- AI PCs will revive the global laptop PC market’s replacement demand in the coming years.

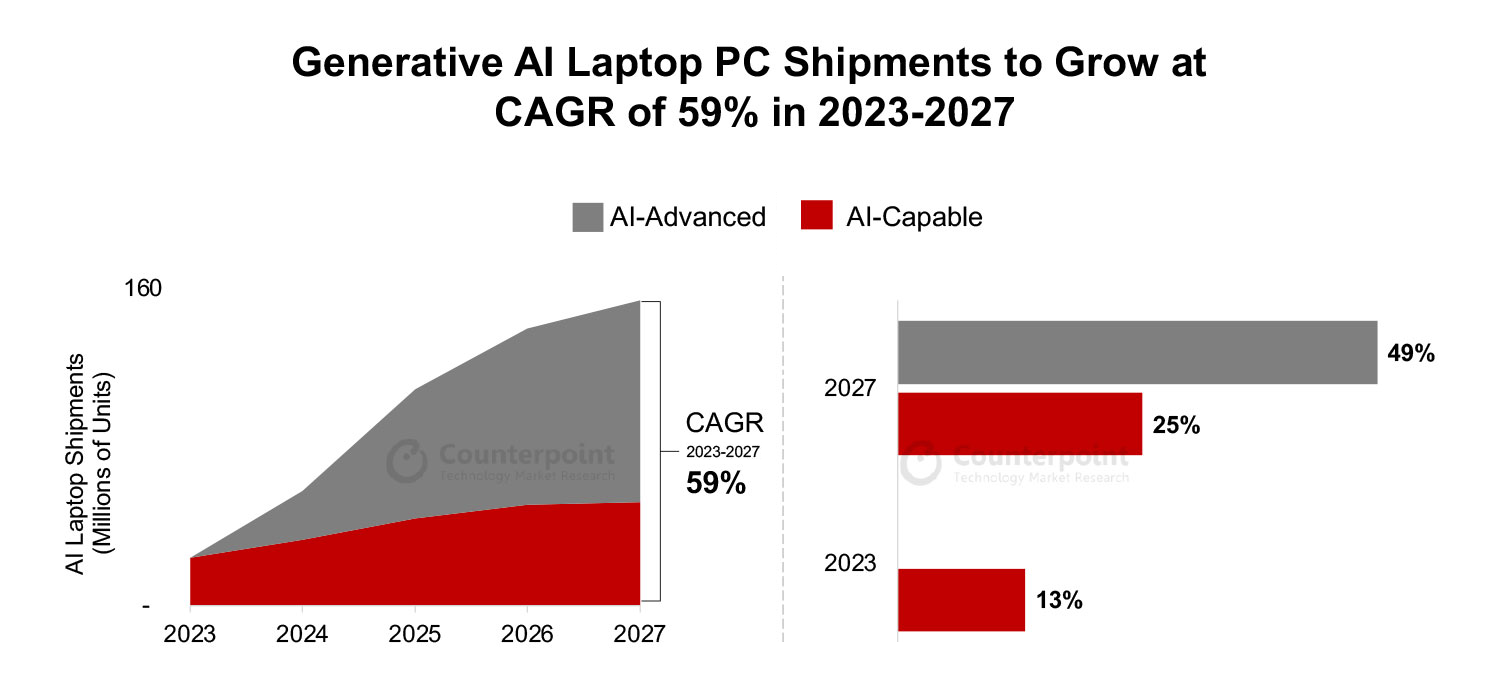

- We estimate that AI laptop PCs with the ability to run advanced GenAI applications will account for every three out of four laptop PCs sold in 2027.

- Microsoft will play a pivotal role in driving the AI laptop PC ecosystem, while Apple will be a dark horse.

- Intel and AMD will look to take the GenAI-capable compute mainstream next year to compete with more efficient Arm-based Qualcomm and Apple solutions in this AI race.

Seoul, Beijing, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi, San Diego, Taipei – April 30, 2024

Personal computers (PCs) have been used as the major productivity device for several decades. But now we are entering a new era of PCs based on artificial intelligence (AI), thanks to the boom witnessed in generative AI (GenAI). We believe the inventory correction and demand weakness in the global PC market have already normalized, with the impacts from COVID-19 largely being factored in. All this has created a comparatively healthy backdrop for reshaping the PC industry. Counterpoint estimates that almost half a billion AI laptop PCs will be sold during the 2023-2027 period, with AI PCs reviving the replacement demand.

Counterpoint separates GenAI laptop PCs into three categories – AI basic laptop, AI-advanced laptop and AI-capable laptop – based on different levels of computational performance, corresponding use cases and the efficiency of computational performance. We believe AI basic laptops, which are already in the market, can perform basic AI tasks but not completely GenAI tasks and, starting this year, will be supplanted by more AI-advanced and AI-capable models with enough TOPS (tera operations per second) powered by NPU (neural processing unit) or GPU (graphics processing unit) to perform the advanced GenAI tasks really well.

Commenting on the GenAI adoption in PCs, Senior Analyst William Li said, “Counterpoint forecasts that the penetration of AI-advanced laptops, which will form a majority of the AI laptop PC segment, will pick up in the next two years as chip vendors scale the GenAI capability to mainstream tiers. With the proliferation of GenAI use cases at the edge or in the cloud or in a hybrid way in the next few years, GenAI will become a de facto and must-have capability in the PC segment. Building the right kind of tools and ecosystem will be crucial for this adoption. Players such as Qualcomm have already accelerated with partners such as Microsoft, Hugging Face and a set of advanced AI Stack toolsets, developer evangelism.”

Li added, “While the overall laptop PC market will register ~3% CAGR during 2023-2027, the AI laptop PC segment is bound to grow at 59% CAGR. The advanced semiconductor content from compute to memory will drive a positive ASP (average selling price) growth associated with newer GenAI capabilities, translating into more value for consumers than before. In addition, we estimate that AI laptop PCs with the ability to run advanced GenAI applications will account for every three out of four laptop PCs sold in 2027.”

The chip vendors are playing a major role in driving GenAI in PCs. Highlighting the trend, Associate Director Brady Wang said, “The first wave of AI PCs will gradually come up with three major CPU platforms – Intel Meteor Lake, AMD Hawk Point and Qualcomm Snapdragon X Elite series. These vendors are also preparing for next-generation solutions for AI laptop PCs rolling out later this year, which will accelerate the adoption of AI PCs at multiple price points. We believe Intel and AMD will also take GenAI-capable compute mainstream next year to compete with relatively efficient Arm-based Qualcomm and Apple solutions in this AI race.”

Wang added, “At the same time, we expect an upward trend in AI-capable laptops, which leverage high-level to premium-level GPUs to enable even higher-end GenAI applications. This will range from current large language models (LLMs) processed at the edge to advanced large models and even autonomous gaming graphics generating (AI Gfx) models. Players like NVIDIA will look to extend their capabilities and leadership in this segment.”

Generative AI supported by both Cloud and Edge

The adoption of GenAI in computing, which was initially solely dependent on the cloud, warrants higher computational capability and performance, from training the model to inferencing millions of potential requests per second. However, this is not feasible as well as viable from capacity, cost and energy perspectives. As a result, GenAI capability at the edge or in the PC becomes paramount.

Further, besides better work efficiency, data privacy and security are also important, which can be facilitated by GenAI applications at the edge. This also becomes pivotal to AI at the edge to preserve data sovereignty and environmental efficiency.

Commenting on GenAI use cases, Associate Director Mohit Agrawal said, “Initial GenAI adoption in the PC will be driven by Microsoft through its Copilot AI deeply integrated across Microsoft properties and further in upcoming Windows 12 along with app developers and partners such as OpenAI, Adobe and Hugging Face, which will catalyze the GenAI and overall AI experiences, initially around productivity and content creation in the PC. It remains to be seen how AI-powered Windows 12 charts upgrade path and AI capabilities for the existing installed base of devices which might not support necessary hardware capabilities to run GenAI applications natively.”

Agrawal added, “Apple could be the dark horse when it comes to adding GenAI capability in the Macs. The company can use its end-to-end vertical approach to leverage its self-designed Arm-based M series of advanced powerful processors, heavily optimized MacOS, newly designed LLM and powerful GenAI application ecosystem.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com