- 2023 global passenger EV* battery installed capacity grew 44% YoY

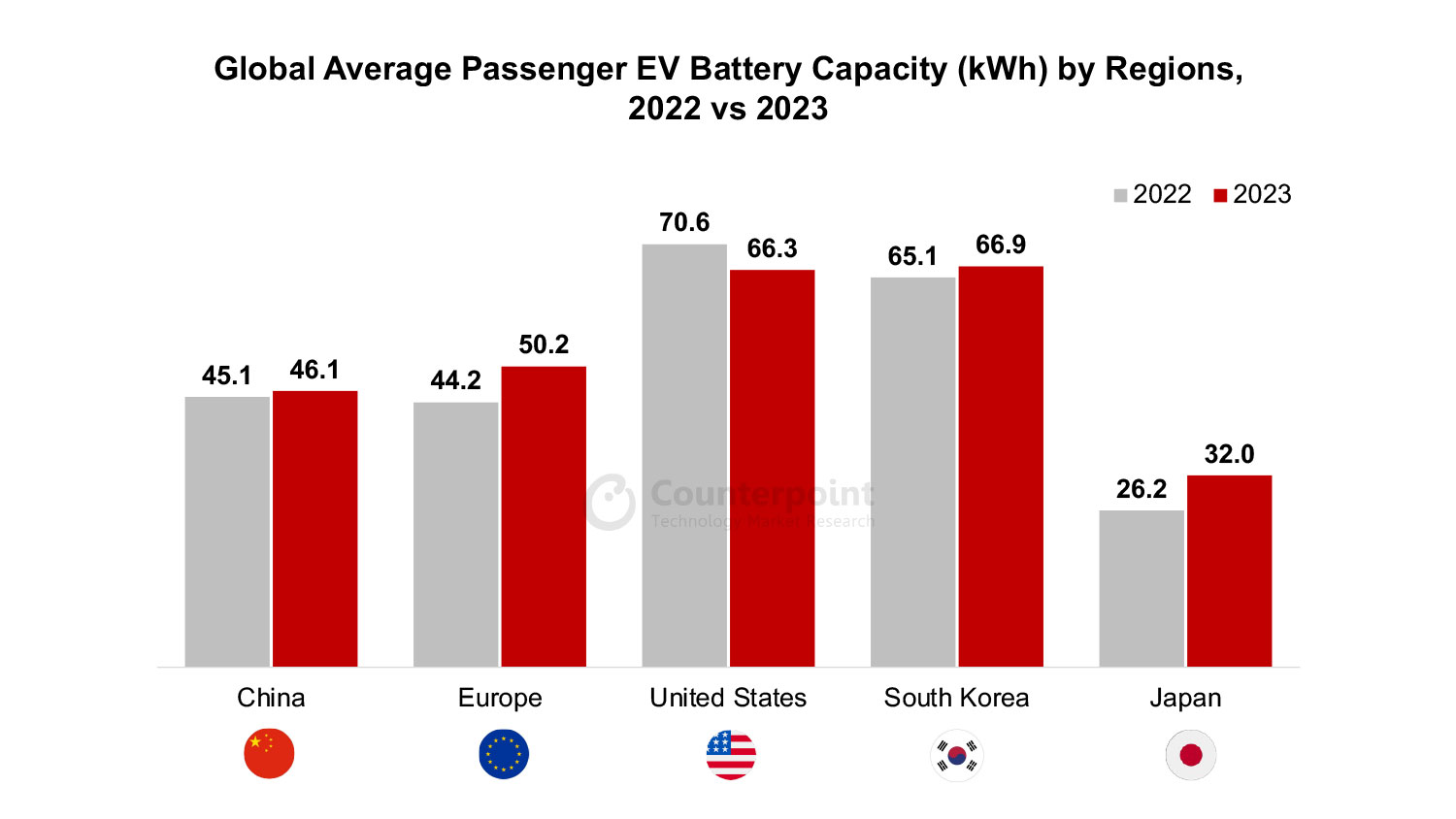

- Average battery capacity installed increased by 4% YoY helping to extend driving ranges

- Chinese suppliers continue to dominate; now account for over two-thirds of the global market

- Long-term opportunities attractive for Korean, Japanese, European makers on tech breakthroughs, geo-politics

Seoul, Beijing, Tokyo, Mumbai, Fort Collins, Hong Kong, London – April 11, 2024

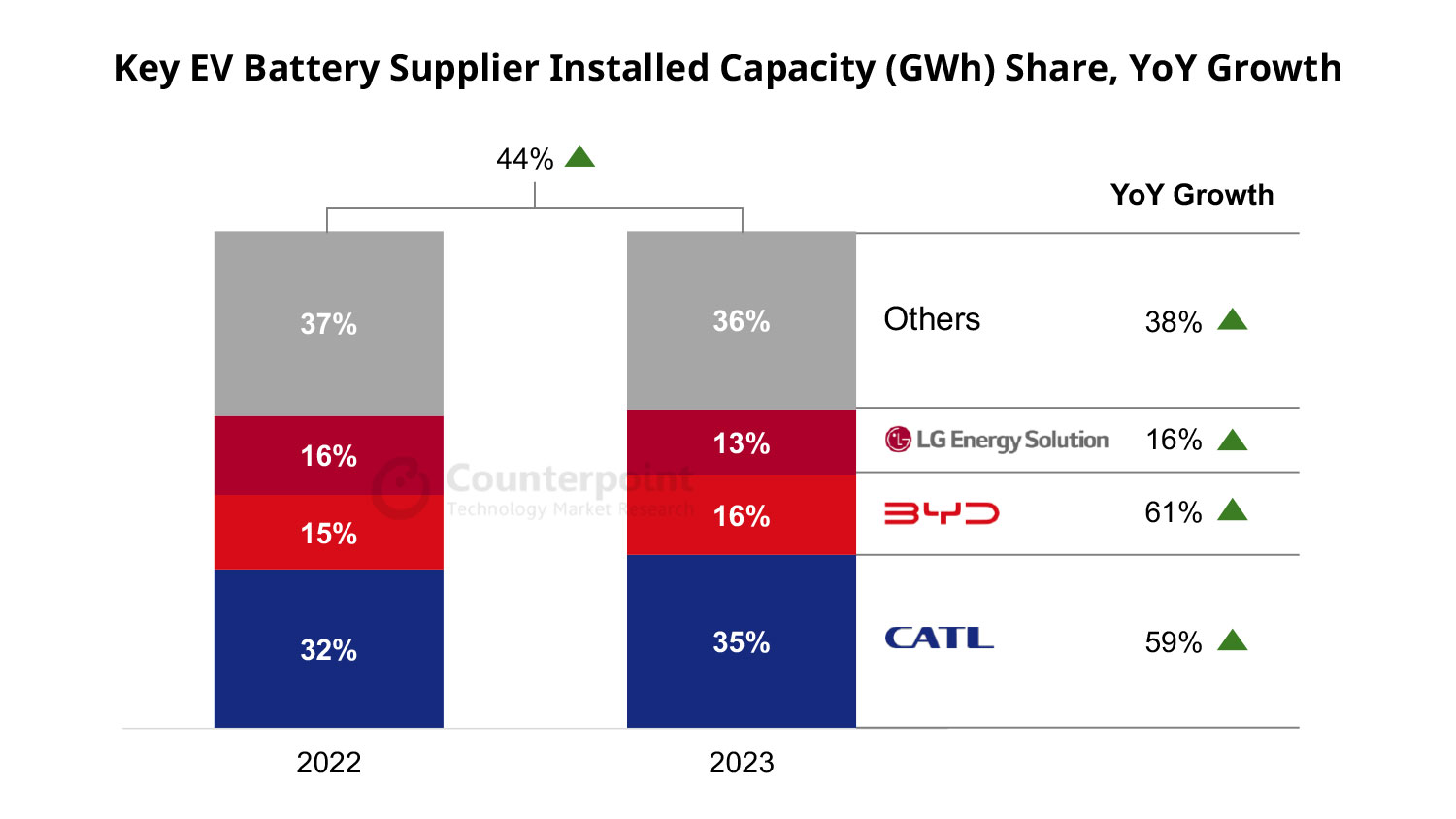

Global battery installed capacity for passenger EVs grew by 44% YoY in 2023, according to Counterpoint’s latest Global EV Battery Tracker. A key driver was increased average battery capacity per vehicle coupled with continued growth of EV sales at 38% YoY in 2023.

Average battery capacity continues to be an important metric, and expanding range, especially for mid-to-high EVs, is a priority for OEMs. “Across the US and Europe, long-range EVs are booming and this is what’s going to drive sales through the long term,” says Liz Lee, Associate Director. “We could have seen average capacities go even higher if not for the big expansion of entry-level EVs in China.”

Domestic battery suppliers are enjoying home field advantage and continued demand overseas to grab further market share. Chinese battery makers grew faster than most others to account for more than two-thirds of the world’s EV battery capacity last year, with CATL and BYD the main beneficiaries of market share gains.

In the short-term, OEMs are likely to continue the shift from performance-centered to price-centered EVs as the market slows, leveraging strategies to expand sales of cost-effective EVs with Chinese LFP batteries.

“This year we’re still forecasting double-digit EV growth across all regions which will help keep overall battery capacity buoyant,” says Lee.

For players like CATL, scale is a big competitive advantage but it also leaves the supplier more exposed to any slowdown in EV demand as well as potential efforts to limit growth in Europe and the US. “Long term we need to also consider further battery cost reductions on tech breakthroughs which, coupled with geo-political factors, could see more promising growth avenues emerge for non-Chinese suppliers,” states Neil Shah, VP of Research.

* EVs include BEVs (battery EVs) and PHEVs (plug-in hybrid EVs).

The comprehensive ‘Global Passenger Vehicle Forecast by Powertrain’ and ‘Global Installed Capacity of EV Batteries, Q4 2023’ reports are now available for purchase at report.counterpointresearch.com.

Feel free to reach us at press@counterpointresearch.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Follow Counterpoint Research

press(at)counterpointresearch.com