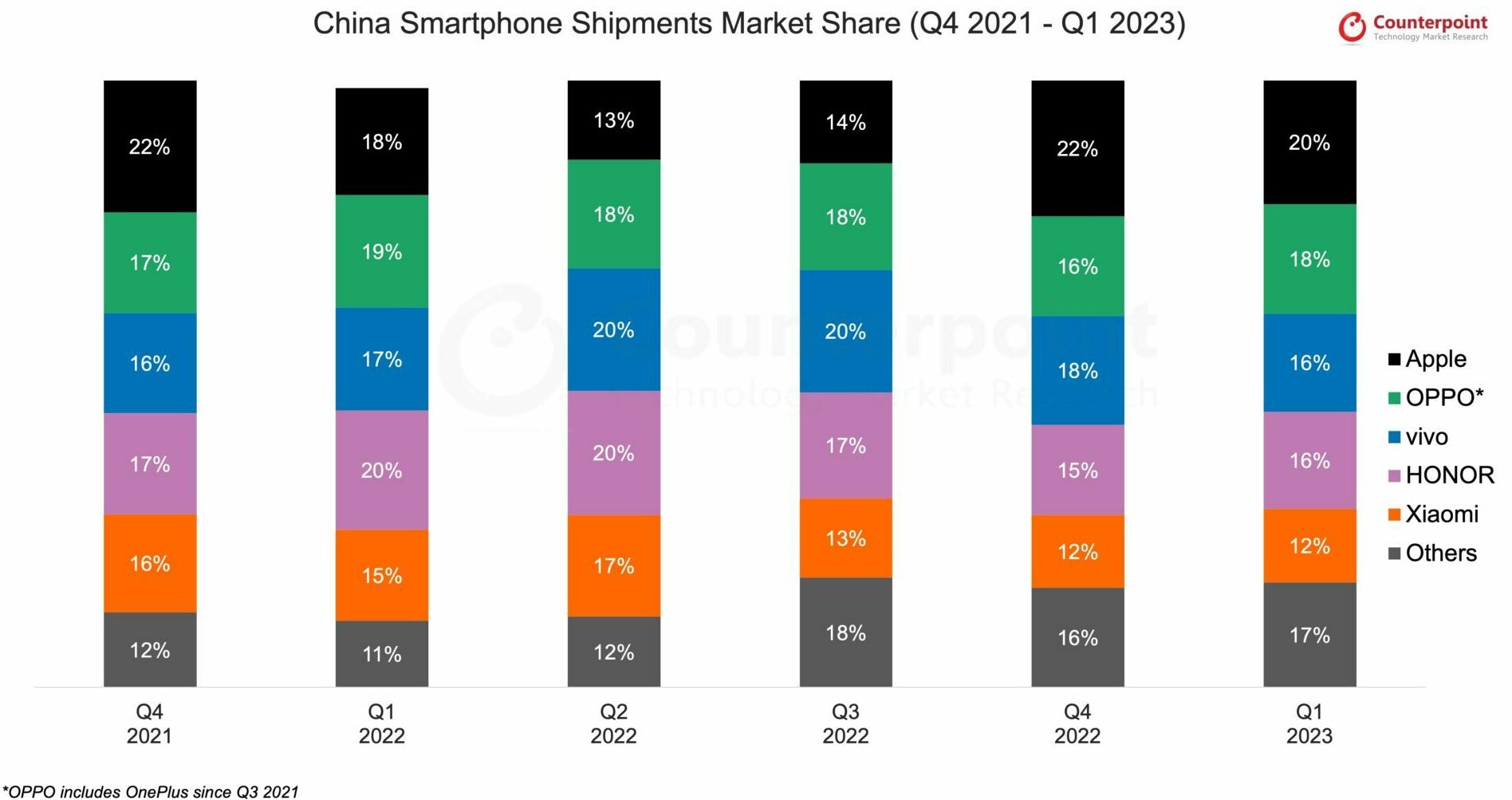

Published Date: May 16, 2023

Market Highlights

• China’s smartphone shipments declined 8% YoY in Q1 2023, reaching their lowest level since Q1 2020. However, this was an improvement from the double-digit YoY declines seen in previous quarters as well as a sign of bottoming out.

• Apple’s market share in China increased to 20% in Q1 2023 from 18% in Q1 2022. This was driven by its continued expansion in China’s premium segment with more aggressive promotion and marketing campaigns for the iPhone 14 series.

• In contrast, all the major Android OEMs saw YoY declines as demand in the mass market remained weak. OEMs remained cautious in ramping up production to manage demand carefully and avoid any unhealthy inventory build-up in the market.

• Despite this caution, we expect the market to further recover in H2 2023, as inventory pressure continues to ease and consumer sentiments improve.

For our detailed research on the China smartphone sales market share Q1 2023, click here.

| Brands | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 |

|---|---|---|---|---|---|---|

| Apple | 22% | 18% | 13% | 14% | 22% | 20% |

| OPPO* | 17% | 19% | 18% | 18% | 16% | 18% |

| vivo | 16% | 17% | 20% | 20% | 18% | 16% |

| HONOR | 17% | 20% | 20% | 17% | 15% | 16% |

| Xiaomi | 16% | 15% | 17% | 13% | 12% | 12% |

| Others | 12% | 11% | 12% | 18% | 16% | 17% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

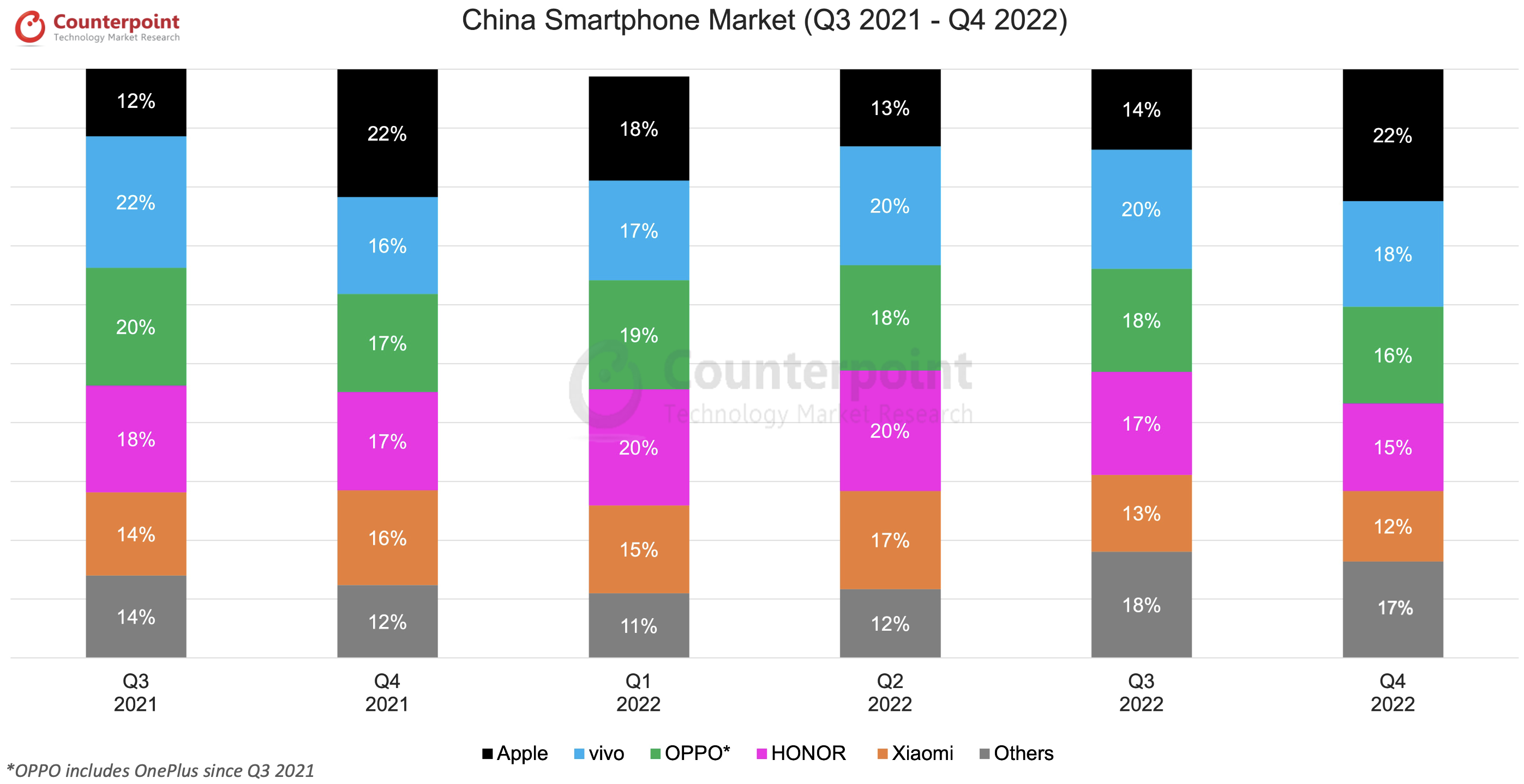

Published Date: February 18, 2023

Market Highlights

• Apple registered a QoQ growth of 67% due to the high demand for new iPhone 14 series. Apple market share in China has now reached 22% in Q4 2022.

• vivo dropped to the 2nd position as the OEM’s market share fell to 18%.

• Major Chinese phone market share (Chinese OEMs) saw YoY shipment declines due to overall market instability due frequent COVID lockdowns and weak economic conditions.

• Xiaomi retained its position in the top five even as its market share fell to its lowest in over two years. Xiaomi market share in China reached 12% in Q4 2022.

• Huawei saw a growth of 25% in it’s shipment that helped it capture 8.7% of Chinese market.

For our detailed research on the China smartphone sales market share Q4 2022, click here.

| Brands | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 |

| Apple | 12% | 22% | 18% | 13% | 14% | 22% |

| vivo | 22% | 16% | 17% | 20% | 20% | 18% |

| OPPO* | 20% | 17% | 19% | 18% | 18% | 16% |

| HONOR | 18% | 17% | 20% | 20% | 17% | 15% |

| Xiaomi | 14% | 16% | 15% | 17% | 13% | 12% |

| Others | 14% | 12% | 11% | 12% | 18% | 17% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

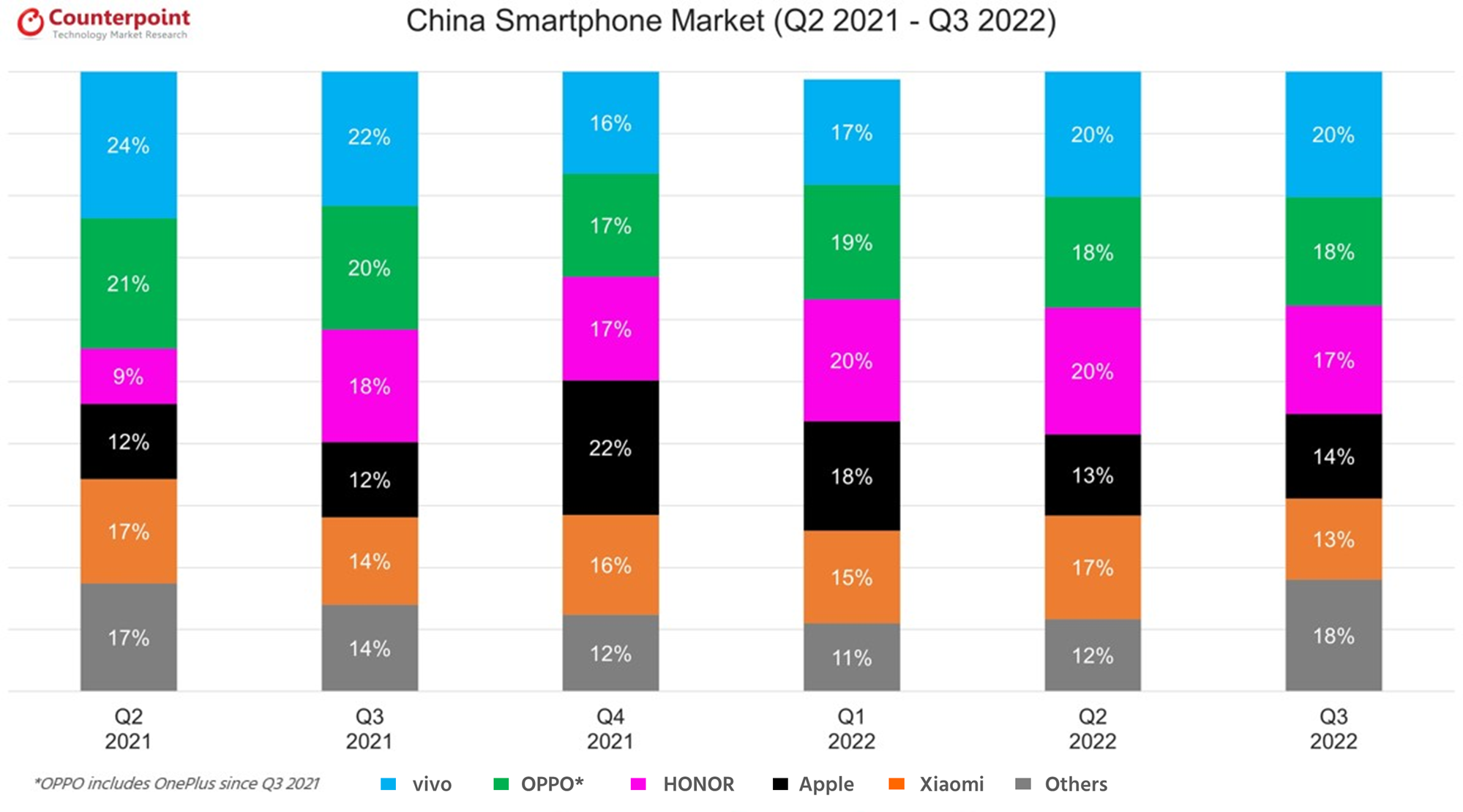

Published Date: December 20, 2022

Market Highlights

• Apple was the only major OEM in China to see a YoY increase mainly driven by strong demand for the iPhone 14 Pro models.

• Other major Chinese OEMs saw YoY sales declines due to overall market plunge resulting from frequent COVID lockdowns and weak economic environment.

• Despite sales declines compared to last year, vivo, OPPO and HONOR remained the top 3 brands in China, while Xiaomi dropped one rank to reach 5th place.

• Although facing sanctions, Huawei also saw a YoY increase due to strong demand for its mid-end Nova 10 and premium foldable smartphones.

For our detailed research on the China smartphone sales market share Q3 2022, click here.

| Brands | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 |

| vivo | 24% | 22% | 16% | 17% | 20% | 20% |

| OPPO* | 21% | 20% | 17% | 19% | 18% | 18% |

| HONOR | 9% | 18% | 17% | 20% | 20% | 17% |

| Apple | 12% | 12% | 22% | 18% | 13% | 14% |

| Xiaomi | 17% | 14% | 16% | 15% | 17% | 13% |

| Others | 17% | 14% | 12% | 11% | 12% | 18% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

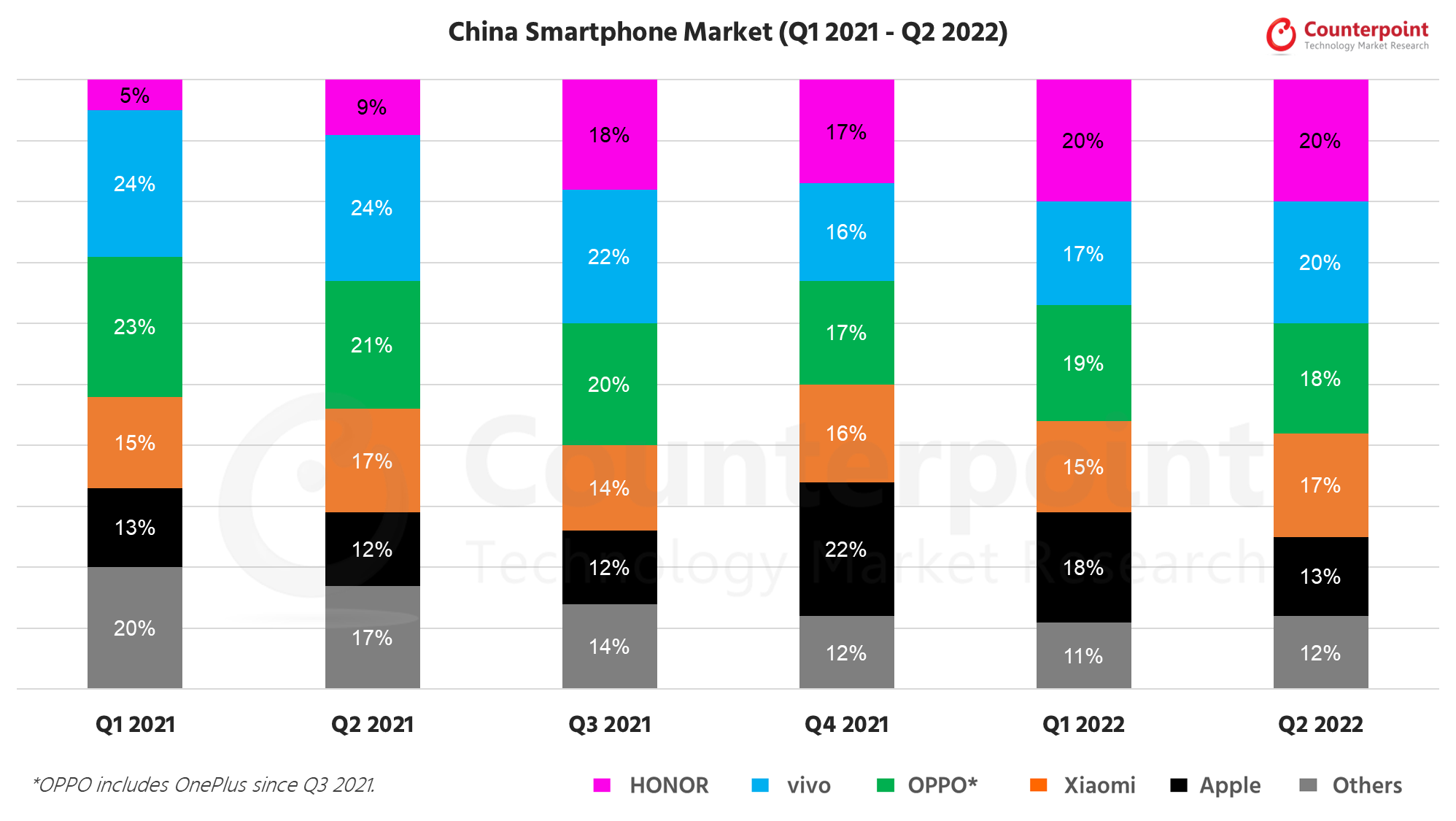

Published Date: August 15, 2022

Market Highlights

• Huge smartphone market share gains were made by HONOR in Q2 2022 as the OEM capitalized on strength in the premium market

• iPhone market share continued to eke upwards, with Apple doing extremely well in the ultra-premium segment

Click here to read about the China smartphone sales market in Q2 2022.

| Brands | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 |

| HONOR | 5% | 9% | 18% | 17% | 20% | 20% |

| vivo | 24% | 24% | 22% | 16% | 17% | 20% |

| OPPO* | 23% | 21% | 20% | 17% | 19% | 18% |

| Xiaomi | 15% | 17% | 14% | 16% | 15% | 17% |

| Apple | 13% | 12% | 12% | 22% | 18% | 13% |

| Others | 20% | 17% | 14% | 12% | 11% | 12% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

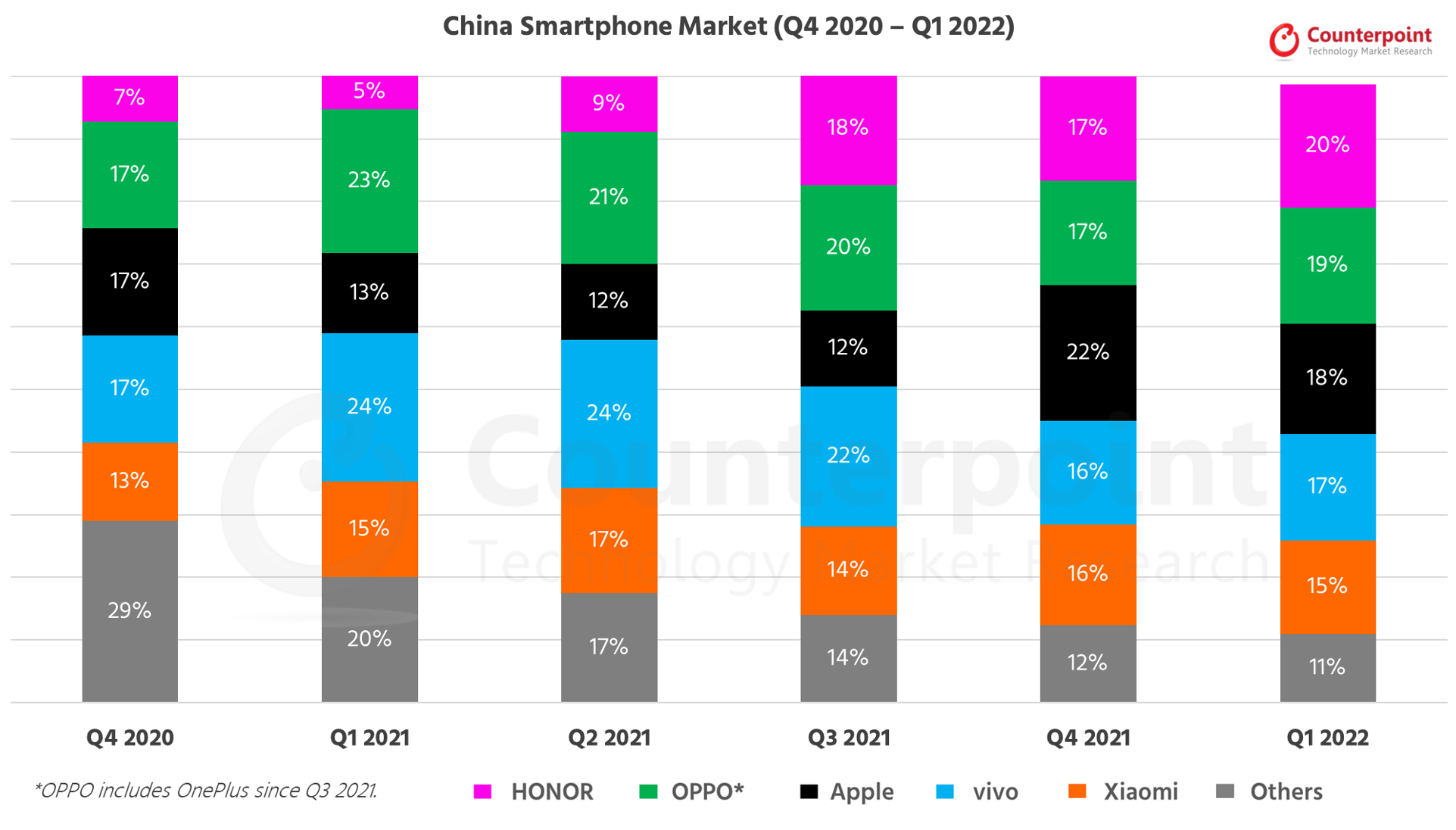

Published Date: May 15, 2022

Market Highlights

• In 2022 Q1, China smartphone shipments declined 19% YoY and 12% QoQ to reach 73.7 million units.

• HONOR continued to outperform the market with shipment growing 190% YoY and 4% QoQ in Q1 2022. HONOR led the market during this quarter and captured 20% market share.

• OPPO (including Oneplus) held the second spot with 13.7 million units in Q1 2022.

• Apple slipped to the third spot with 13 million units in Q1 2022. Although Apple’s shipment fell compared to Q4 2021, Apple still registered 11% YoY growth driven by strong demand for iPhone 13 series.

• Dropping to the fourth spot, vivo declined 42%YoY and 9% QoQ to 12.5 million units in Q1 2022. Q1 2022 was its worst performing quarter since the severe pandemic-hit Q1 2020.

Click here to read about the China smartphone market in Q1 2022.

| Brands | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 |

| HONOR | 7% | 5% | 9% | 18% | 17% | 20% |

| OPPO* | 17% | 23% | 21% | 20% | 17% | 19% |

| Apple | 17% | 13% | 12% | 12% | 22% | 18% |

| vivo | 17% | 24% | 24% | 22% | 16% | 17% |

| Xiaomi | 13% | 15% | 17% | 14% | 16% | 15% |

| Others | 29% | 20% | 17% | 14% | 12% | 11% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

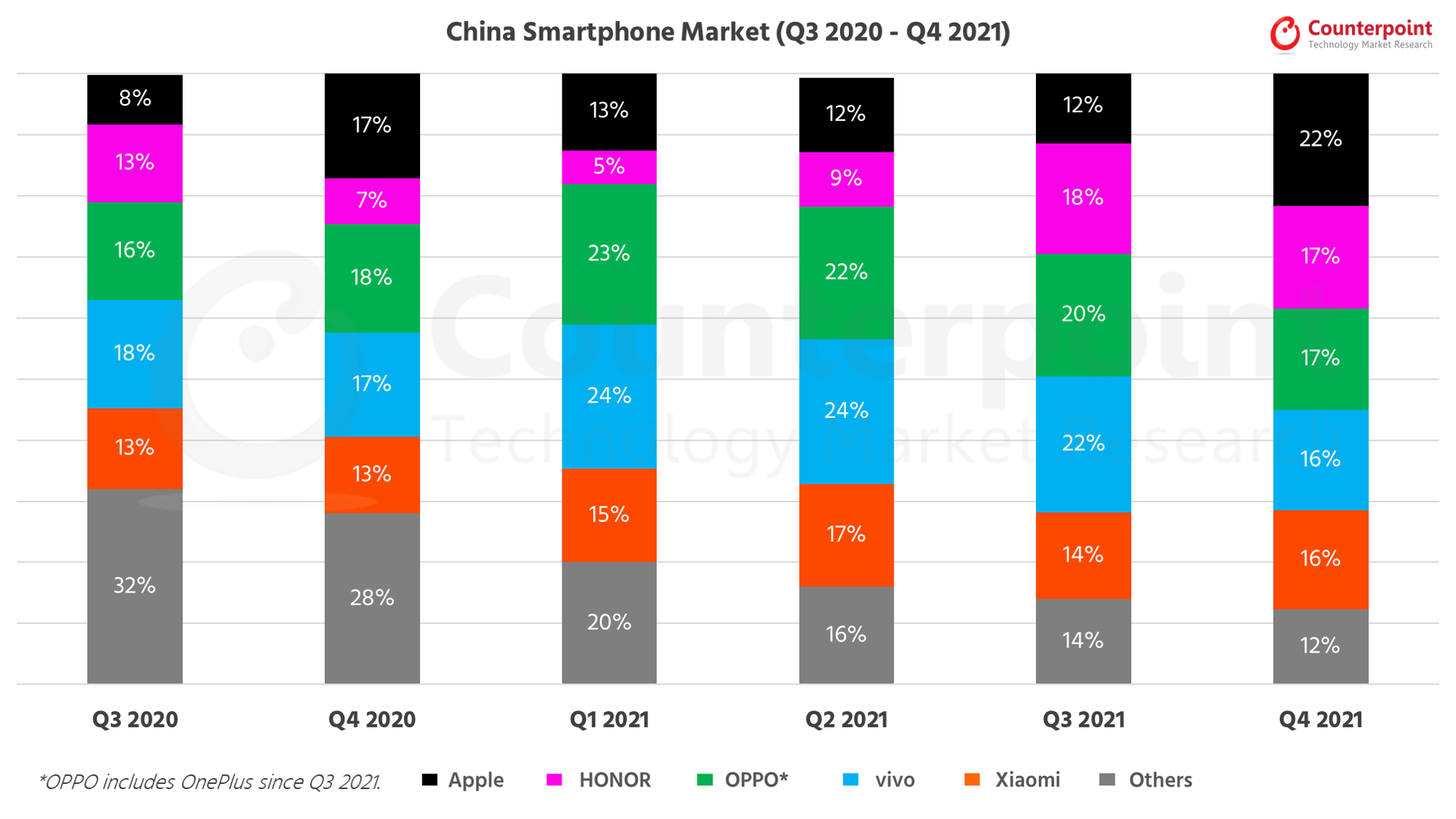

Published Date: February 15, 2022

Market Highlights

• China smartphone shipments declined 11% YoY to reach 84 million units. However, the market increased 9% QoQ in Q4 2021.

• Apple’s 13% YoY and 95% QoQ growth helped it lead the China market, capturing 22% market share in Q4 2021.

• For the first time, HONOR reached the second spot after becoming an independent brand. It grew 100% YoY to reach 14 million units.

• vivo slipped to the fourth spot with ~14 million units in Q4 2021, However, it led the overall China smartphone market in CY 2021.

Click here to read about the China smartphone market in Q4 2021.

| Brands | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 |

| Apple | 8% | 17% | 13% | 12% | 12% | 22% |

| HONOR | 13% | 7% | 5% | 9% | 18% | 17% |

| OPPO* | 16% | 18% | 23% | 22% | 20% | 17% |

| vivo | 18% | 17% | 24% | 24% | 22% | 16% |

| Xiaomi | 13% | 13% | 15% | 17% | 14% | 16% |

| Others | 32% | 28% | 20% | 16% | 14% | 12% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

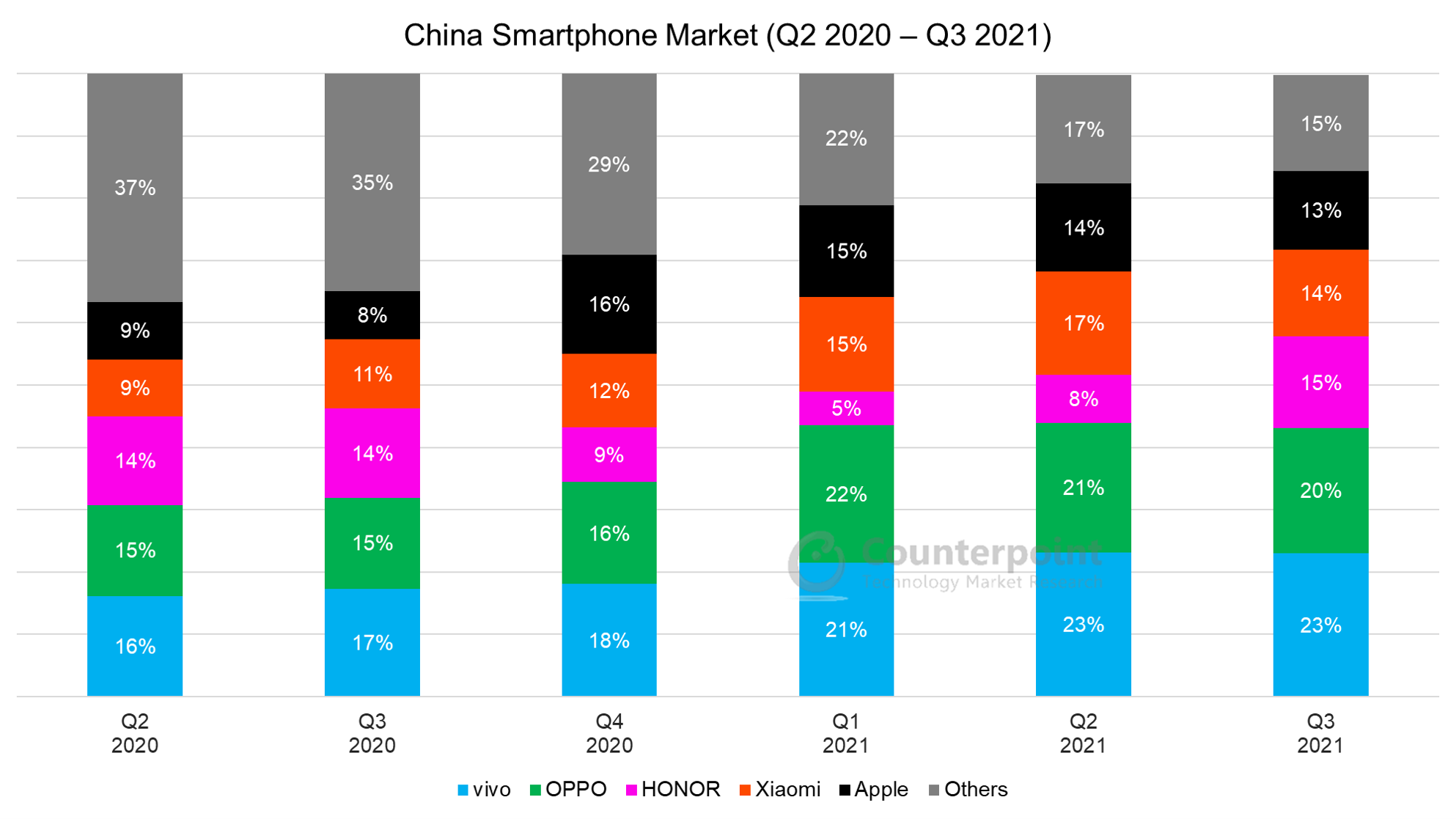

Published Date: November 15, 2021

Market Highlights

• Smartphone sales in China increased 3% QoQ but declined 9% YoY in Q3 2021.

• vivo led the market in Q3 2021, capturing a 23% share, followed by OPPO (20%) and HONOR (15%).

• HONOR was the fastest-growing OEM (96% QoQ) in China during the quarter.

• China’s 5G smartphone sales accounted for 79% of total smartphone sales in Q3 2021.

| Brands | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 |

| vivo | 16% | 17% | 18% | 21% | 23% | 23% |

| OPPO | 15% | 15% | 16% | 22% | 21% | 20% |

| HONOR | 14% | 14% | 9% | 5% | 8% | 15% |

| Xiaomi | 9% | 11% | 12% | 15% | 17% | 14% |

| Apple | 9% | 8% | 16% | 15% | 14% | 13% |

| Others | 37% | 35% | 29% | 22% | 17% | 15% |

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

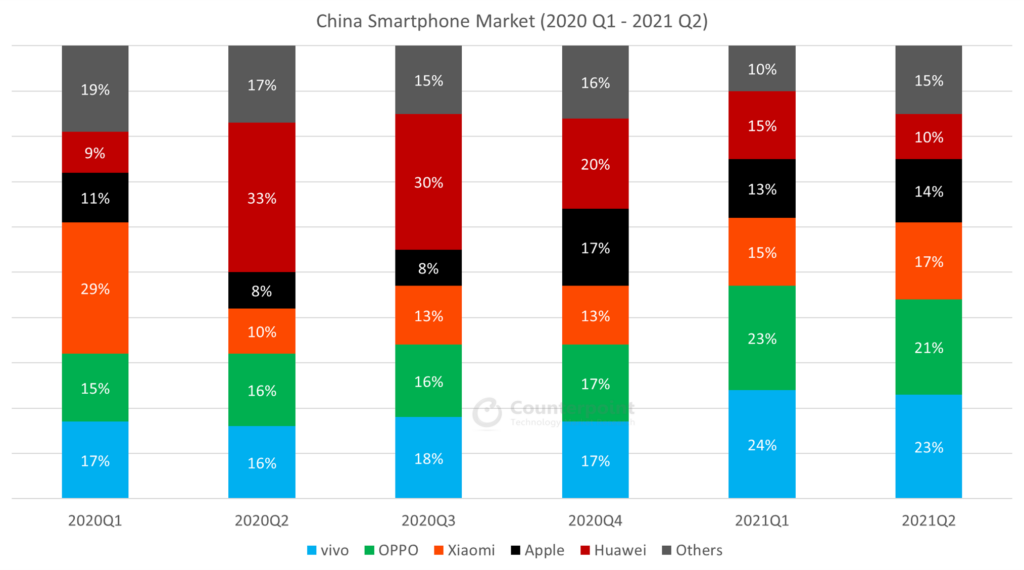

Published Date: August 15, 2021

Market Highlights

• Smartphone sales in China declined 13% QoQ and 6% YoY in Q2 2021.

• vivo led the market in Q2 2021, capturing a 23% share, followed by OPPO (21%) and Xiaomi (17%).

• Xiaomi was the fastest-growing OEM (70% YoY) in China, followed by Apple (43%) and OPPO (37%).

| Brands | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 |

| vivo | 17% | 16% | 18% | 17% | 24% | 23% |

| OPPO | 15% | 16% | 16% | 17% | 23% | 21% |

| Xiaomi | 29% | 10% | 13% | 13% | 15% | 17% |

| Apple | 11% | 8% | 8% | 17% | 13% | 14% |

| Huawei | 9% | 33% | 30% | 20% | 15% | 10% |

| Others | 19% | 17% | 15% | 16% | 10% | 15% |

#Huawei includes HONOR.

*Ranking is according to the latest quarter.

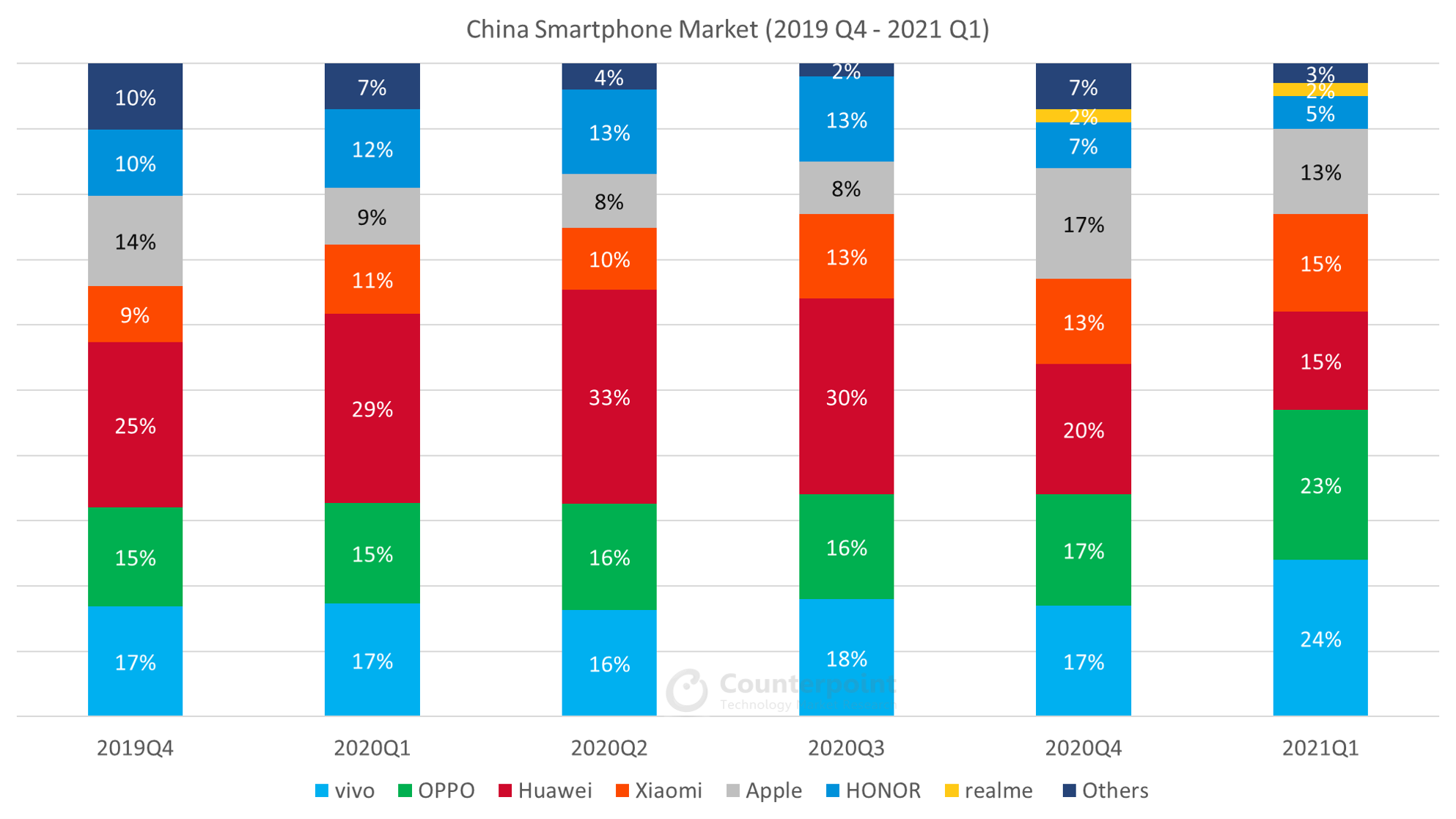

Published Date: May 15, 2021

Market Highlights

• Smartphone shipment growth in China turned positive in Q1 2021.

• Smartphone shipments grew 36% compared to last year’s COVID-impacted first quarter to register 90.7mn shipments.

• The quarter marked the inevitable succession of Huawei’s leadership, as the beleaguered handset maker struggled to maintain shipments.

• vivo and OPPO emerged as clear leaders, accounting for nearly half of all smartphones shipped during the period.

| Brands | 2019Q4 | 2020Q1 | 2020Q2 | 2020Q3 | 2020Q4 | 2021Q1 |

| vivo | 17% | 17% | 16% | 18% | 17% | 24% |

| OPPO | 15% | 15% | 16% | 16% | 17% | 23% |

| Huawei | 25% | 29% | 33% | 30% | 20% | 15% |

| Xiaomi | 9% | 11% | 10% | 13% | 13% | 15% |

| Apple | 14% | 9% | 8% | 8% | 17% | 13% |

| HONOR | 10% | 12% | 13% | 13% | 7% | 5% |

| realme | 0% | 0% | 0% | 0% | 2% | 2% |

| Others | 10% | 7% | 4% | 2% | 7% | 3% |

#Huawei includes HONOR.

*Ranking is according to the latest quarter.

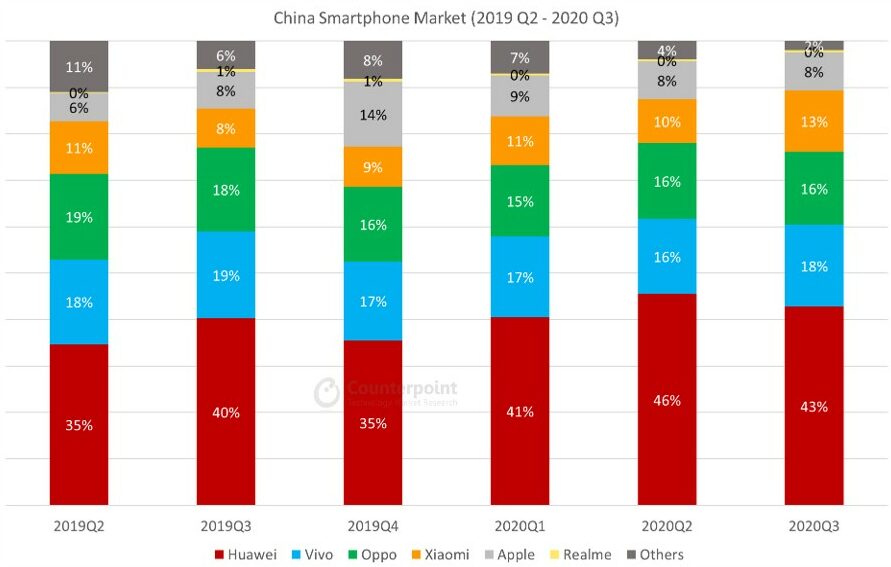

Published Date: February 15, 2021

Market Highlights

• China’s smartphone market declined 17% YoY in 2020.

• China’s 5G smartphone sales accounted for more than 60% of total smartphone sales in Q4 2020.

• Huawei and HONOR combined took the top spot in the market, capturing 41% share in 2020.

• Apple was the only brand to witness a positive YoY growth in the market in 2020.

| Brands | 2019Q3 | 2019Q4 | 2020Q1 | 2020Q2 | 2020Q3 | 2020Q4 |

| Huawei# | 40% | 35% | 41% | 46% | 43% | 30% |

| vivo | 19% | 17% | 17% | 16% | 18% | 18% |

| Oppo | 18% | 16% | 15% | 16% | 16% | 16% |

| Xiaomi | 8% | 9% | 11% | 10% | 13% | 13% |

| Apple | 8% | 14% | 9% | 8% | 8% | 8% |

| realme | 0% | 0% | 0% | 0% | 0% | 2% |

| Others | 6% | 9% | 6% | 4% | 2% | 13% |

#Huawei includes HONOR

*Ranking is according to the latest quarter.

Market Highlights

• Smartphone sales in China recovered slowly with 6% QoQ growth in Q3. But the growth was still down 14% YoY.

• Xiaomi outperformed the market as the only major OEM to achieve a positive YoY growth in Q3 in China.

• Huawei continued to lead the market with 45% share in Q3 (in smartphone sales). However, its sales have started to decline.

| Brands | 2019

Q2 | 2019

Q3 | 2019

Q4 | 2020

Q1 | 2020

Q2 | 2020

Q3 |

| Huawei# | 35% | 40% | 35% | 41% | 46% | 43% |

| Vivo | 18% | 19% | 17% | 17% | 16% | 18% |

| Oppo | 19% | 18% | 16% | 15% | 16% | 16% |

| Xiaomi | 11% | 8% | 9% | 11% | 10% | 13% |

| Apple | 6% | 8% | 14% | 9% | 8% | 8% |

| Realme | 0% | 1% | 1% | 0% | 0% | 0% |

| Others | 11% | 6% | 8% | 7% | 4% | 2% |

#Huawei includes HONOR

*Ranking is according to the latest quarter.

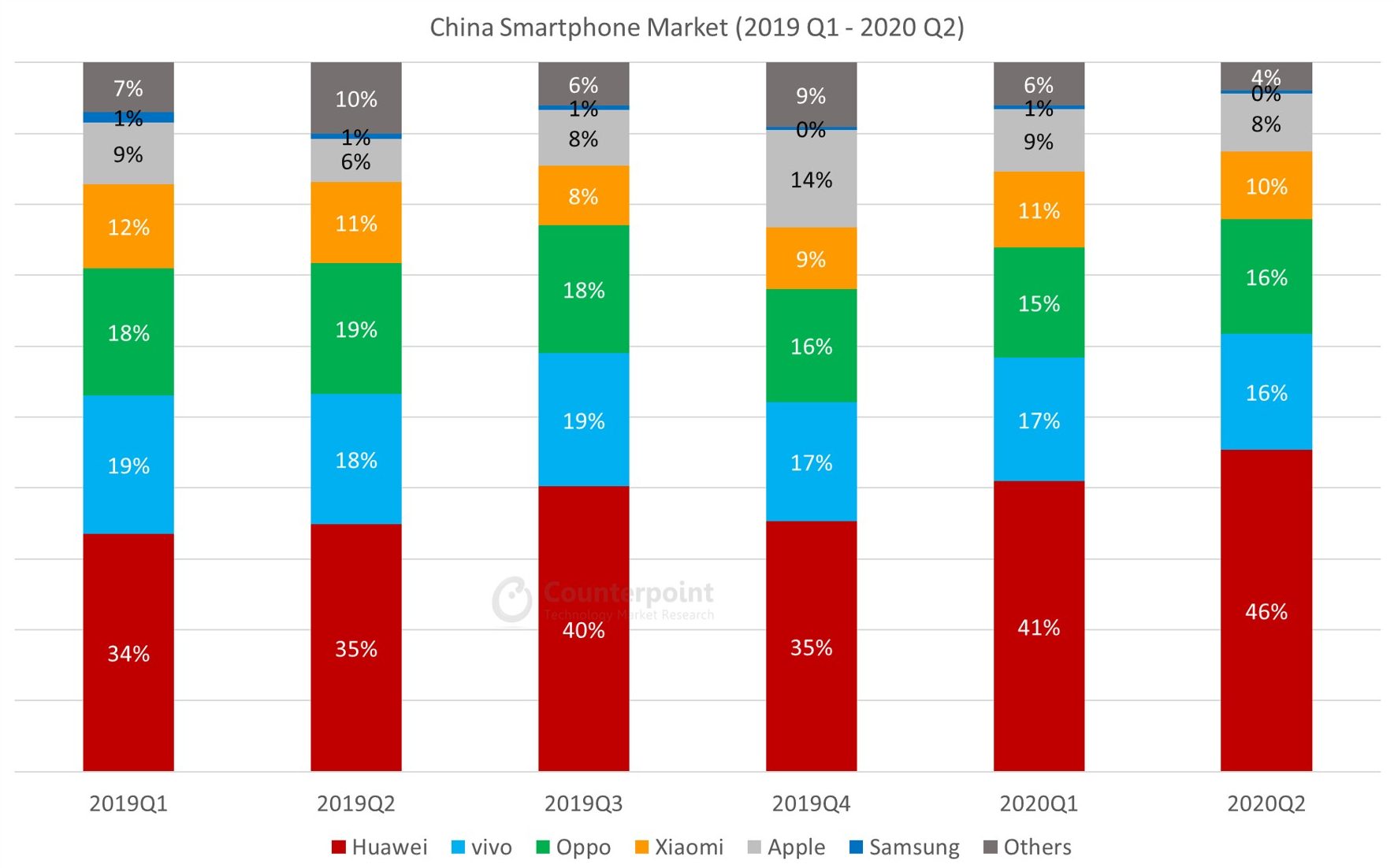

Market Highlights

• Smartphone sales in China declined 17% YoY in Q2 2020. However, the sales increased 9% QoQ indicating some signs of recovery.

• Huawei captured a massive 60% share of the 5G smartphone market.

• Huawei reached its highest ever share in China capturing 46% of sales volumes.

• Apple was the fastest-growing OEM (32% YoY) during the quarter.

| Brands | 2019 Q1 | 2019 Q2 | 2019 Q3 | 2019 Q4 | 2020 Q1 | 2020 Q2 |

| Huawei# | 34% | 35% | 40% | 35% | 41% | 46% |

| vivo | 19% | 18% | 19% | 17% | 17% | 16% |

| Oppo | 18% | 19% | 18% | 16% | 15% | 16% |

| Xiaomi | 12% | 11% | 8% | 9% | 11% | 10% |

| Apple | 9% | 6% | 8% | 14% | 9% | 8% |

| Samsung | 1% | 1% | 1% | 0% | 1% | 0% |

| Others | 7% | 10% | 6% | 9% | 6% | 4% |

#Huawei includes HONOR

*Ranking is according to the latest quarter.

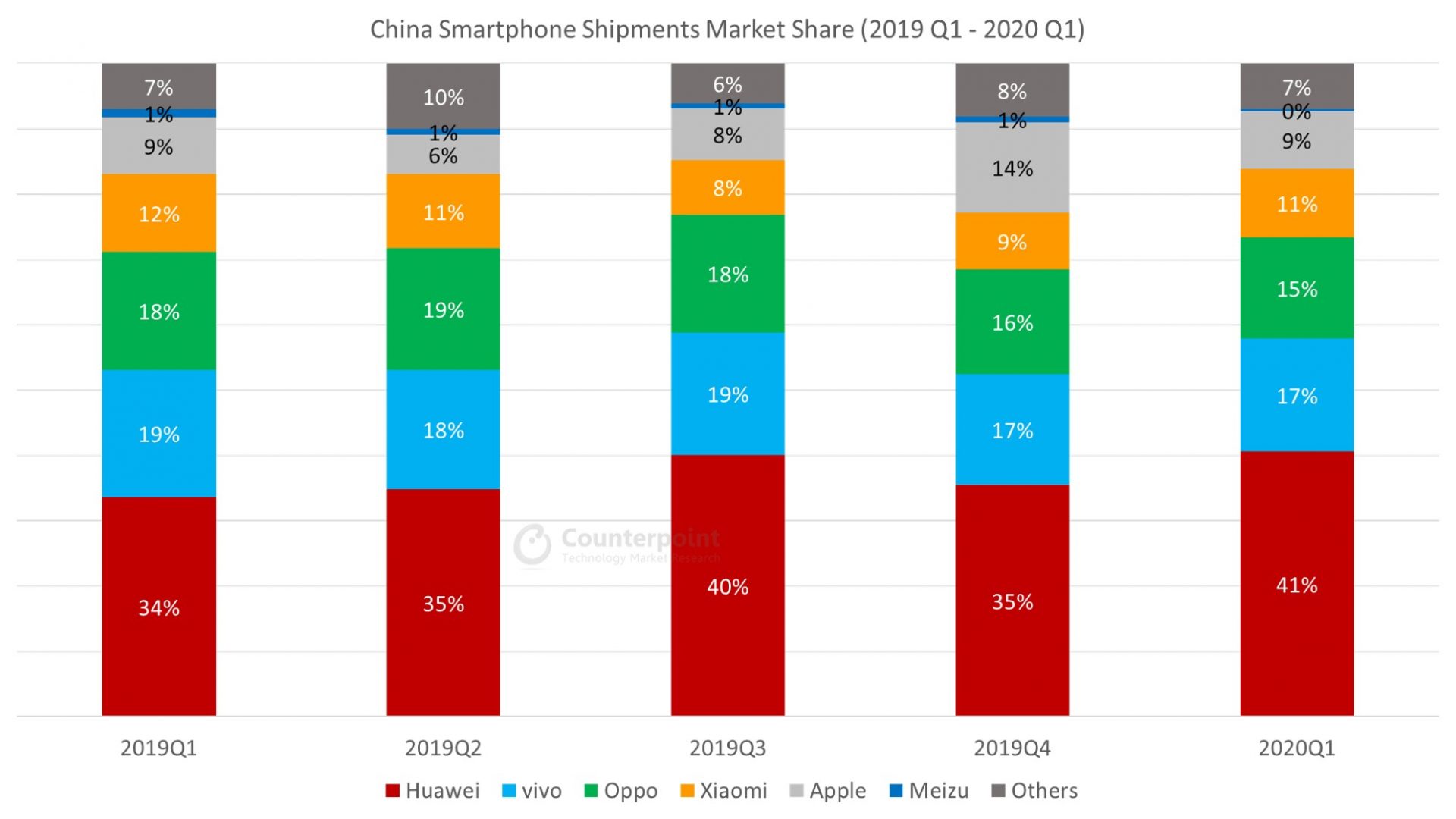

Market Highlights

• China’s Smartphone sales fell by 22% YoY (Year-on-Year) in Q1 2020.

• Except for Huawei, all major OEMs underwent YoY decline.

• However,5G smartphone sales grew sequentially by about 120%. 5G smartphones now capture over 15% of the total smartphone sales.

• Apple and Huawei group, managed to increase market share from the same period last year, clearly out-performing the overall market in Q1 2020

| Brands | 2019 Q1 | 2019 Q2 | 2019 Q3 | 2019 Q4 | 2020 Q1 |

| Huawei# | 34% | 35% | 40% | 35% | 41% |

| vivo | 19% | 18% | 19% | 17% | 17% |

| Oppo | 18% | 19% | 18% | 16% | 15% |

| Xiaomi | 12% | 11% | 8% | 9% | 11% |

| Apple | 9% | 6% | 8% | 14% | 9% |

| Meizu | 1% | 1% | 1% | 1% | 0% |

| Others | 7% | 10% | 6% | 8% | 7% |

#Huawei includes HONOR

*Ranking is according to the latest quarter.

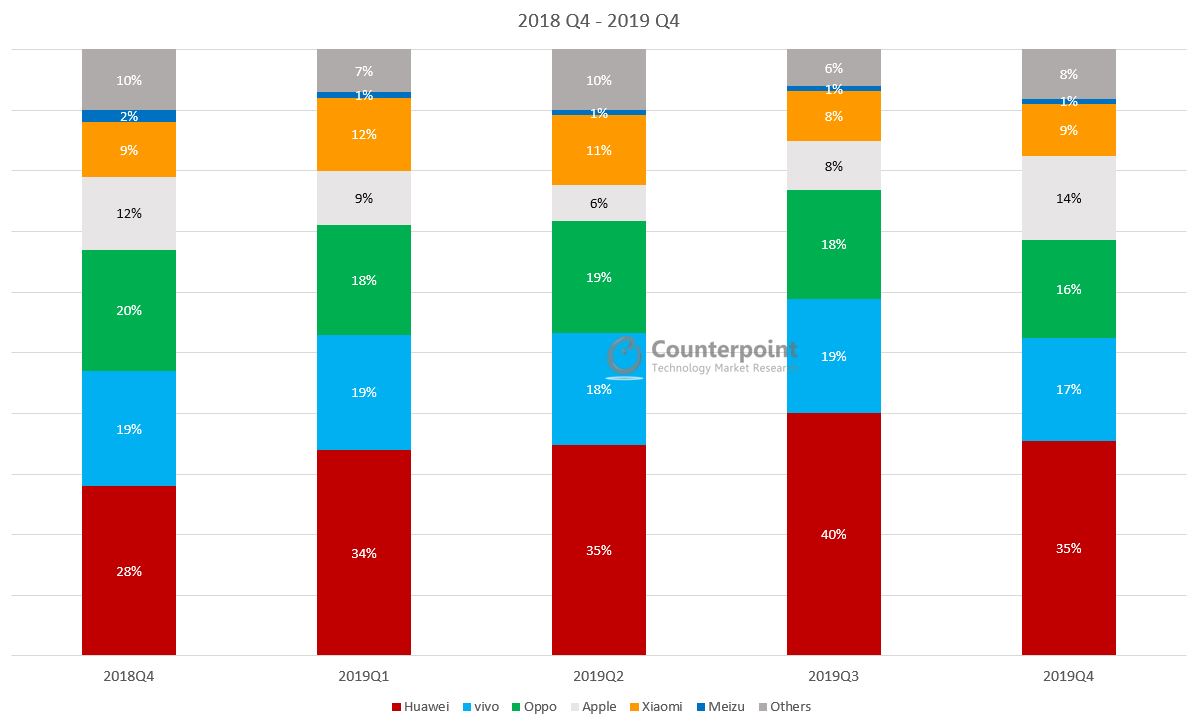

Market Highlights

• China’s smartphone market declined for the 10th consecutive quarter in Q4 2019. The decline is expected to continue in the coming quarters due to the impact of nCoV.

• Top 5 OEMs captured 90% of the total market during the quarter as compared to 87% a year ago. This is an indication of the ongoing consolidation in the market.

• Huawei (including HONOR) leads the Chinese smartphone market capturing over one-third of the total smartphone shipments. The OEM has concentrated its efforts in the home market post the trade ban which helped it grow 12% YoY in the region. China now contributes to 60% of the global shipments for Huawei.

• OPPO (19% YoY), vivo (11% YoY) and Xiaomi (8% YoY) all declined during the quarter. Amidst the declining home market, the OEMs have been expanding overseas to attain growth.

• Apple grew 6% YoY driven by the popularity of the iPhone 11 series, which was the first iPhone with dual cameras and launched at a price lesser than its predecessor.

• China led the global 5G market contributing to over 67% of the total 5G shipments in 2019 Q4. This was driven by Huawei (including HONOR), which alone shipped over 6 million 5G devices in the region during the quarter.

| Brands | 2018

Q4 | 2019

Q1 | 2019

Q2 | 2019

Q3 | 2019

Q4 |

| Huawei# | 28% | 34% | 35% | 40% | 35% |

| vivo | 19% | 19% | 18% | 19% | 17% |

| Oppo | 20% | 18% | 19% | 18% | 16% |

| Apple | 12% | 9% | 6% | 8% | 14% |

| Xiaomi | 9% | 12% | 11% | 8% | 9% |

| Meizu | 2% | 1% | 1% | 1% | 1% |

| Others | 10% | 7% | 10% | 6% | 8% |

#Huawei includes HONOR

*Ranking is according to the latest quarter.

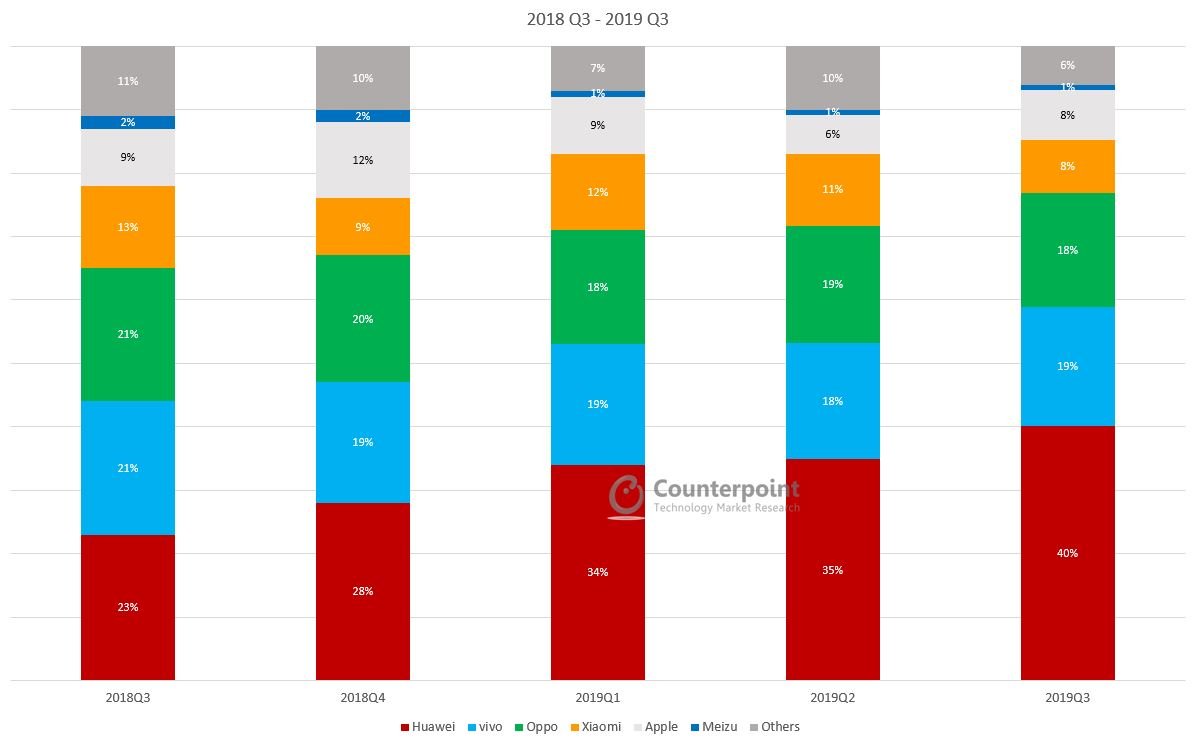

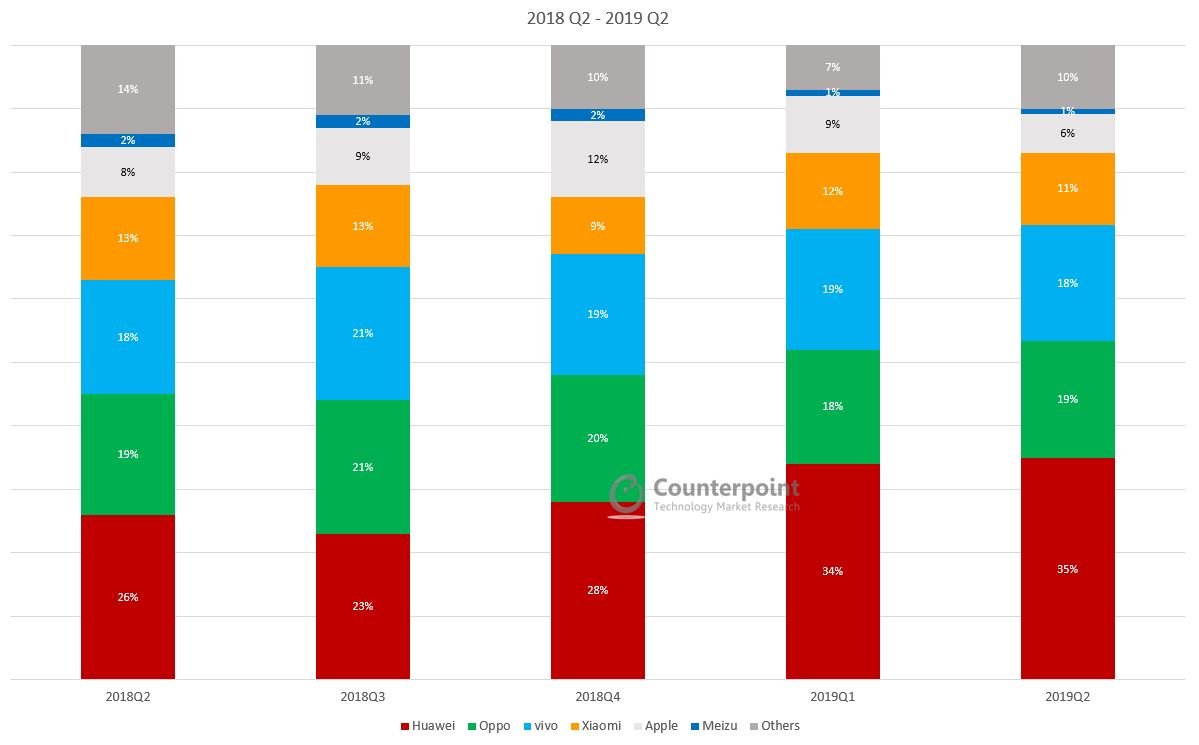

Market Highlights

• Huawei (including the HONOR brand) leads the Chinese smartphone market with its market share growing to 40%, a record high. Huawei’s total shipments in Q3 reached 41.5 million units.

• For Vivo, the X27, Y93, and Y3 series were the highlights in terms of contribution to sales. While for OPPO, the A9 shipped nearly five million units in the third quarter, making it the best-selling model of the quarter according to our model sales tracker.

• Xiaomi sales continued to decline 38% YoY with the onslaught from Honor brand on one side, and Oppo A-series and Vivo Y-series on the other.

• Apple‘s iPhone sales were down 14% YoY. However, Apple’s price corrections with iPhone 11 and XR as well as introducing a new palette of colors, have stimulated demand during the last week of September offsetting the sharp annual decline during July and August.

| Brands | 2018

Q3 | 2018

Q4 | 2019

Q1 | 2019

Q2 | 2019

Q3 |

| Huawei# | 23% | 28% | 34% | 35% | 40% |

| vivo | 21% | 19% | 19% | 18% | 19% |

| Oppo | 21% | 20% | 18% | 19% | 18% |

| Xiaomi | 13% | 9% | 12% | 11% | 8% |

| Apple | 9% | 12% | 9% | 6% | 8% |

| Meizu | 2% | 2% | 1% | 1% | 1% |

| Others | 11% | 10% | 7% | 10% | 6% |

#Huawei includes HONOR

*Ranking is according to the latest quarter.

Market Highlights

• Huawei (including the HONOR brand) leads the Chinese smartphone market with its market share growing to 36%, reaching a record high.

• Overall, with almost 19% market share for both OPPO and Vivo, the brands became the second and third largest brands in China, respectively.

• Xiaomi is still in the recovery stage in Q2 when compared to last year but increased 8% QoQ.

• Apple‘s iPhones shipped less than six million, with a 6% market share, the lowest level in a year.

| Brands | 2018

Q2 | 2018

Q3 | 2018

Q4 | 2019

Q1 | 2019

Q2 |

| Huawei# | 26% | 23% | 28% | 34% | 35% |

| Oppo | 18% | 21% | 19% | 18% | 19% |

| vivo | 19% | 21% | 20% | 19% | 18% |

| Xiaomi | 13% | 13% | 9% | 12% | 11% |

| Apple | 8% | 9% | 12% | 9% | 6% |

| Meizu | 2% | 2% | 2% | 1% | 1% |

| Others | 14% | 11% | 10% | 7% | 10% |

#Huawei includes HONOR

*Ranking is according to the latest quarter.

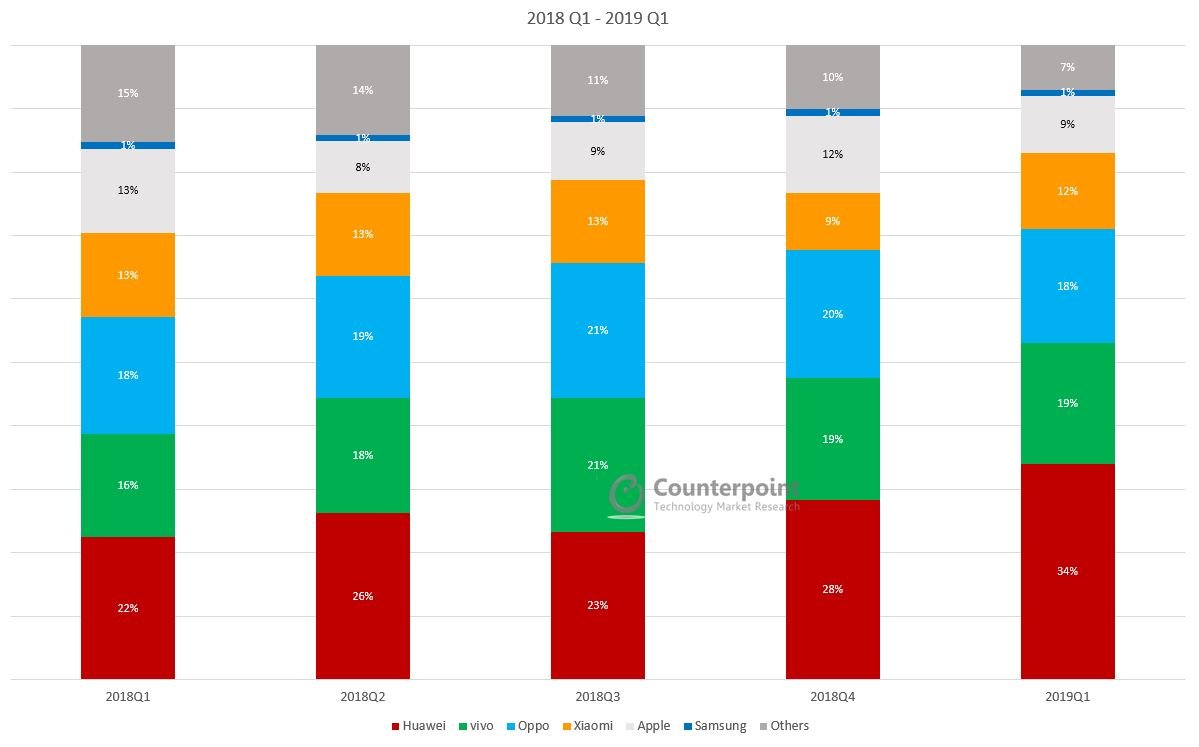

Market Highlights

• As the largest smartphone market in the world, the start of 2019 continues the sluggishness from H2 2018.

• The sustained decline can be attributed to the overall economic downturn in China which has resulted in consumers’ prolonged replacement cycles for smartphones.

• Consumer demand continues to remain divided. While some are delaying smartphone upgrades others are buying other electronic products to satisfy their desire for freshness.

• In addition, other factors affecting sales in Q1 2019 includes the lack of new product launches.

| Brands | 2018

Q1 | 2018

Q2 | 2018

Q3 | 2018

Q4 | 2019 Q1 |

| Huawei# | 22% | 26% | 23% | 28% | 34% |

| vivo | 16% | 18% | 21% | 19% | 19% |

| Oppo | 18% | 19% | 21% | 20% | 18% |

| Xiaomi | 13% | 13% | 13% | 9% | 12% |

| Apple | 13% | 8% | 9% | 12% | 9% |

| Samsung | 1% | 1% | 1% | 1% | 1% |

| Others | 15% | 14% | 11% | 10% | 7% |

#Huawei includes HONOR

*Ranking is according to the latest quarter.

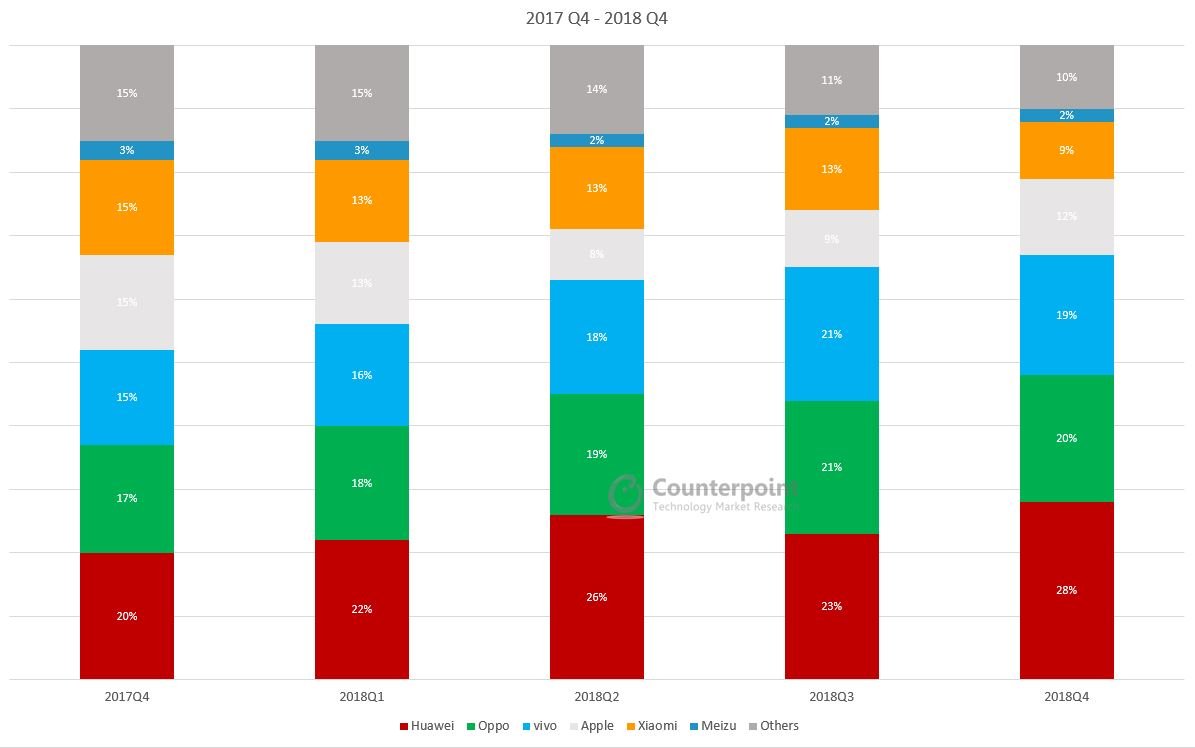

Market Highlights

• Huawei (including Honor) was firmly the market leader in China in 2018, capturing 25% market share. We saw outstanding contributions from the Nova series in 2018.

• OPPO and vivo’s market share did not change much compared to 2017, but their sales have declined slightly.

• Apple’s volume dropped 12% YoY due to its high-ticket price and impact from competitors. But it still has the highest sales revenue among all brands.

| China Smartphone Share (%) | 2017Q4 | 2018Q1 | 2018Q2 | 2018Q3 | 2018Q4 |

| Huawei | 20% | 22% | 26% | 23% | 28% |

| Oppo | 17% | 18% | 19% | 21% | 20% |

| vivo | 15% | 16% | 18% | 21% | 19% |

| Apple | 15% | 13% | 8% | 9% | 12% |

| Xiaomi | 15% | 13% | 13% | 13% | 9% |

| Meizu | 3% | 3% | 2% | 2% | 2% |

| Others | 15% | 15% | 14% | 11% | 10% |

*Ranking is according to the latest quarter.

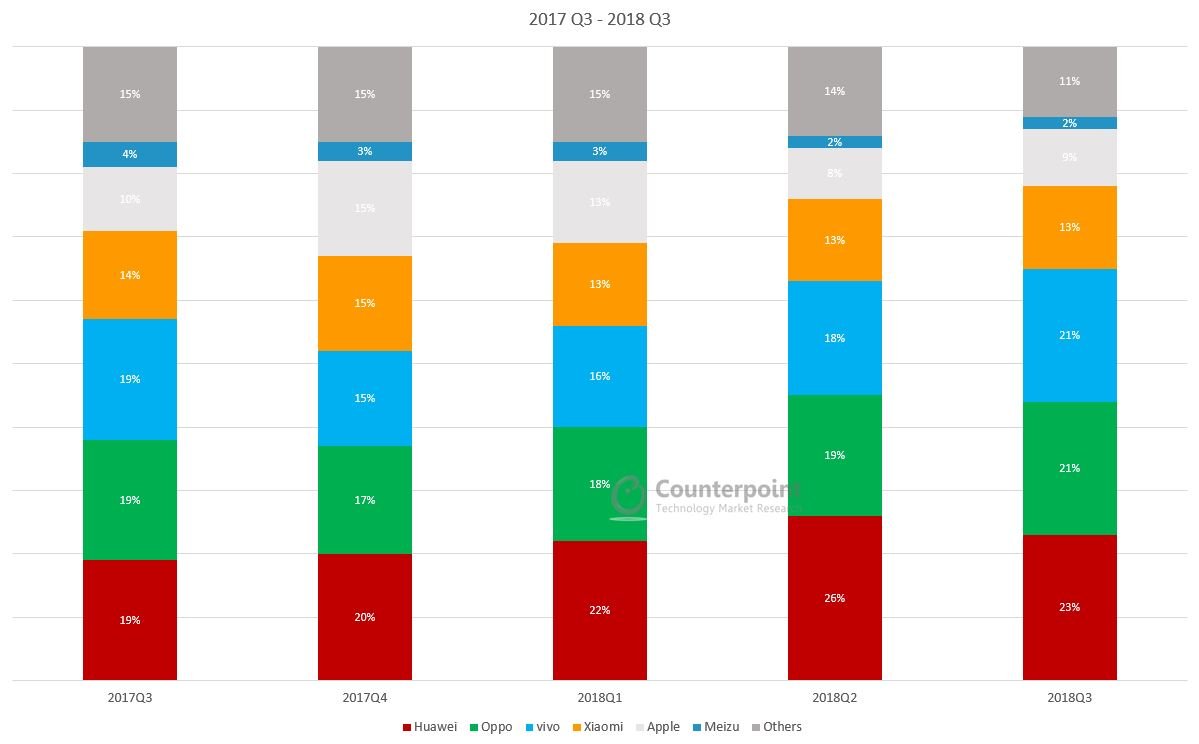

Market Highlights

• Market consolidation is apparent in China, with the top five OEMs capturing 86% of smartphone share in Q3, increasing from less than 80% in the same period last year.

• Huawei (including Honor) was the market leader in terms of both sales volume and growth momentum in Q3, with its leadership position fixed in China, capturing 23% market share.

• vivo with 4% YoY growth was the second best-selling brand in Q3 capturing 21% market share.

| Brands | 2017Q3 | 2017Q4 | 2018Q1 | 2018Q2 | 2018Q3 |

| Huawei | 19% | 20% | 22% | 26% | 23% |

| Oppo | 19% | 17% | 18% | 19% | 21% |

| vivo | 19% | 15% | 16% | 18% | 21% |

| Xiaomi | 14% | 15% | 13% | 13% | 13% |

| Apple | 10% | 15% | 13% | 8% | 9% |

| Meizu | 4% | 3% | 3% | 2% | 2% |

| Others | 15% | 15% | 15% | 14% | 11% |

*Ranking is according to the latest quarter.

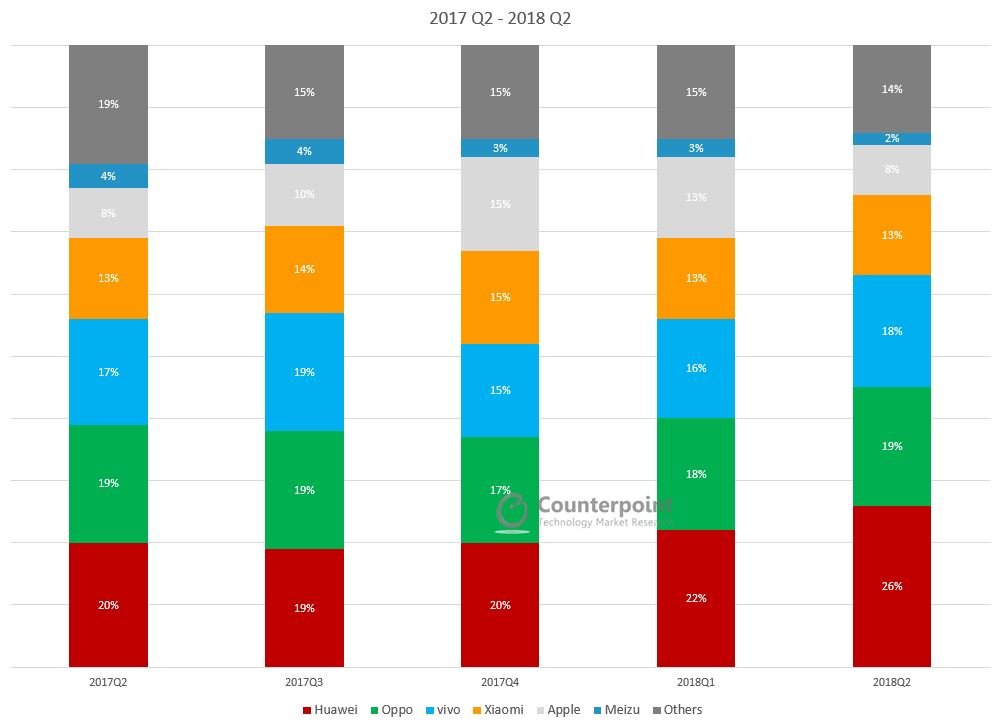

Market Highlights

• OPPO and Vivo secured one spot each on the bestselling models list with their flagships, the R15 and the X21.

• Apple iPhone X continue to surpass iPhone 8 sales in China due to decline in price and offers running during the quarter.

• Honor 7C was the fifth best selling model during the quarter. One of the key reasons for the success of Honor 7C was its aggressive pricing (RMB 1100) & sales during 618 festival.

| Brands | 2017Q2 | 2017Q3 | 2017Q4 | 2018Q1 | 2018Q2 |

| Huawei | 20% | 19% | 20% | 22% | 26% |

| Oppo | 19% | 19% | 17% | 18% | 19% |

| vivo | 17% | 19% | 15% | 16% | 18% |

| Xiaomi | 13% | 14% | 15% | 13% | 13% |

| Apple | 8% | 10% | 15% | 13% | 8% |

| Meizu | 4% | 4% | 3% | 3% | 2% |

| Others | 19% | 15% | 15% | 15% | 14% |

*Ranking is according to the latest quarter.

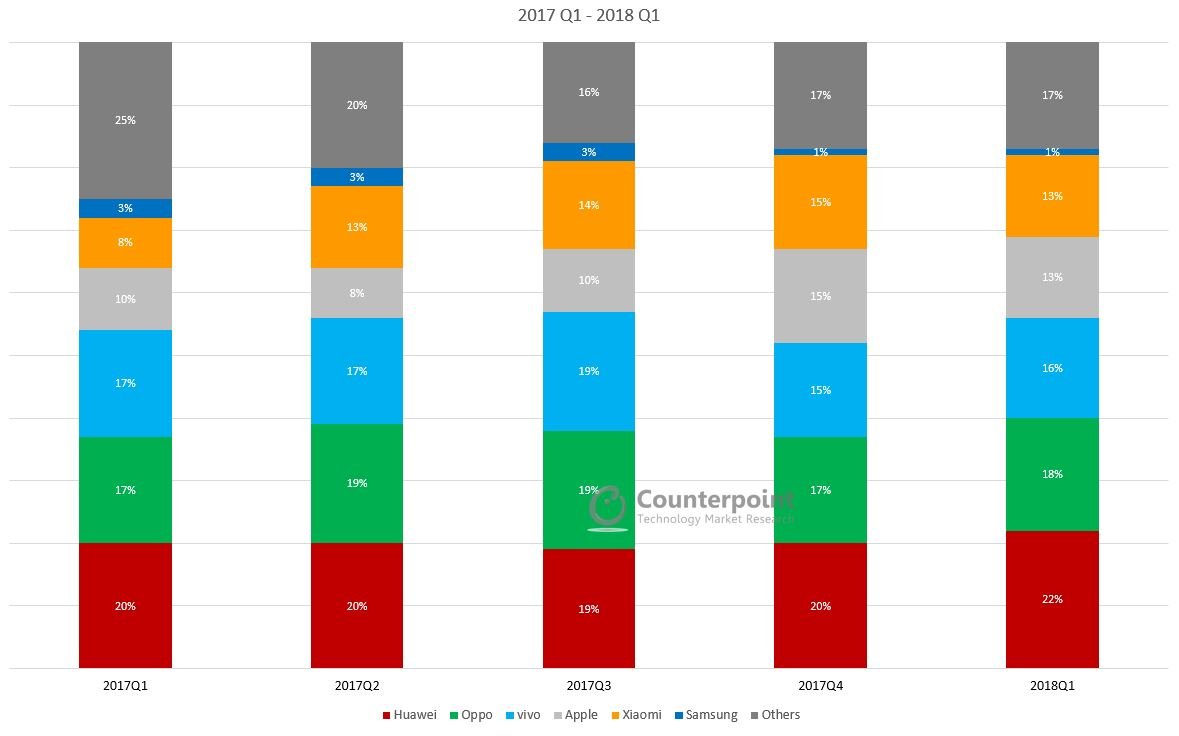

Market Highlights

• Huawei continues to lead the Chinese smartphone market with 22% market share followed by OPPO and vivo with 18% and 16% share respectively

• Xiaomi (+51%) and Apple (+32%) were the fastest growing brands among the top five

• Xiaomi was the fastest growing brand in China during the quarter. The growth was driven by Xiaomi’s expansion in the offline segment with aggressive promotions

• By the end of Q1 2018 four out of the top five smartphone OEMs had already launched their devices with notch displays in China

• Apple is now back to YoY growth in the first quarter since Q1 2015, which is an indication that its older generation iPhone user base is now upgrading

| Brands | 2017Q1 | 2017Q2 | 2017Q3 | 2017Q4 | 2018Q1 |

| Huawei | 20% | 20% | 19% | 20% | 22% |

| Oppo | 17% | 19% | 19% | 17% | 18% |

| vivo | 17% | 17% | 19% | 15% | 16% |

| Apple | 10% | 8% | 10% | 15% | 13% |

| Xiaomi | 8% | 13% | 14% | 15% | 13% |

| Samsung | 3% | 3% | 3% | 1% | 1% |

| Others | 25% | 20% | 16% | 17% | 17% |

#Huawei includes HONOR

*Ranking is according to the latest quarter.

Copyright ⓒ Counterpoint Technology Market Research | All rights reserved