- About nine out of 10 connected cars sold in 2030 will have embedded 5G capability.

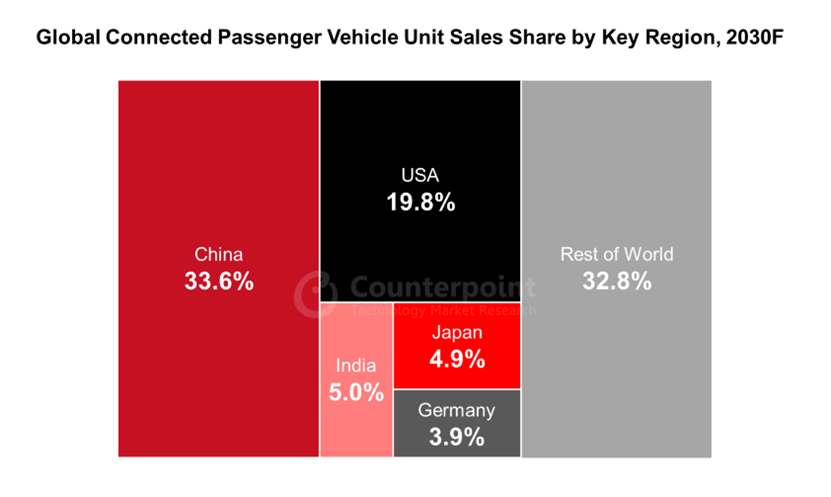

- China is expected to lead the connected car sales market, followed by USA, India, Japan and Germany.

- Electrification, autonomous and advanced infotainment capabilities are major drivers for growing connectivity in a car.

Seoul, Beijing, Boston, Buenos Aires, Hong Kong, London, New Delhi, San Diego – April 26, 2024

The entire automotive industry is ripe for disruption with the marriage of various advanced capabilities from electric drive train and AI-driven autonomous driving to advanced HMI, real-time HD maps and infotainment systems. All of these capabilities require an active, stable, low latency and high-bandwidth cellular connectivity. This is where 5G steps in, adding another technology dimension to tie these capabilities together.

Over the last decade, 4G was the major cellular connectivity embedded in car via NAD modules focusing on telematics, safety and emergency call use-cases. However, the use-cases for the cars rolling out over the next decade will warrant 5G connectivity to satisfy the new advanced mobility use-cases. According to Counterpoint’s latest Smart Automotive research report on the Global Connected Car Forecast by Technology, Regions and Brands, two out of every three cars sold already feature embedded connectivity and this will grow to almost 100% connectivity by end of the decade. The cumulative sales of 5G embedded cars will account for almost half of the total connected cars sold between 2024 and 2030.

At present, Germany leads in terms of connectivity penetration, but China is expected to achieve 100% connectivity penetration by 2028. This development positions China to lead the global connected car sales market by 2030, with USA, India, Japan, and Germany following suit. These top five countries are projected to collectively account for over two-thirds of global connected car sales by 2030.

Commenting on the regional dynamics, Senior Analyst Soumen Mandal said, “China is poised to dominate the connected car market, fueled by the rapid adoption of EVs, C-V2X and other connected infotainment features. Domestic EV manufacturers such as BYD, NIO, Xpeng and Li Auto are striving to differentiate their offerings from traditional players and expand into international markets.”

Mandal added, “In the US, the world’s second-largest connected car market, growth will be driven primarily by the adoption of advanced safety features such as Vehicle-to-Everything (V2X) communication and Level 2+ autonomy. Telecom giants like AT&T are at the forefront of the connected car space, while competitors like Verizon and T-Mobile are striving to capitalize on revenue opportunities through features like predictive maintenance, service scheduling, remote diagnostics, live maps and content platforms.”

“India is set to experience the fastest growth in connected car sales between 2023 and 2030. Indian automakers are gradually catching up with their international counterparts and enhancing their digital offerings to improve the driving experience,” Mandal said.

Commenting on the connectivity trends, Senior Analyst Parv Sharma said, “Currently, more than 96% of connected cars are powered by 4G while 5G is still picking up. The higher price of 5G telematics devices, lack of 5G infrastructure and unavailability of killer use cases have been the major reasons for 5G’s slow growth earlier in the decade.”

“However, with increasing 5G coverage and the introduction of L3+ ADAS, 5G adoption in connected cars will be swift for the rest of the decade. The availability of 5G RedCap in 2026 will also find application in lower-tier cars, driving mass-market adoption sooner rather than later. We forecast that by 2030, almost 90% of cars sold will have 5G connectivity.”

* Sales here refer to wholesale figures, i.e. deliveries out of factories by respective brands, and take into consideration only passenger cars with embedded connectivity.

The comprehensive and in-depth ‘Global Connected Car Tracker, Q4 2023’ and ‘Global Connected Car Forecast, 2019-2030F’ are now available for purchase at report.counterpointresearch.com.

Feel free to reach us at press@counterpointresearch.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com