Aiming to more than double its footprint in US national retail channels, T‑Mobile will soon start selling its wireless plans at 2,300 Walmart store locations across the US. This is timely and could be very beneficial for T-Mobile. The carrier is under-indexed in rural America. With its improved 4G and 5G coverage, it can get far more aggressive in rural areas where its network has been uncompetitive in the past.

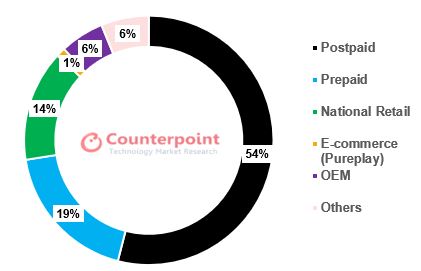

According to Counterpoint Research’s US Monthly channel share tracker, national retail accounted for 14% of the US smartphone sell-through in the second quarter. Walmart remains the largest national retail channel followed by Best-Buy, Target, Costco and Sam’s Club.

Exhibit 1: US Smartphone Sell-through by Sales Channel

Source: US Online-Offline Monthly Channel Share Tracker (Q2 2021)

Walmart Targeted at Low-End & Mid-Tier

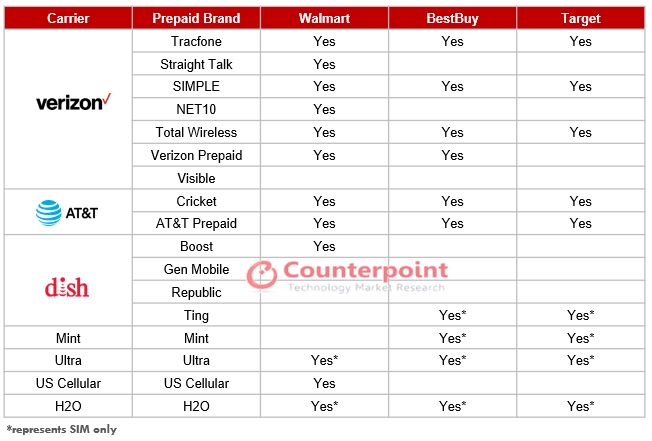

Sales at Walmart remain targeted towards mid-tier and low-end wireless retail opportunity. Smartphone brands like Samsung, Motorola, Alcatel and white-labeled AT&T and Cricket devices remain very strong at Walmart. The competition in national retail remains heavily in favor of TracFone brands (such as TracFone, Straight Talk, Total Wireless, NET10 and Simple) selling in Walmart. This places Verizon in a very favorable position as it looks to complete the integration of TracFone by the end of 2021.

Exhibit 2: US Prepaid Brand Ownership and Sales Channel

While AT&T, too, enjoys a strong prepaid presence with Cricket and AT&T prepaid, Dish is likely to be the dark horse that can disrupt the competition in national retail. Dish, which now owns the Boost Mobile brand, has been on a buying spree that will likely continue. The #4 US carrier acquired Republic Wireless in March 2021, Ting in August 2021 and Gen Mobile in September 2021. This takes Dish’s prepaid subscriber count to over nine million and brand count to four in national retail.

Prepaid-Postpaid Migration

In 2021, postpaid deals have been very strong for premium smartphone devices. 5G remained at the center of the three national carriers’ marketing focus. BOGOs and $800+ trade-in deals on new iPhones and Galaxy S21 remained consistent throughout the year, leading to a higher migration in favor of postpaid. This trend of deals is likely to continue in Q4 2021 and 2022, making competition in prepaid more intense.

While Metro by T-Mobile and Cricket account for the majority of the net adds, Dish and Verizon (especially after the Tracfone acquisition) will now be looking to advance their subscriber base. Dish with its four prepaid brands would likely expand its presence in national retail. It is expected to start selling in Target stores in October 2021. Earlier, during an investor presentation, Verizon’s John Dunne also hinted at broadening Verizon’s prepaid offerings. We can expect Verizon to get more aggressive within prepaid if the TracFone deal is completed in Q4 2021.

Overall, national retail remains key to US carriers’ wireless retail strategy. Carriers continue to pay lucrative per-line commissions to retailers. The key target of the carriers is to capture the “customer lifetime value (CLV)”, as 5G opens up new opportunities, and/or finally have them upgrade to a premium unlimited plan.