- AMOLED Smartphone sales will grow 46% YoY in 2020 driven by an increased mix of Flexible OLED smartphones in $300-$500 price tier

- Top five smartphone brands will account for more than 80% of the total AMOLED smartphone sales

New Delhi, Hong Kong, Seoul, London, Beijing, San Diego, Buenos Aires –

Dec 24th, 2019

Global sales of smartphones with AMOLED panels are set to surpass 600 million units by the end of 2020 with a YoY growth of 46%, according to the latest research from Counterpoint’s Display Market Outlook service. The growth will be coming from the diffusion of AMOLED into mid-tier price bands, driven by Chinese brands like Huawei, Vivo, OPPO, realme, and Xiaomi, as they seek to differentiate their offerings.

Commenting on the market dynamics, Tarun Pathak, Associate Director, said, “Displays drive a major part of the overall smartphone experience. In 2019 smartphone displays gained a lot of attention in a bid to attract users to upgrade their smartphones. Some notable supply chain efforts included reducing the screen to body ratio, increasing the refresh rate, changing the form factor (foldable) or innovating with other components to get more real estate for the display (smaller notch, punch hole camera, pop-up camera, in-display fingerprint sensor, image sensors). These innovations further drove the growth of AMOLED as the technology is best suited to leverage these trends thanks to superior image quality, reduced power consumption and flexible form factors, among other things. Hence, we believe that AMOLED-based smartphones will remain in demand with Chinese smartphone brands aggressively adopting them for their mid-tier portfolio. AMOLED panels are already a default choice in premium-tier smartphones”

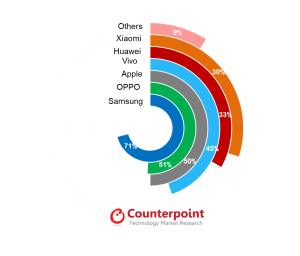

Commenting on brand performance, Jene Park, Senior Research Analyst at Counterpoint Research said, “Samsung remained the leading smartphone vendor, capturing 45% of the total AMOLED smartphone sales in 2019 followed by Apple with 16% share and OPPO with 11% share. However, all the leading brands have launched their flagships in 2019 with AMOLED panels. But Chinese players led by Huawei, OPPO, Vivo, and Xiaomi have now adopted OLED panels in their mid-tier portfolios ($300-$500) to differentiate their products. This is one of the key reasons for the growth of AMOLED smartphones. In future we expect these brands to further bring the AMOLED smartphones to the sub-$200 price tier in 2020. Apple is also likely to go for an all OLED portfolio in its next launch cycle. These factors will further lead to the growth of AMOLED based smartphones in 2020”.

Exhibit 1: AMOLED-based Smartphones Penetration within Key Brands’ Portfolios – 2020

Source: Counterpoint Research Display Market Outlook Dec 2019

Although AMOLED is a preferred choice for smartphone brands there are still some reservations that might lead to a slower transition from LCD to OLEDs. One factor being production capability. Samsung display currently accounts for close to 90% of the OLED panel market. Other brands that have LCD fabs like BOE, Tianma, CSOT are transitioning fast but might take some time to arrive with good volume. Additionally, the demand for AMOLED in other product categories like wearables, TVs will further put a supply constraint on existing OLED panel makers. Furthermore, the majority of the other smartphone brands in sub-$200 will continue to use LCD panels. Hence we believe that AMOLED’s growth will be upwards but a lot will also depend on the production capacity of the panel makers.

The comprehensive and in-depth Dec 2019 Display Market Outlook is available for subscribing clients. Please feel free to contact us at press@counterpointresearch.com for further questions regarding our in-depth latest research, insights or press inquiries.

The Market Outlook research is based on Counterpoint research assumptions, historical data, supply chain checks, and secondary research.

Analyst Contacts:

Follow Counterpoint Research

press@counterpointresearch.com