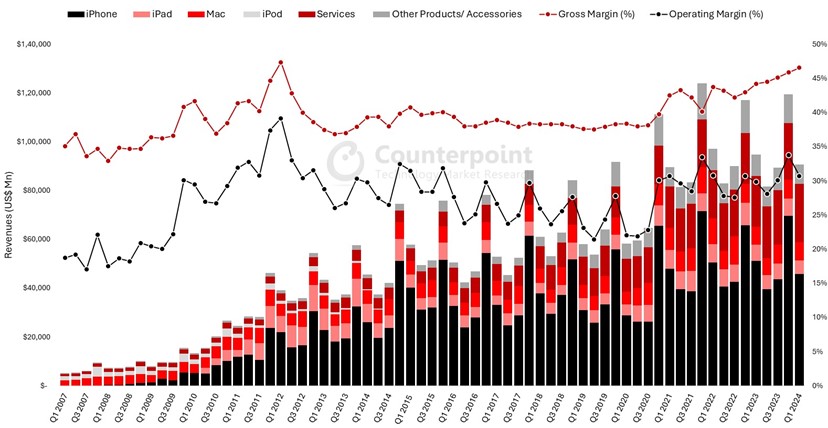

Apple’s Q1 2024 (fiscal Q2 2024) revenues declined 4% YoY. While the revenues from products declined 10% YoY, revenue from services grew impressive 14% YoY reaching the highest ever share (26%) of Apple’s total revenue. This was also the first time that services captured over one fourth of Apple’s total revenue in the first quarter.

Commenting on the results, Varun Mishra, Senior Analyst at Counterpoint Noted, “With iPhones facing competition in China, record low upgrade rates in the US, a difficult compare from last year due to lock down effects, and segments like iPads and AirPods due for refresh, the overall product revenues declined, as expected. However, there are some upsides as well. Services revenues continues to show healthy growth and Apple’s reach in emerging markets continues to rise, which could be a long-term growth opportunity for the entire Apple ecosystem. Gross margins also increased to reach the highest levels in over a decade. This was driven by higher contribution of services as well as a better product mix for iPhones with 15 Pro series performing better than its predecessors”.

Apple Revenues by Product Categories

Results Analysis:

- iPhone: Revenues down 10% YoY. According to Counterpoint Research Market Monitor, shipments were down 13% YoY with Global smartphone shipment market share reducing from 21% in Q1 2023 to 17% in Q1 2024. The quarter was also a difficult compare because of 14 Pro’s supply shifting to Q1 2023 because of COVID lockdowns in Q4 2022 affecting manufacturing facilities in China.

- Mac revenues grew 4% YoY. The resilience was supported by M3 base models and also a recovery of the overall PC industry.

- iPad revenues declined 17% YoY. The segment is due for refresh with no new models launching in 2023. We will see new iPads launching in Q2 2024, which will drive some growth in the coming quarters.

- Wearables Home and Accessories revenues declined 4% YoY even though Vision Pro sales were likely included in the segment, indicating a steeper decline in other products in the division.

- Services: Continues to be a bright spot for Apple with 14% revenue growth YoY. It’s also an important segment for bottom line growth considering high services margins. Paying subscribers grew by double digits, reaching an all-time high. We also saw Google and Amazon’s subscription businesses deliver impressive numbers, suggesting customers are rewarding product bundles with high value. According to Counterpoint Research’s Apple 360, Services is likely to capture one fourth of Apple revenues in 2025.

Outlook:

Apple does face a few headwinds in China. We will likely see Apple being more aggressive in the China market, especially during the 618 festival in June, which will help drive some sales. At the same time, Apple will continue to increase its footprint in emerging markets. Investments around financing solutions, expansion of trade-in programs etc., will also support growth especially in emerging markets. Revenues for iPads and AirPods are also likely to grow in the coming quarters owing to product refreshes. Services segment is also expected to continue to grow in double digits in the coming quarters.

Another aspect is the increasing popularity of Generative AI in smartphones, and Apple’s absence thus far. Commenting on the Generative AI, Tarun Pathak, Director at Counterpoint Research noted, “Apple has been late to GenAI as compared to its competition. However, this has not been a new trend with Apple. It has a history of bringing new features later to the market. Also, we have not seen iOS users jumping ship due to AI features. The launch of GenAI capabilities in the Apple ecosystem will have a large value add due to its tightly knit nature. It will be a welcome move by over 2-billion active device users. We are already seeing Apple is likely working on external partnerships to bring GenAI to its devices. We think Apple’s GenAI will help drive iPhone upgrades.”