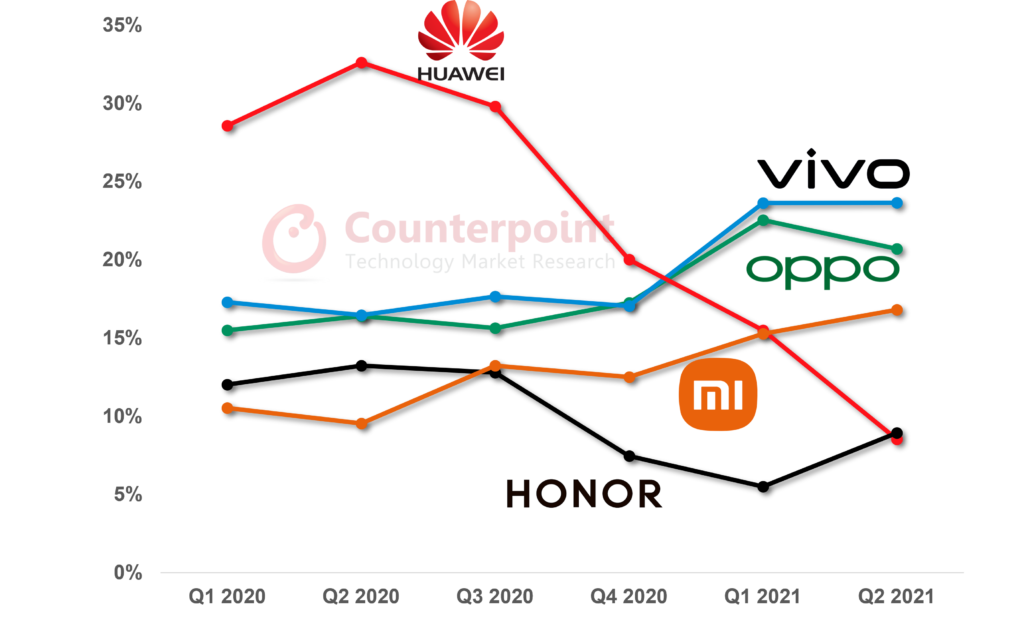

People hardly notice any public statement by vivo’s top management on the company’s culture or an eye-catching social media post lashing out at other brands. But the fact is vivo has retained the top spot in China’s smartphone market since Q1 2021. According to Counterpoint Research’s data, the OEM had a 24% market share in Q1 and Q2 2021, up from 16% in Q1 2020. vivo was followed by OPPO at 21% and Xiaomi at 17% in Q2 2021.

OEM Market Shares in China by Quarter

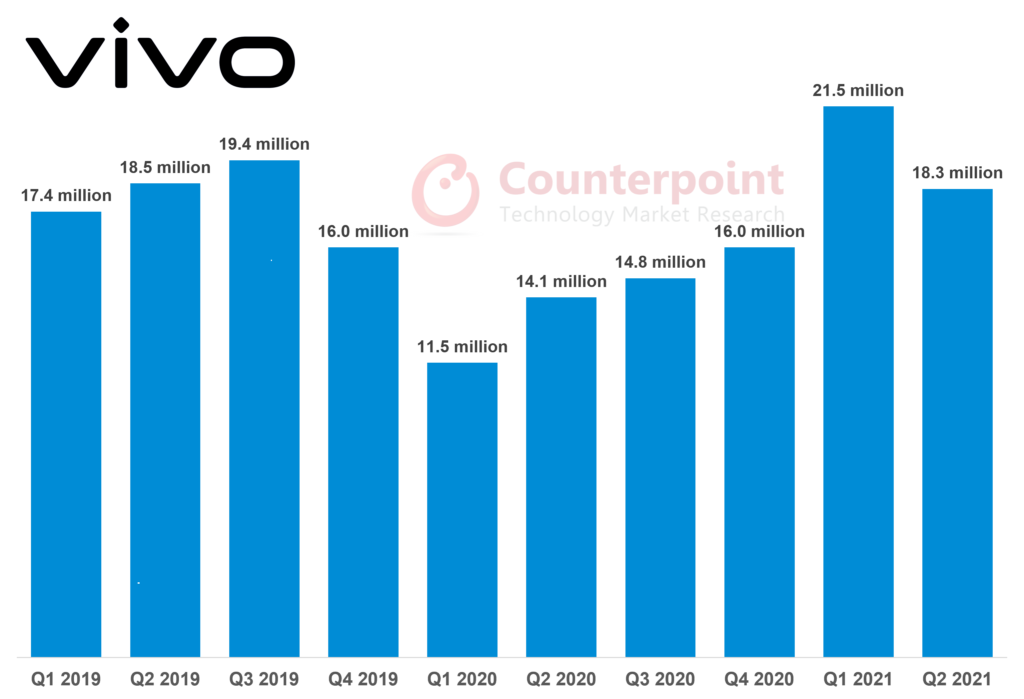

China Smartphone Shipments of vivo by Quarter

Though all top OEMs have benefited from Huawei’s retreat, it is vivo that has managed to reach the top spot with its secured supplies of crucial components, optimized product portfolio, and a strong distribution network.

Remarkable component supply chain management

The COVID-19 pandemic has plunged the whole world into a chipset shortage which is not expected to end soon. Main chipset suppliers for mobile phones — Qualcomm, MediaTek and UNISOC — are seeing lengthening delivery lead times. As a result, they are only focusing on key accounts and also increasing prices, the latest being UNISOC with its average 25% hike. But with the BBK group’s powerful supply chain, vivo can maintain a consistent supply of chipsets for its key volume segments — Y series and the newly launched S series. Within the Y series, there are 5G models available for as low as CNY 1,298 (~$200).

Optimized product portfolio

The newly launched S series of vivo is a liberator. Its focus on the CNY 2,000-CNY 3,500 segment means the X series is now free to focus on the CNY 3,500 and above segment. The Y series, with its focus on the CNY 1,999 and below band, remains a volume-driven product group. This clear categorization of smartphones has helped vivo’s performance in 2021. While retaining around 50% share in the CNY 1,999 and below segment with its Y series, vivo has managed to make a breakthrough with the S series and increased visibility in the CNY 3,500 and above segment with the X60 series. Other major Chinese brands have been aiming to have such product categorization and increase their ASPs (average selling prices), but their efforts in this direction are yet to see big results.

Channel distribution

Huawei’s woes have provided an opportunity for OPPO and vivo to grab more than 70% share in China’s offline channels. vivo has also gone in for a reorganization of its offline channel partners. The rising e-commerce sector has been hugely impacting both brands and offline channels. However, due to different levels of development in Chinese cities, there is still a big offline market. vivo has invested considerable resources in the offline segment, including in trade marketing, promoters, ATL and BTL synergy, and margin schemes.

iQOO: Designed for Generation Z

Although iQOO operates independently from vivo since its launch in 2019, it is still listed on vivo’s website as a series. Unlike OPPO, realme and OnePlus, iQOO is heavily focusing on the online segment. The consumer group it is eyeing here is those born in 1995 and beyond. These are the people who have been exposed to the internet, social media and mobile phones from their earliest youth.

iQOO has been the sponsor for ‘Honor of Kings – KPL’, an e-sport competition, since 2019. As the hottest smartphone e-sport competition in China, it has been attracting millions of viewers every season. In fact, the vivo family (vivo and iQOO) has been its sponsor since the beginning of this game back in 2016.

Fierce competition

On August 12, 2021, HONOR unveiled its flagship Magic 3 series, aimed at capturing the space vacated by the Huawei Mate and P series. However, its high prices have left many unimpressed. To Chinese consumers, a smartphone above CNY 4,000 is a segment reserved for a few, like Apple’s iPhone, Samsung’s S and Note series, and Huawei’s Mate and P series. This is because these brands have invested a lot over the years in promoting their flagship models as high-end phones with cutting-edge technology and innovation. As we know, vivo has a series called NEX which is high on innovation, just like Xiaomi’s Mix series. Maybe vivo can use this series to target the high-end segment.

With HONOR pushing ahead with its comeback and Xiaomi’s focus on the offline channels, the Chinese smartphone market will see fierce competition between vivo, OPPO, Xiaomi, HONOR, Apple and keen-to-be-back Samsung in the coming days.