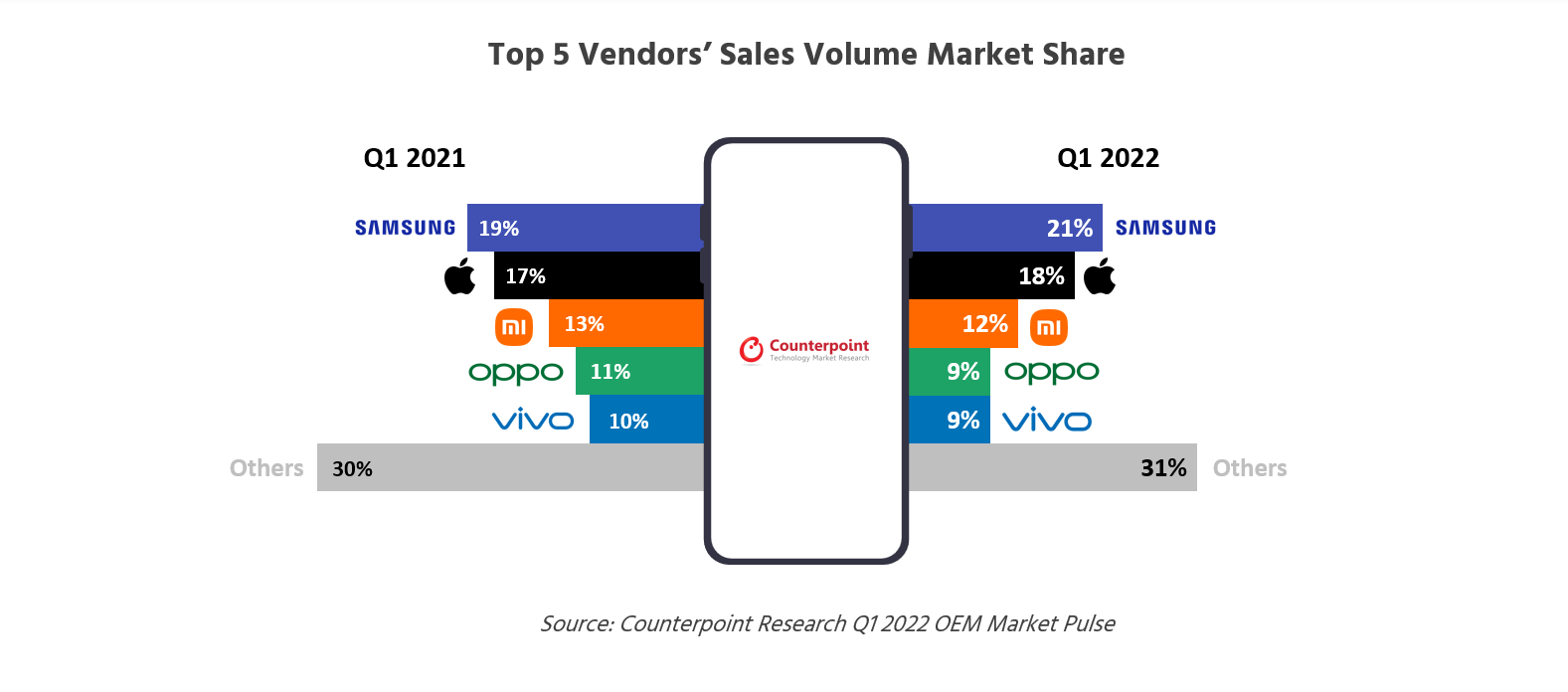

With a March quarter with many headwinds – inflation, component shortages, war and COVID-19 lockdowns – Apple recorded impressive results. Overall revenues grew 9% YoY while iPhone revenues were up 5%. Apple was able to grow its installed base to an all-time high even as all services hit new highs and all regions grew with the exceptions of Japan and Rest of Asia Pacific, which had tough exchange rates during the quarter. According to Counterpoint Research’s Q1 2022 OEM Market Pulse, Apple outpaced the global smartphone market sales volume, which declined 7% YoY, to record a 1% pt share gain for the quarter.

Key highlights from Apple’s March quarter

Key highlights from Apple’s March quarter

- iPhone sales were very solid despite the company noting there were some shortages due to mature node chips. The iPhone 13 family and new iPhone SE 2022 were both strong during the quarter.

- Regions:

- The largest growth region was the Americas with 19% YoY revenue growth. All hardware and service categories contributed to the region’s growth.

- Despite many headwinds and homegrown handset OEM competition, Apple grew 3% in China.

- Apple stopped shipping to Russia in March, which cost it 1.5% of iPhone revenues. The European region as a whole grew 5%.

- Japan declined 0.23% and Rest of Asia Pacific declined 7%. Dollar appreciation contributed to the declines.

- Product categories:

- iPhone: Supply did not keep up with demand for iPhones. But the iPhone 13 family will go down as a strong release. The iPhone SE 2022 fills a niche and Apple will be able to cost-erode and run it for many quarters.

- Mac: Revenues grew 15% to $10.4 billion and hit an all-time high in the March quarter. The performance and marketing of the homegrown M1 chip helped. The past seven quarters have been the best for Mac as Apple has gained share aided by B2B.

- Wearables, home, accessories: Revenues grew 15%. An interesting highlight is that two-thirds of Apple Watch buyers were buying their first Apple Watch. Counterpoint’s Smartwatch Tracker also shows Apple dominant within the space. New health applications, HR and sleep monitoring, and battery life continue to improve.

- iPad: iPad revenues fell 2%, mainly because of component shortages within common and mature nodes. The impressive note here is 50% of iPad buyers were new to iPad. Key segments of B2B, government and education will likely see growth as shortages ease.

- Services: Revenues grew an impressive 17%. Each category and each geography registered growth. Apple called out its 240 awards within Apple TV Plus. The space is super-competitive with many big spenders — not all doing well. If the rumors of Apple moving to buy the NFL Sunday Ticket (rights to NFL games) are true, it would add a lot of stickiness, especially to the North American market. Paid subscribers registered strong growth. Even as iPhone volumes go flat, revenue growth via services is significant.

- Outlook:

- Apple warned of component shortages lasting through 2022, which will likely cost the company $4 billion to $8 billion over the June quarter. Luckily for Apple, due to the stickiness of iOS and its services, a large percentage of this revenue will likely be “pushed” and not lost.

- Final assembly factories are back up and running in China. However, it is unknown how long key cities in China will remain in the grip of COVID-19.

- Inflation is a concern for all Apple competitors. Apple is slightly shielded from this as commentaries from Microsoft and Qualcomm highlight that the high-end market and B2B/government/education sectors remain solid.

Key highlights from Apple’s March quarter

Key highlights from Apple’s March quarter